The Human Tsunami -- Tracking the Summer of Love Toward Death

People occassionally accuse me of being cynical. I don't think I am. I am just seeing the world around me, and extrapolating on possible causes and effects. Sometimes I project these extrapolations toward tomorrow.

Take the Baby Boomers. At the moment, they are about to destroy the world around them.

It's not their fault, I know that. The fault lies with their parents, who all celebrated the end of four decades of war and economic depression with a quiet, peaceful, relieved frenzy of breeding the likes of which may very well be unrivaled in all of human history. The Boomers, product of that frenzy, merely found themselves surrounded by kids their own age.

Way too many kids their own age.

Let's extrapolate. The Baby Boom started in 1946, peaked in 1957, and declined sharply in 1964. The Summer of Love in 1969, therefore, proved something of a cresting of the Boomer Wave. The older boomers ranged from 16 to 23 (with a peak age group 14 nubile years old), gathered together, and started doing what 16-23 year olds the world around them do:

Listen to Music. In any given properly shaped bell-curve population, musical tastes are dominated by young people. New music surplants the older tastes as the focus, those young kids who buy recordings and attend shows, get too busy to do so, and use their money in other ways.

This is not happening. There are simply too many "classic rock" stations making money today because of that Boomer curve. Why? Frank Zappa once wrote a commencement address to a music school, telling the poor graduated saps that their professional lives will be spent appeasing the musical tastes of the most influential demographic, thirteen year old girls; in 1969 there were a lot of kids that age. There are now too many Boomers listening to the old, old music of their youth to allow younger tastes to gain much traction. Don't believe me? Listen to the radio. The songs on heaviest rotation mostly date from within 10 years of the Summer of Love.

Fuck. From the fucking came the families -- not as many as the parents prior had produced, but families that needed food and shelter nonetheless. This started to shift the Boomer spending priorities toward homes and goodies.

(After this bachannal, we find the Seventies, a depressing era dominated by the trailing edge of the Baby Boom trying desparately to have just as good a time as their older siblings, and failing miserably. They did manage to listen to some tunes and get some action; however, like the Victorian poets trying to outdo the powerhouse Romantics, they simply Failed Stupendously. I also believe -- and I was there -- that much of that failure stemmed from Peak Boomers partying way too long.)

Back to extrapolation tracing the coming A-mama&papa-colypse.

If we assume that many couples started many households just after 1969, the children of those homes would fledge and fly the coop starting in 1990. Before these nests emptied, the family income was mostly earmarked for feeding, educating and housing children. Therefore, after the children leave, the family often sees a large portion of the paycheck freed for other uses . . . like investments.

Read this Wiki entry on the dot-com bubble:

In 1994 the Internet came to the public's attention with the public advent of the Mosaic Web browser and the nascent World Wide Web, and by 1996 it became obvious to most publicly traded companies that a public Web presence was desirable. (Emphasis mine)

Now consider this very simple axiom in economics that the emphasized portion of the entry fails to appreciate: The price of any commodity depends on the amount of money available for purchase.

My point?

I believe the dot-com bubble started not out of a frenzy for all things internet, but due to the need for folks -- a lot of folks -- with suddenly expendable money to invest that money in something. The availability of the liquid, investable assets preceded -- and subsequently caused -- the rise in the market. The tech stocks had two important attributes which ensured their over-enrichment:

The newness of the industry precluded anyone being able to accurately value company worth; and

They were simply in the right place at the right time to attract that money -- 26 years after the Summer of Love Boomer kids left the house.

(If one assumes most families have more than one kid, and must therefore wait to invest most of their money after the youngest leaves, this fits perfectly.)

In a nutshell, Boomers caused the dot-com bubble by simply buying stocks the same way they bought records years ago -- all at once. They fouled the stock market just like they tainted the country's ability to hear new music years before.

Of course, it gets worse. Those music-hogging, stock market-rushing Boomers are all getting old. Soon they will stop driving their cars to work and start, again in record numbers, driving their recreational vehicles at a time when gasoline and diesel prices are on the rise. This decision to drive around and "see the country" will no doubt put an enormous crunch on fuel supplies.

Some retirement communities have started to exert political muscle. Sequim, Washington recently had a seniors-only development inform the local taxation board that, since none of the homes within the development had children, they would not be paying property taxes toward local schools. (Sadly, I could not find a link.)

And quickly, the situation will worsen. Our Boomed economy might just unBoom. Remember all that money the Boomers invested? When people retire, they generally liquidate invested assets to pay for retirement.

What does one call an unBoom in market parlance? Oh, yeah -- a Bust.

