My Tax Burden, In Detail

Democrats are high taxing, high-spending liberals who raise taxes. Republicans cut taxes because they don't have a big government to pay for. That's the conventional wisdom, anyway. And every year around tax time, some people bitch about how much this President or that President spends on taxes. Recently the Tea Party Movement in particular are up in arms about being "Taxed Enough Already", with particular complaints about the communist in the White House responsible for it all. If you want to be persnickety (and I do), this isn't a question of whether this is "true" or not, but to what extent this is true. How much more (or less) taxes have I paid under each president? I've kept all my tax records since 1999 and I've always intended to find out, and today is tax day so I decided to do it.

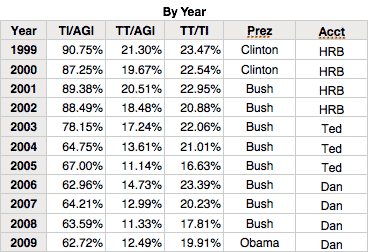

If you'd like to play along, here's my methodology. Find your 1080 form and look for the line that says "Adjusted Gross Income" (AGI, #38). That's how much you earned. Then find "Taxable Income" (TI, #43). That's how much you earned minus your mortgage, business expenses, etc. Find "Total Tax" (TT, #60). That's how much tax you owed. I figure my tax burden as what I paid out of either my total income or post-deduction taxable income. I'm not going to give you my raw numbers, but as a college-educated professional I'm in the top part of the income distribution so I ought to be totally getting screwed by that liberal Obama, right?

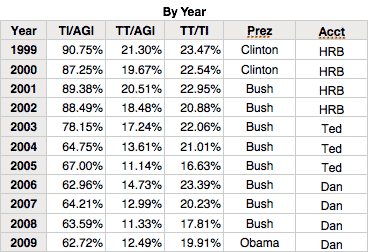

Here's my last decade: the gross income that's taxable, the gross income that's tax, and the taxable income that's tax:

It might be a little clearer to present the data this way. As a percentage, here's where my money goes every year:

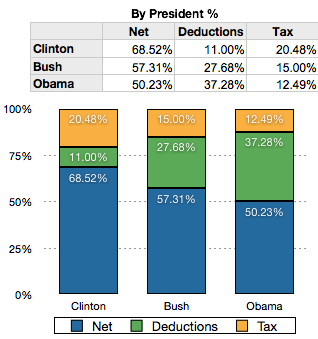

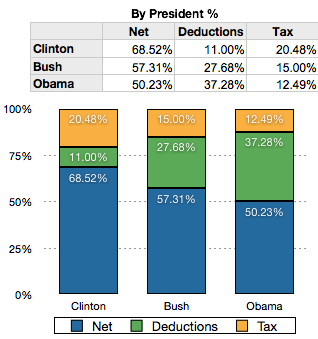

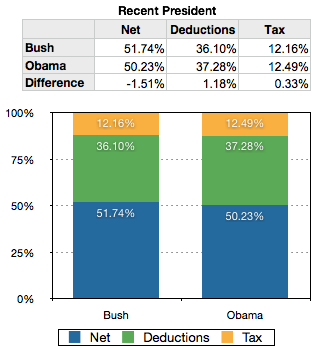

Does the President make a difference? Here's the data grouped by president.

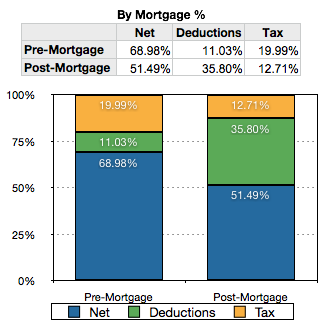

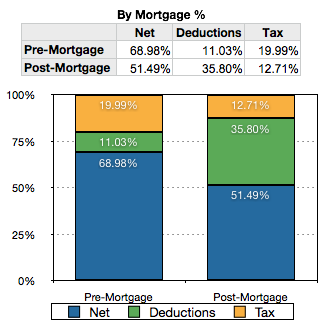

I paid a higher percentage of taxes under Clinton than under Bush, but I'm paying an even lower percentage under Obama. That said, there are some pretty big caveats. I bought a house in July 2003, which let me deduct the interest on my mortgage. That made a big difference. Before 2003, almost 90% of my income was taxable. After 2003, 64% of my income was taxable because a lot of it was going to pay my mortgage.

