Net Energy

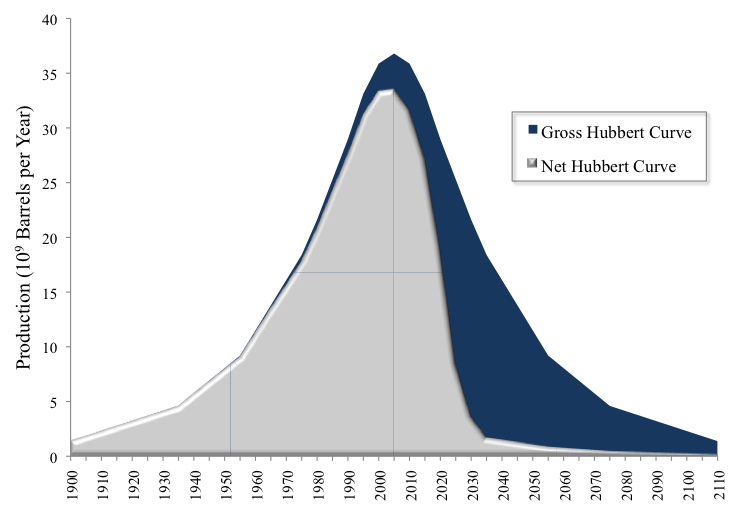

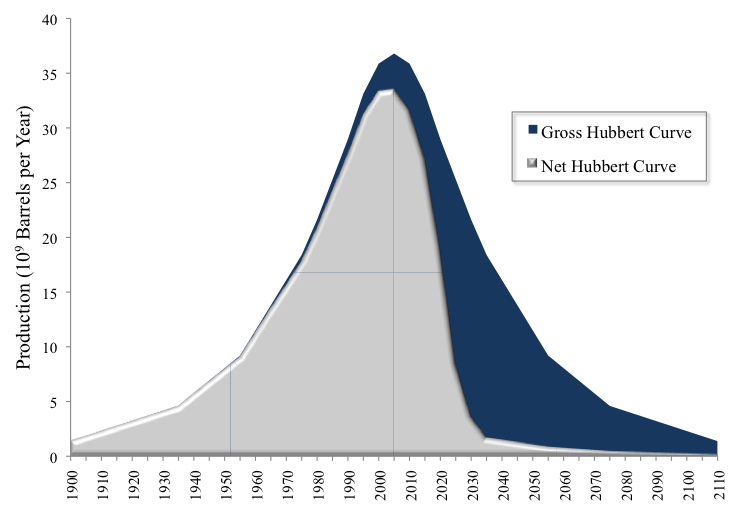

The following graphic is a simple, clear and unpleasant sample of the future. It simplifies things somewhat. But the simplification is illustrative.

The linked article describes the intent behind the graph better than I will here. Building from the basic Hubbert principles:

Detractors and technocopians (disclaimer: at one point I fell into that camp) will argue that this is too simple, that economics will magically cause new reserves or subsitutes to appear. However, given the last two years, I'd have to disagree. For each of their points that make the graph cheerier, there are ones to make it gloomier again.

We already see signs that critical investment in extraction equipment is being deferred due to economic issues. Experts in the required fields are set to retire. As the rate of return becomes worse future extraction efforts may not even be funded as "uneconomic". (It's a variant of this line of reasoning that makes me think that we won't get $1000/barrel oil. Things will go bad before that and fossil fuel usage will no longer be an economic issue but a political/military one. There won't be enough of it).

Mining of hydrocarbons will increasingly become a political problem, and it will not matter one bit what scientifically is (not) possible. It is a nice hobby... but the endgame will be determined by soldiers and not scientists.

eastender

The linked article describes the intent behind the graph better than I will here. Building from the basic Hubbert principles:

- An individual [fossil fuel] field (well, mine, tar sands project) has a bell-shaped production curve

- As you combine fields within a "province", a bell-shaped production curve arises for the province.

- This can be extrapolated to the fossil energy supply for the world.

- Resource exploitation generally follows a "best first" exploitation pattern. The easiest/cheapest finds are exploited first, and as exploitation continues, harder and more difficult finds are progressively exploited.

- In the US, oil has moved from a roughly 100-to-1 return on energy investment in the early heady days to 11-to-1 return now. This is going to continue as development continues to harder and more difficult fields

- It follows that world production of oil-equivalents (including NGL and tar sands, super heavy oil) will follow the same pattern.

Detractors and technocopians (disclaimer: at one point I fell into that camp) will argue that this is too simple, that economics will magically cause new reserves or subsitutes to appear. However, given the last two years, I'd have to disagree. For each of their points that make the graph cheerier, there are ones to make it gloomier again.

We already see signs that critical investment in extraction equipment is being deferred due to economic issues. Experts in the required fields are set to retire. As the rate of return becomes worse future extraction efforts may not even be funded as "uneconomic". (It's a variant of this line of reasoning that makes me think that we won't get $1000/barrel oil. Things will go bad before that and fossil fuel usage will no longer be an economic issue but a political/military one. There won't be enough of it).

Mining of hydrocarbons will increasingly become a political problem, and it will not matter one bit what scientifically is (not) possible. It is a nice hobby... but the endgame will be determined by soldiers and not scientists.

eastender