I don't think the Boomer Bust will be nearly as big, but I could be very wrong. The dot-com boom did have one silver lining; it diversified portfolios. Still, one cannot remove assets that large without causing a ripple, and once the ripple starts, folks will probably do what they have traditionally done; Panic.

Panic selling should become the future norm. If my extrapolations are correct, we can assume a massive stock market shock -- or several -- starting 20 years after the beginnings of the dot-com rise in 1993.

(I know what you're saying: It should be at 1999, the peak of the market. Remember, though, that the latter portion of the market boom really was fueled by irrational exhuberance, not just an influx of liquid assets new to the market. The difference; those that know should be able to track how much investment was made on margin verses how much was made using cold, hard cash.)

Any collapse of the stock market will doubly impact the economy. Thanks to the rise in 401-K styled retirement funds (and the subsequent decline in defined benefit retirement plans) shocks to the market system will impact people disproportionately. Some will be largely unaffected. Others will lose everything -- just when they're too old to keep working.

What else might happen when the economy goes down the drain? How about the ability to care for suddenly impoverished elders?

This is the confluence that worries me the most.

Just as we citizens go broke, the government follows suit.

Great.

I've been mulling over these numbers now for a few years. A gif imomus used in this post gave graphic and telling representation to this cresting demographic wave. Though it represents the demographics in Canada, rest assured those of the United States are very similar.

I've seen nothing like it. I love the image of the age wave moving through the years toward Death. Of course, if I had the software, I would make a slightly different image, rushing horizontally with men and women combined. It would start in 1946, and not stop its deadly advance until 2030.

First the wave would crash into the popular culture, destroying Music and dragging the shards of a shattered album through the decades like overplayed, tired Beattles standards.

Next it would crash into Wall Street, first lifting the market off its solid foundation, causing it to buoy unstably upward and bob just as suddenly downward, briefly submerging in 1999; after the market seems stable for just over a decade, the wave would dump the building, shattering it on a reef of bankruptcies, taking out whole swaths of the population -- peopled with folks still having trouble avoiding Creedence while waiting on hold.

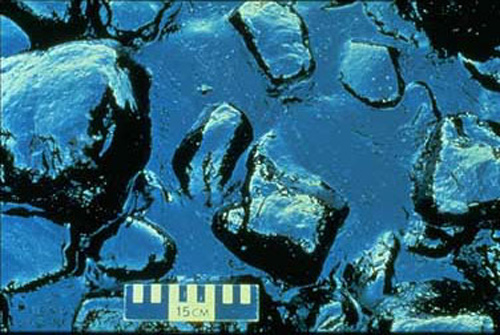

Near the end, the wave would dribble on some unknown shore, the detritus of its passing -- broken records, broken banks, broken dreams -- clogging the beach with a concentration of filth that would make the shores surrounding Bligh Reef after the Exxon Valdez wreck seem like someone just spilled a single Slurpy in the sand.

Take the Baby Boomers. At the moment, they are about to destroy the world around them.

It's not their fault, I know that. The fault lies with their parents, who all celebrated the end of four decades of war and economic depression with a quiet, peaceful, relieved frenzy of breeding the likes of which may very well be unrivaled in all of human history. The Boomers, product of that frenzy, merely found themselves surrounded by kids their own age.

Way too many kids their own age.

Let's extrapolate. The Baby Boom started in 1946, peaked in 1957, and declined sharply in 1964. The Summer of Love in 1969, therefore, proved something of a cresting of the Boomer Wave. The older boomers ranged from 16 to 23 (with a peak age group 14 nubile years old), gathered together, and started doing what 16-23 year olds the world around them do:

Listen to Music. In any given properly shaped bell-curve population, musical tastes are dominated by young people. New music surplants the older tastes as the focus, those young kids who buy recordings and attend shows, get too busy to do so, and use their money in other ways.

This is not happening. There are simply too many "classic rock" stations making money today because of that Boomer curve. Why? Frank Zappa once wrote a commencement address to a music school, telling the poor graduated saps that their professional lives will be spent appeasing the musical tastes of the most influential demographic, thirteen year old girls; in 1969 there were a lot of kids that age. There are now too many Boomers listening to the old, old music of their youth to allow younger tastes to gain much traction. Don't believe me? Listen to the radio. The songs on heaviest rotation mostly date from within 10 years of the Summer of Love.

Fuck. From the fucking came the families -- not as many as the parents prior had produced, but families that needed food and shelter nonetheless. This started to shift the Boomer spending priorities toward homes and goodies.

(After this bachannal, we find the Seventies, a depressing era dominated by the trailing edge of the Baby Boom trying desparately to have just as good a time as their older siblings, and failing miserably. They did manage to listen to some tunes and get some action; however, like the Victorian poets trying to outdo the powerhouse Romantics, they simply Failed Stupendously. I also believe -- and I was there -- that much of that failure stemmed from Peak Boomers partying way too long.)

