US vs UK Taxes

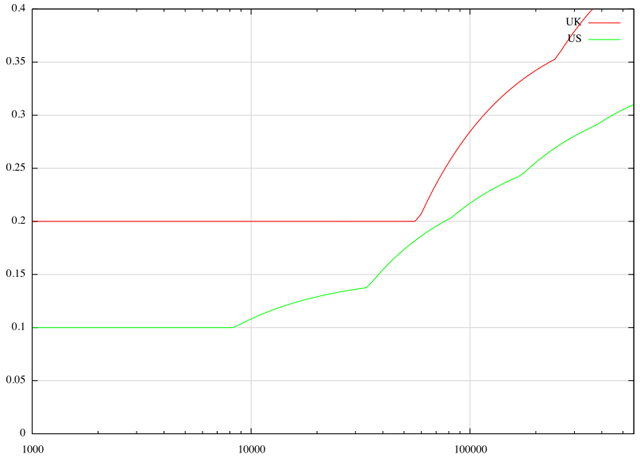

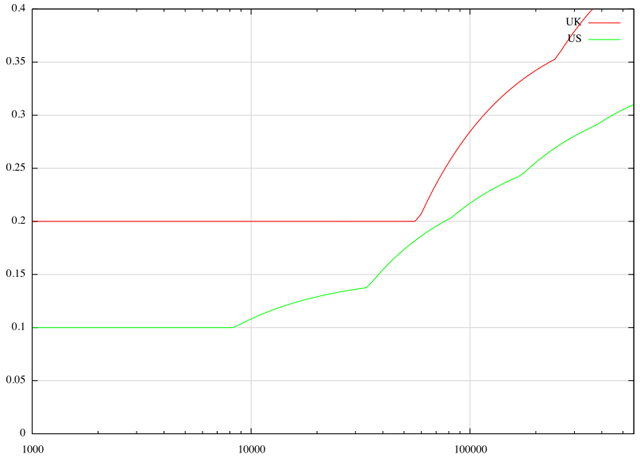

UK taxes are significantly higher than US taxes. If you compare the effective Federal income tax rates of each country (at current dollar/pound exchange rates) you can see that UK taxes are about twice as much as US taxes. The rates get pretty close at £35,000 (right before Brits start falling into the upper bracket) but above or below that number you'll find the British rich and poor paying much higher taxes.

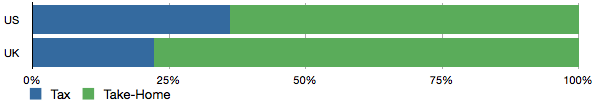

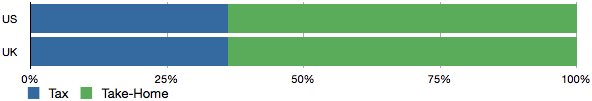

Actually it's not that simple. When I started receiving British paychecks I was pleasantly surprised to discover that after my taxes were deducted, a full 77% was finding its way into my bank account. Brilliant, right?

Actually it's not quite that simple. As a new UK earner with no previous pay history, my first £35,000 was taxed at 20%. Her Majesty's automated tax system is slow to figure out what I'm actually earning, but as I continue to collect paychecks they're starting to tax me at the UK's higher rates. A better estimate for my end-of-year tax burden is extremely close to what my pay stubs showed in America:

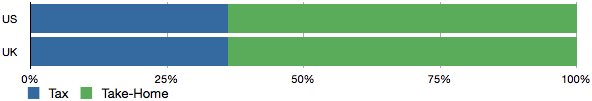

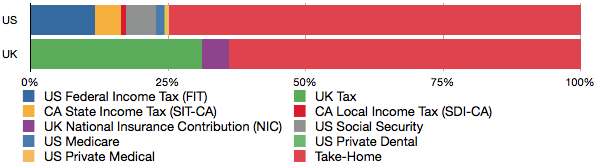

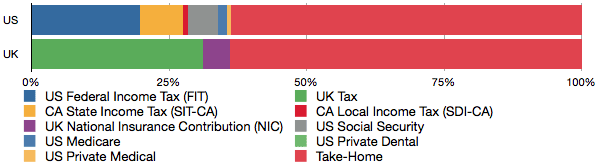

How can this be, when that British taxes are higher than American taxes? The "higher" British tax rate is a single all-inclusive line item. The "lower" US Federal tax rate doesn't include all the extra line items that federal taxes don't cover. State taxes, local taxes, social security, medicare, and voluntary participation in private medical, dental plans, etc. If you break down the composition of the tax burden you can see how the low Federal rate giveth and state taxes / social security taketh away. With all these extras, a British person earning £35,000 would take home more money than an American earning a similar amount.

