ОПЕК: текущие данные

OPEC Basket Price

OPEC Upstream Investment

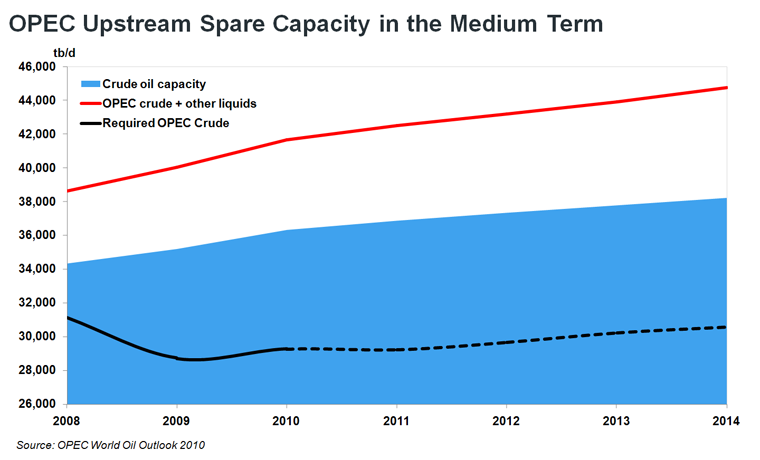

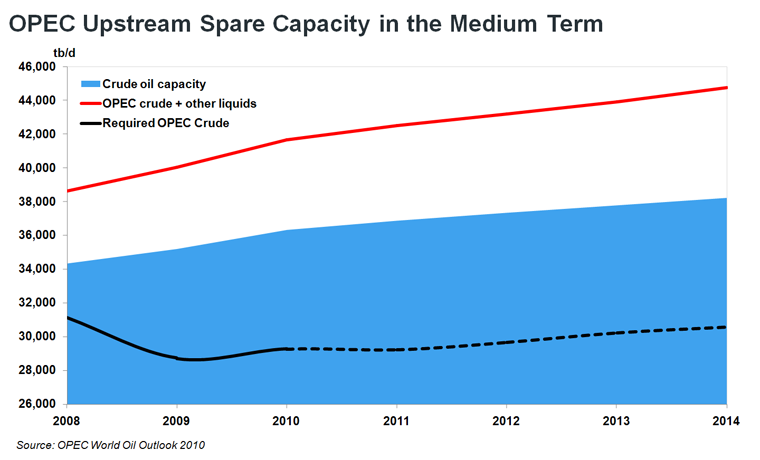

To ensure that the world economy benefits from regular and secure oil supplies, OPEC Member Countries continue to invest to expand upstream capacity. Over the period to 2014, according to OPEC's projects database, around 140 projects are expected to come on-stream. These projects will result in net crude oil capacity additions of around 3.0 mb/d by the end of 2014. On top of this, over 2 mb/d of net NGL capacity additions is anticipated.

OPEC Member Countries continue to expand upstream capacity. This should be sufficient not only to satisfy increases in the amount of oil OPEC is asked to provide, but also to provide a comfortable cushion of spare capacity. These investments, coupled with the decline in demand, will lead to an increase in spare capacity of around 6 mb/d, or more, over the medium term.

In the medium term, about 140 projects, with an overall estimated cost of some $155 billion, are being undertaken by OPEC Member Countries. These projects are in addition to all energy infrastructure projects, such as pipelines, export terminals and downstream expansion schemes.

OPEC Oil Reserves

According to current estimates, more than 80% of the world's proven oil reserves are located in OPEC Member Countries, with the bulk of OPEC oil reserves in the Middle East, amounting to 65% of the OPEC total. OPEC Member Countries have made significant additions to their oil reserves in recent years, for example, by adopting best practices in the industry, realizing intensive explorations and enhancing recoveries. As a result, OPEC's proven oil reserves currently stand at well above 1,190 billion barrels.

During the period 2001-2010, OPEC Member Countries added 347.2 billion barrels to their total proven crude oil reserves, more than ten times the additions made by other crude oil producers.

The global reserve/resource base can easily meet forecast demand growth for decades to come. Estimates of ultimately recoverable reserves (URR) have increased over time, with advancing technology, enhanced recovery and new reservoir development. For example, according to an established industry source, reserve growth from improved recovery alone in existing fields amounted to 175 billion barrels in 1995-2003; combined with new discoveries of 138 billion barrels, total reserve growth was therefore well above the cumulative production of 236 billion barrels for that period. Moreover, technology continues to blur the distinction between conventional and non-conventional oil, of which there is also abundance, as well as with other fossil fuels. We expect the world’s URR to continue to increase in the future.

Market Indicators April 2012

- - - - - - - - - -

Согласно официальным данным ОПЕК убыль продаж Ирана покрывают в первую очередь Ирак, Ливия, Саудовская Аравия, Нигерия, Ангола

OPEC Upstream Investment

To ensure that the world economy benefits from regular and secure oil supplies, OPEC Member Countries continue to invest to expand upstream capacity. Over the period to 2014, according to OPEC's projects database, around 140 projects are expected to come on-stream. These projects will result in net crude oil capacity additions of around 3.0 mb/d by the end of 2014. On top of this, over 2 mb/d of net NGL capacity additions is anticipated.

OPEC Member Countries continue to expand upstream capacity. This should be sufficient not only to satisfy increases in the amount of oil OPEC is asked to provide, but also to provide a comfortable cushion of spare capacity. These investments, coupled with the decline in demand, will lead to an increase in spare capacity of around 6 mb/d, or more, over the medium term.

In the medium term, about 140 projects, with an overall estimated cost of some $155 billion, are being undertaken by OPEC Member Countries. These projects are in addition to all energy infrastructure projects, such as pipelines, export terminals and downstream expansion schemes.

OPEC Oil Reserves

According to current estimates, more than 80% of the world's proven oil reserves are located in OPEC Member Countries, with the bulk of OPEC oil reserves in the Middle East, amounting to 65% of the OPEC total. OPEC Member Countries have made significant additions to their oil reserves in recent years, for example, by adopting best practices in the industry, realizing intensive explorations and enhancing recoveries. As a result, OPEC's proven oil reserves currently stand at well above 1,190 billion barrels.

During the period 2001-2010, OPEC Member Countries added 347.2 billion barrels to their total proven crude oil reserves, more than ten times the additions made by other crude oil producers.

The global reserve/resource base can easily meet forecast demand growth for decades to come. Estimates of ultimately recoverable reserves (URR) have increased over time, with advancing technology, enhanced recovery and new reservoir development. For example, according to an established industry source, reserve growth from improved recovery alone in existing fields amounted to 175 billion barrels in 1995-2003; combined with new discoveries of 138 billion barrels, total reserve growth was therefore well above the cumulative production of 236 billion barrels for that period. Moreover, technology continues to blur the distinction between conventional and non-conventional oil, of which there is also abundance, as well as with other fossil fuels. We expect the world’s URR to continue to increase in the future.

Market Indicators April 2012

- - - - - - - - - -

Согласно официальным данным ОПЕК убыль продаж Ирана покрывают в первую очередь Ирак, Ливия, Саудовская Аравия, Нигерия, Ангола