Back to extrapolation tracing the coming A-mama&papa-colypse.

If we assume that many couples started many households just after 1969, the children of those homes would fledge and fly the coop starting in 1990. Before these nests emptied, the family income was mostly earmarked for feeding, educating and housing children. Therefore, after the children leave, the family often sees a large portion of the paycheck freed for other uses . . . like investments.

Read this Wiki entry on the dot-com bubble:

In 1994 the Internet came to the public's attention with the public advent of the Mosaic Web browser and the nascent World Wide Web, and by 1996 it became obvious to most publicly traded companies that a public Web presence was desirable. (Emphasis mine)

Now consider this very simple axiom in economics that the emphasized portion of the entry fails to appreciate: The price of any commodity depends on the amount of money available for purchase.

My point?

I believe the dot-com bubble started not out of a frenzy for all things internet, but due to the need for folks -- a lot of folks -- with suddenly expendable money to invest that money in something. The availability of the liquid, investable assets preceded -- and subsequently caused -- the rise in the market. The tech stocks had two important attributes which ensured their over-enrichment:

(If one assumes most families have more than one kid, and must therefore wait to invest most of their money after the youngest leaves, this fits perfectly.)

In a nutshell, Boomers caused the dot-com bubble by simply buying stocks the same way they bought records years ago -- all at once. They fouled the stock market just like they tainted the country's ability to hear new music years before.

Of course, it gets worse. Those music-hogging, stock market-rushing Boomers are all getting old. Soon they will stop driving their cars to work and start, again in record numbers, driving their recreational vehicles at a time when gasoline and diesel prices are on the rise. This decision to drive around and "see the country" will no doubt put an enormous crunch on fuel supplies.

Some retirement communities have started to exert political muscle. Sequim, Washington recently had a seniors-only development inform the local taxation board that, since none of the homes within the development had children, they would not be paying property taxes toward local schools. (Sadly, I could not find a link.)

And quickly, the situation will worsen. Our Boomed economy might just unBoom. Remember all that money the Boomers invested? When people retire, they generally liquidate invested assets to pay for retirement.

What does one call an unBoom in market parlance? Oh, yeah -- a Bust.

I don't think the Boomer Bust will be nearly as big, but I could be very wrong. The dot-com boom did have one silver lining; it diversified portfolios. Still, one cannot remove assets that large without causing a ripple, and once the ripple starts, folks will probably do what they have traditionally done; Panic.

Panic selling should become the future norm. If my extrapolations are correct, we can assume a massive stock market shock -- or several -- starting 20 years after the beginnings of the dot-com rise in 1993.

(I know what you're saying: It should be at 1999, the peak of the market. Remember, though, that the latter portion of the market boom really was fueled by irrational exhuberance, not just an influx of liquid assets new to the market. The difference; those that know should be able to track how much investment was made on margin verses how much was made using cold, hard cash.)

Any collapse of the stock market will doubly impact the economy. Thanks to the rise in 401-K styled retirement funds (and the subsequent decline in defined benefit retirement plans) shocks to the market system will impact people disproportionately. Some will be largely unaffected. Others will lose everything -- just when they're too old to keep working.

What else might happen when the economy goes down the drain? How about the ability to care for suddenly impoverished elders?

This is the confluence that worries me the most.

Just as we citizens go broke, the government follows suit.

Great.

I've been mulling over these numbers now for a few years. A gif imomus used in this post gave graphic and telling representation to this cresting demographic wave. Though it represents the demographics in Canada, rest assured those of the United States are very similar.

I've seen nothing like it. I love the image of the age wave moving through the years toward Death. Of course, if I had the software, I would make a slightly different image, rushing horizontally with men and women combined. It would start in 1946, and not stop its deadly advance until 2030.

First the wave would crash into the popular culture, destroying Music and dragging the shards of a shattered album through the decades like overplayed, tired Beattles standards.

Next it would crash into Wall Street, first lifting the market off its solid foundation, causing it to buoy unstably upward and bob just as suddenly downward, briefly submerging in 1999; after the market seems stable for just over a decade, the wave would dump the building, shattering it on a reef of bankruptcies, taking out whole swaths of the population -- peopled with folks still having trouble avoiding Creedence while waiting on hold.

Near the end, the wave would dribble on some unknown shore, the detritus of its passing -- broken records, broken banks, broken dreams -- clogging the beach with a concentration of filth that would make the shores surrounding Bligh Reef after the Exxon Valdez wreck seem like someone just spilled a single Slurpy in the sand.