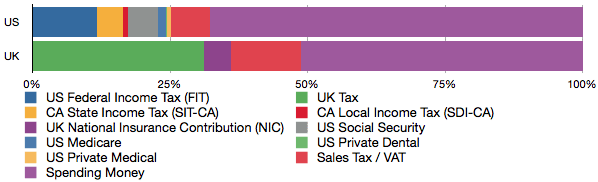

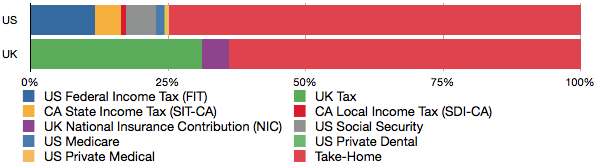

Actually it's not quite that simple. No American actually pays what their tax bracket says they should pay thanks to our complicated system of tax credits and deductions. Americans save receipts and pay accountants to file their returns. UK taxes are far more straightforward and the deductions are quite limited. UK homeowners don't get a home mortgage interest deduction or a "home office" deduction for computers, office supplies, and other "business expenses". In 2010, as a receipt-saving American homeowner I reduced my theoretical 36% tax burden to a Federal rate of 12% and a total rate of 25%. Here's this year's US actual and UK estimated end-of-year tax burdens:

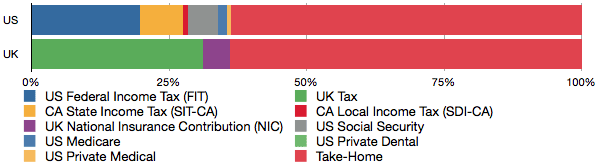

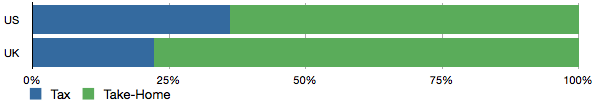

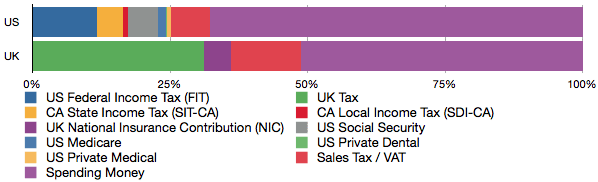

Actually it's not quite that simple. We should compare not just income but purchasing power. Californians and UK citizens also pay sales tax / VAT. How much goes toward the actual purchase? Retail sales in San Francisco are taxed at 9.5% while the UK just raised their VAT to 20%. Here's relative purchasing power after deducting VAT and sales tax:

Of course these are only my numbers, specific to my particular case and should not be generalized. If you make a lot less or a lot more than I do, your numbers will be different. It's also worth considering that the taxes I pay give me access benefits unavailable to Americans: a reliable system of buses and series of Tubes, 4 weeks paid vacation, a stronger currency, a less responsive but more reliable but less costly medical system (more on that later), etc. The ale, cheese, and pies are cheaper and better but the rent, movie theaters, and consumer electronics aren't. Point political and lifestyle choices - what you do with your money, what you get from it, how you value the trade-off - make the question of taxes and benefits extremely subjective. Would you rather pay high taxes to live in New York or San Francisco, low taxes for Nevada, or get paid to live in Alaska? Depends.

