Leading Indicators Still Worrisome, But Mostly Less So

While no longer flashing as much red as they were over the summer, leading indicators still suggest that the economy remains in a soft spot, and may be especially vulnerable to any new shocks.

Here are a few leading indexes worth keeping in mind

From Cullen Roche (Posted in Seeking Alpha)

The U.S. Economy Is Weaker Than You Think - Goldman Sachs

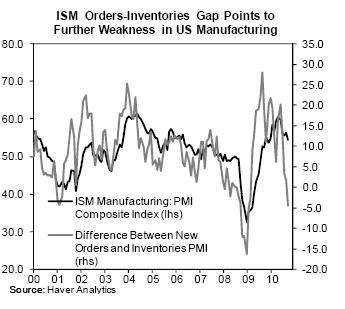

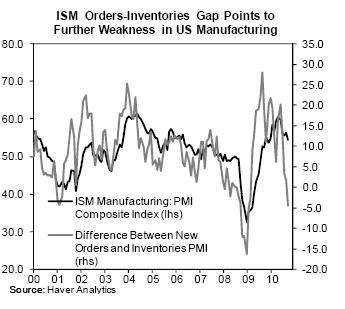

Goldman Sachs issued a very bullish note on the Euro this morning. Not because they think Europe is entering a period of robust growth. No, in fact they reduced their estimates for European growth based on the recent Euro strength; however, they see the U.S. economy simply deteriorating more than Europe. The chart in this presentation that jumped out was the ISM’s index compared to the orders & inventories. The orders and inventories data shows a very strong leading indication of future ISM growth. Currently, the orders and inventories data is forecasting ISM readings in the low 40s. The lead time here ranges from 3-6 months so based on this data it would not be shocking to see contraction in the ISM data in the next two quarters:

David Rosenberg recently highlighted a similar chart showing that there is a 75% chance of recession when this occurs. He said:

“What is critical here is the orders-to-inventories ratio, which leads the headline ISM by roughly three months and strongly suggests that we will be sub-50 and as such ‘double dip’ talk will re-emerge before the end of the year...

From Dough Short (Posted in Dshort.com)

Consumer Metrics Institute's Growth Index: Waiting for the Other Shoe to Drop

Note from dshort: The CMI charts are now updated through October 7. The current Growth Index contraction has temporarily leveled out around -6.10. The 2008-2009 contraction bottomed out at a similar level in September 2008, over six months prior to the market low in March 2009. Will we look back in another six months at the Growth Index as a valid leading indicator of the market?

What about the index as a leading indicator for GDP? See the Institute's October 5th commentary for a discussion of the Bureau of Economic Analysis (BEA) September revision to GDP...

Here are a few leading indexes worth keeping in mind

From Cullen Roche (Posted in Seeking Alpha)

The U.S. Economy Is Weaker Than You Think - Goldman Sachs

Goldman Sachs issued a very bullish note on the Euro this morning. Not because they think Europe is entering a period of robust growth. No, in fact they reduced their estimates for European growth based on the recent Euro strength; however, they see the U.S. economy simply deteriorating more than Europe. The chart in this presentation that jumped out was the ISM’s index compared to the orders & inventories. The orders and inventories data shows a very strong leading indication of future ISM growth. Currently, the orders and inventories data is forecasting ISM readings in the low 40s. The lead time here ranges from 3-6 months so based on this data it would not be shocking to see contraction in the ISM data in the next two quarters:

David Rosenberg recently highlighted a similar chart showing that there is a 75% chance of recession when this occurs. He said:

“What is critical here is the orders-to-inventories ratio, which leads the headline ISM by roughly three months and strongly suggests that we will be sub-50 and as such ‘double dip’ talk will re-emerge before the end of the year...

From Dough Short (Posted in Dshort.com)

Consumer Metrics Institute's Growth Index: Waiting for the Other Shoe to Drop

Note from dshort: The CMI charts are now updated through October 7. The current Growth Index contraction has temporarily leveled out around -6.10. The 2008-2009 contraction bottomed out at a similar level in September 2008, over six months prior to the market low in March 2009. Will we look back in another six months at the Growth Index as a valid leading indicator of the market?

What about the index as a leading indicator for GDP? See the Institute's October 5th commentary for a discussion of the Bureau of Economic Analysis (BEA) September revision to GDP...