Another thing changed in 2003: I stopped going to H&R Block and started going to a real accountant. For a while it was a guy in LA named Ted, and now it's a guy named Dan in SF. My personal accountants are better about finding deductions, they keep a file on me from year to year, and although they're more expensive than H&R they generally pay for themselves. As you can see Dan is a little more aggressive than Ted.

My income hasn't been constant, either. I'd been working at a junior position until 2002 when I changed jobs. I worked a lot of overtime in 2002 and 2003, and then I moved to LA where I earned a better rate but I wasn't working full time. In 2005 I worked in Canada and paid Canadian income taxes to the Canadian government which is why there's a big drop then, and in 2007 I started working in the north office and stopped working overtime so my income dropped.

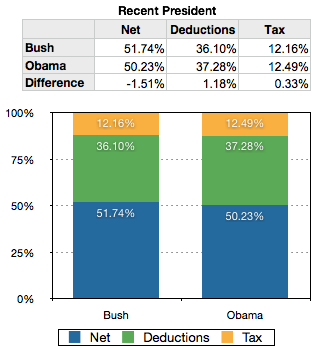

It's only been in the last three years that my situation has stabilized enough to make a comparison valid. In the last three years I've had the same housing situation, income, deductions, and accountant under two Presidents. And what's the difference?

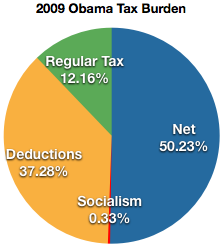

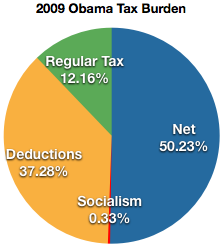

So to what extent is it true that Obama is a tax-hiking communist? Under Obama I got to deduct a little over 1% more than I did under Bush, but (to my surprise) he's still taxing me more by 0.33% (gross) and 0.80% (net). In other words I don't care. It's a rounding error, and I don't get bent out of shape about rounding errors. The federal government has been spending around 20% of GDP since the 1950s. The choices I make - which job to take, which accountant to use, which house to buy - have way more to do with how much I pay in taxes than whoever happens to be in office.

If you'd like to play along, here's my methodology. Find your 1080 form and look for the line that says "Adjusted Gross Income" (AGI, #38). That's how much you earned. Then find "Taxable Income" (TI, #43). That's how much you earned minus your mortgage, business expenses, etc. Find "Total Tax" (TT, #60). That's how much tax you owed. I figure my tax burden as what I paid out of either my total income or post-deduction taxable income. I'm not going to give you my raw numbers, but as a college-educated professional I'm in the top part of the income distribution so I ought to be totally getting screwed by that liberal Obama, right?

Here's my last decade: the gross income that's taxable, the gross income that's tax, and the taxable income that's tax:

It might be a little clearer to present the data this way. As a percentage, here's where my money goes every year:

Does the President make a difference? Here's the data grouped by president.

I paid a higher percentage of taxes under Clinton than under Bush, but I'm paying an even lower percentage under Obama. That said, there are some pretty big caveats. I bought a house in July 2003, which let me deduct the interest on my mortgage. That made a big difference. Before 2003, almost 90% of my income was taxable. After 2003, 64% of my income was taxable because a lot of it was going to pay my mortgage.

Another thing changed in 2003: I stopped going to H&R Block and started going to a real accountant. For a while it was a guy in LA named Ted, and now it's a guy named Dan in SF. My personal accountants are better about finding deductions, they keep a file on me from year to year, and although they're more expensive than H&R they generally pay for themselves. As you can see Dan is a little more aggressive than Ted.

My income hasn't been constant, either. I'd been working at a junior position until 2002 when I changed jobs. I worked a lot of overtime in 2002 and 2003, and then I moved to LA where I earned a better rate but I wasn't working full time. In 2005 I worked in Canada and paid Canadian income taxes to the Canadian government which is why there's a big drop then, and in 2007 I started working in the north office and stopped working overtime so my income dropped.

It's only been in the last three years that my situation has stabilized enough to make a comparison valid. In the last three years I've had the same housing situation, income, deductions, and accountant under two Presidents. And what's the difference?

So to what extent is it true that Obama is a tax-hiking communist? Under Obama I got to deduct a little over 1% more than I did under Bush, but (to my surprise) he's still taxing me more by 0.33% (gross) and 0.80% (net). In other words I don't care. It's a rounding error, and I don't get bent out of shape about rounding errors. The federal government has been spending around 20% of GDP since the 1950s. The choices I make - which job to take, which accountant to use, which house to buy - have way more to do with how much I pay in taxes than whoever happens to be in office.