In conclusion: It's a mistake to confuse the top tax bracket for the actual tax burden, compare federal rates instead of the full burden, or consider theoretical rates without practical deductions. If you earn around £35,000, don't own a house, and file with a 1040-EZ you'll likely pay more taxes in America. If you earn a lot less or a lot more, buy a house, hire an accountant, and spend all your money buying stuff you'll probably pay a lot more taxes in the UK.

ps; The difference between listed tax rates and actual taxes paid is one of the greatest intellectual dishonesties in public discourse today. Ignoring this difference is what lets "pro-business" types complain about usurious corporate tax rates strangling capitalists and quashing innovation, while corporations pay no takes or take refunds. The same goes for liberals reminiscing about the 94% tax rate of '44-'45, or conservatives celebrating Reagan cutting taxes from 70% to 50%. Reagan cut taxes and deductions, which is whyhis tax revenues only went down by 2%-4%. Without figuring the effective marginal rate and accounting for deductions, the top marginal tax rate is an essentially meaningless number.

Actually it's not that simple. When I started receiving British paychecks I was pleasantly surprised to discover that after my taxes were deducted, a full 77% was finding its way into my bank account. Brilliant, right?

Actually it's not quite that simple. As a new UK earner with no previous pay history, my first £35,000 was taxed at 20%. Her Majesty's automated tax system is slow to figure out what I'm actually earning, but as I continue to collect paychecks they're starting to tax me at the UK's higher rates. A better estimate for my end-of-year tax burden is extremely close to what my pay stubs showed in America:

How can this be, when that British taxes are higher than American taxes? The "higher" British tax rate is a single all-inclusive line item. The "lower" US Federal tax rate doesn't include all the extra line items that federal taxes don't cover. State taxes, local taxes, social security, medicare, and voluntary participation in private medical, dental plans, etc. If you break down the composition of the tax burden you can see how the low Federal rate giveth and state taxes / social security taketh away. With all these extras, a British person earning £35,000 would take home more money than an American earning a similar amount.

Actually it's not quite that simple. No American actually pays what their tax bracket says they should pay thanks to our complicated system of tax credits and deductions. Americans save receipts and pay accountants to file their returns. UK taxes are far more straightforward and the deductions are quite limited. UK homeowners don't get a home mortgage interest deduction or a "home office" deduction for computers, office supplies, and other "business expenses". In 2010, as a receipt-saving American homeowner I reduced my theoretical 36% tax burden to a Federal rate of 12% and a total rate of 25%. Here's this year's US actual and UK estimated end-of-year tax burdens:

Actually it's not quite that simple. We should compare not just income but purchasing power. Californians and UK citizens also pay sales tax / VAT. How much goes toward the actual purchase? Retail sales in San Francisco are taxed at 9.5% while the UK just raised their VAT to 20%. Here's relative purchasing power after deducting VAT and sales tax:

Of course these are only my numbers, specific to my particular case and should not be generalized. If you make a lot less or a lot more than I do, your numbers will be different. It's also worth considering that the taxes I pay give me access benefits unavailable to Americans: a reliable system of buses and series of Tubes, 4 weeks paid vacation, a stronger currency, a less responsive but more reliable but less costly medical system (more on that later), etc. The ale, cheese, and pies are cheaper and better but the rent, movie theaters, and consumer electronics aren't. Point political and lifestyle choices - what you do with your money, what you get from it, how you value the trade-off - make the question of taxes and benefits extremely subjective. Would you rather pay high taxes to live in New York or San Francisco, low taxes for Nevada, or get paid to live in Alaska? Depends.

In conclusion: It's a mistake to confuse the top tax bracket for the actual tax burden, compare federal rates instead of the full burden, or consider theoretical rates without practical deductions. If you earn around £35,000, don't own a house, and file with a 1040-EZ you'll likely pay more taxes in America. If you earn a lot less or a lot more, buy a house, hire an accountant, and spend all your money buying stuff you'll probably pay a lot more taxes in the UK.

ps; The difference between listed tax rates and actual taxes paid is one of the greatest intellectual dishonesties in public discourse today. Ignoring this difference is what lets "pro-business" types complain about usurious corporate tax rates strangling capitalists and quashing innovation, while corporations pay no takes or take refunds. The same goes for liberals reminiscing about the 94% tax rate of '44-'45, or conservatives celebrating Reagan cutting taxes from 70% to 50%. Reagan cut taxes and deductions, which is whyhis tax revenues only went down by 2%-4%. Without figuring the effective marginal rate and accounting for deductions, the top marginal tax rate is an essentially meaningless number.