The "TBA Party" : Taxed Below Average

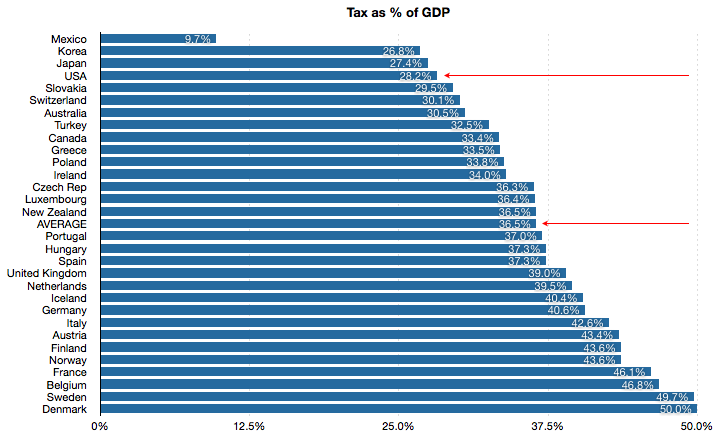

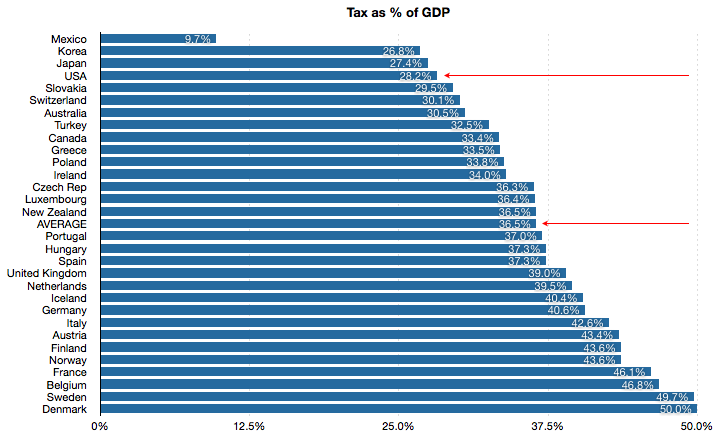

The "TEA Party" stands for "Taxed Enough Already". The story goes that out of control government spending causes unreasonable tax burdens. Obama's liberal tax-and-spend policy will cause businesses to flee America to places with lower taxes which will ruin our country. It's not true. Even according to the Heritage Foundation, Americans' tax burdens are at historic lows. Federal tax revenue as a percentage of GDP is even lower today than it was under George Bush. If you look at tax as a percentage of GDP the USA ranks 4 out of 30:

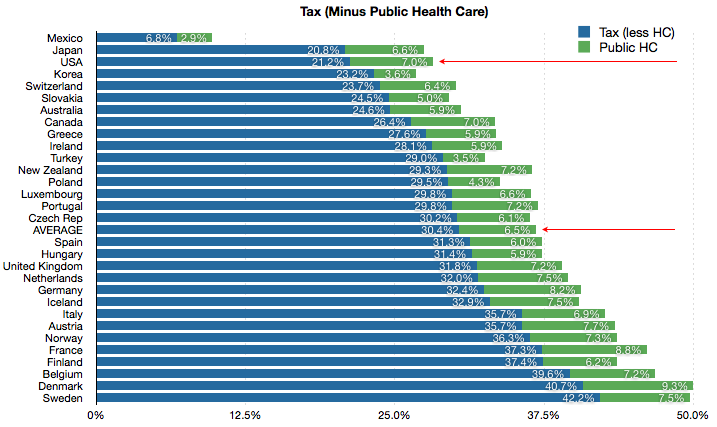

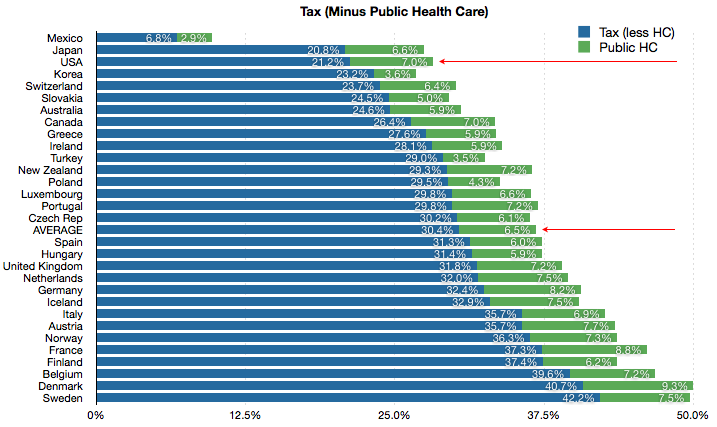

Where do the taxes go? Health care, for one. Some countries spend more on the health of their citizens than others. Between Medicare, Medicaid, and the VA the United States spends 7% of its GDP on public health care, which is relatively high considering that most Americans don't get public health care yet. If we subtract the cost of socialized medicine the American tax burden America pops up to 3 out of 30:

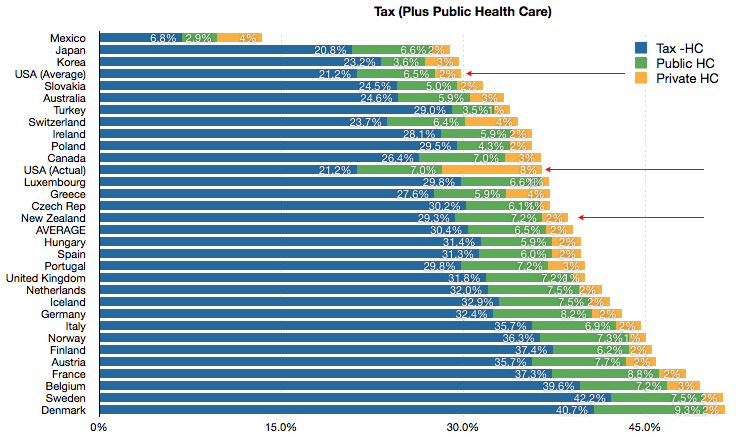

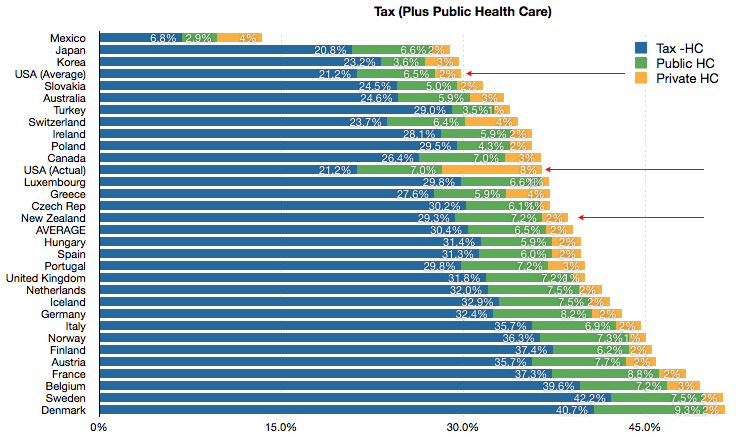

Of course we *do* pay for health care. We pay socialized costs, and we pay out-of-pocket costs. If you add up all these costs - how much GDP Americans spend on taxes and health care. If we add *that* in, America drops to 12 out of 30. Still above average, but not nearly as good as before. But here's the catch. If America can put together a health care system that's completely average - 6.5% public, 2.2% private - we'd go back up to 4th place.

I'm posting this for a few reasons. First, I wanted to put up a milepost for future conversations. When the teabaggers show up to protest the 2010, 2011, or 2012 tax seasons and blame "Obamacare" I wanted to show what we've been paying in the past to see what changes in the future. Second, I wanted to show that taxes are not high in America. They're actually quite low, relatively speaking, especially when you consider how much of it is defense spending that other countries don't spend. And third, one of the things that concerns me about the health care reform bill is that I don't think it does nearly enough on the cost side. Public mandates to purchase insurance work pretty well in Switzerland and Japan, but only alongside extremely strict laws that either mandate prices directly or require bottom-tier policies to be no-profit policies. In the next few years charts like these will show whether what we've done with health care has improved efficiency as well as coverage.

(Inspired by this post.)

Where do the taxes go? Health care, for one. Some countries spend more on the health of their citizens than others. Between Medicare, Medicaid, and the VA the United States spends 7% of its GDP on public health care, which is relatively high considering that most Americans don't get public health care yet. If we subtract the cost of socialized medicine the American tax burden America pops up to 3 out of 30:

Of course we *do* pay for health care. We pay socialized costs, and we pay out-of-pocket costs. If you add up all these costs - how much GDP Americans spend on taxes and health care. If we add *that* in, America drops to 12 out of 30. Still above average, but not nearly as good as before. But here's the catch. If America can put together a health care system that's completely average - 6.5% public, 2.2% private - we'd go back up to 4th place.

I'm posting this for a few reasons. First, I wanted to put up a milepost for future conversations. When the teabaggers show up to protest the 2010, 2011, or 2012 tax seasons and blame "Obamacare" I wanted to show what we've been paying in the past to see what changes in the future. Second, I wanted to show that taxes are not high in America. They're actually quite low, relatively speaking, especially when you consider how much of it is defense spending that other countries don't spend. And third, one of the things that concerns me about the health care reform bill is that I don't think it does nearly enough on the cost side. Public mandates to purchase insurance work pretty well in Switzerland and Japan, but only alongside extremely strict laws that either mandate prices directly or require bottom-tier policies to be no-profit policies. In the next few years charts like these will show whether what we've done with health care has improved efficiency as well as coverage.

(Inspired by this post.)