On the Solidifying Deflation, Dating the 2007 Recession, and Depressions

As mentioned before, data continues to build strongly that the US has indeed been sliding into a textbook deflationary downdraft, literally our first since the 1930s. Deflations generally sap the ability of economies to snap back from downturns, and in addition to making for subdued recoveries, also usually leaving them quite vulnerable to future shocks and slowdowns spiraling into more outright recessions, rather than just mere bumps in the road.

Also as mentioned before, recent research keeps showing how GDI (Gross Domestic Income) is probably a more reliable leading and coincident indicator of recessions than is GDP (Gross Domestic Product).

Today's revisions to first quarter GDI & GDP expose how this recovery, while being touted in some quarters as being a "V-shaped recovery," is actually still quite humble, given its depth.

Also more clearly shown, is how the NBER may be inclined to date the recovery quarter as Q4 of last year, rather than Q3, as GDI continued to contract noticeably over the third quarter of last year. This could conceivably date the recession as running from Dec. 2007 through Sep. 2009, denoting it to be by far the longest since the recession of 1929-1933.

Calculated Risk

Gross Domestic Income shows more sluggish recovery

Most of the revisions in the "Second Estimate" GDP report this morning were small; the headline GDP number was revised down to 3.0% from 3.2% (annualized real growth rate).

There are really two measures of GDP: 1) real GDP, and 2) real Gross Domestic Income (GDI). The BEA also released GDI today. Recent research suggests that GDI is often more accurate than GDP.

For a discussion on GDI, see from Fed economist Jeremy Nalewaik, “Income and Product Side Estimates of US Output Growth,” Brookings Papers on Economic Activity...

Click on graph for larger image in new window.

It appears that GDP bottomed in Q2 2009 and GDI in Q3 2009. Real GDP is only 1.2% below the pre-recession peak - but real GDI is still 2.3% below the previous peak.

GDI suggests the recovery has been more sluggish than the headline GDP report and better explains the weakness in the labor market...

Seeking Alpha Editor's Pick

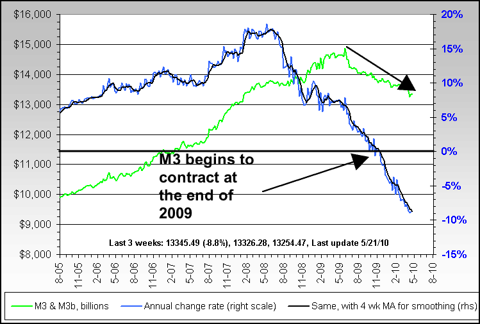

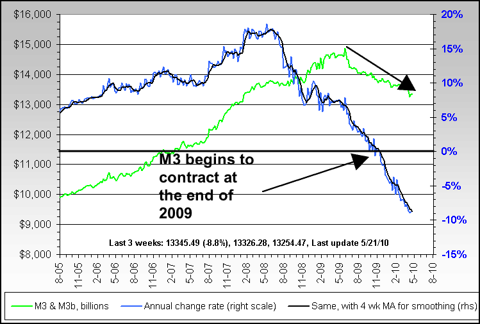

Andy Sutton: The Consequences of M3

M3 growth has collapsed. We had pointed this out several months ago and again more recently amidst a barrage of protest emails that the printing press always wins the battle with the deflationary black hole. To date, the black hole is winning hands down. The reasons are nebulous and complex, but the point is that our broadest monetary aggregate is now shrinking. This does not bode well for our economic prospects moving forward.

True to form, even the mainstream press is starting to take notice, long after the trend has been well established. Ambrose Evans Pritchard dedicated a piece yesterday to the collapse in M3 growth, something that hasn’t been seen in the US since the Great Depression. Monetarists the world around are frightened about this trend, and with good reason. US interest rates are already essentially zero. The massive monetary and fiscal stimulus has been epic in nature. And all this has still not prevented the actual textbook deflationary trend we now find ourselves in...

Telegraph.co.uk

US money supply plunges at 1930s pace as Obama eyes fresh stimulus

The M3 money supply in the United States is contracting at an accelerating rate that now matches the average decline seen from 1929 to 1933, despite near zero interest rates and the biggest fiscal blitz in history.

The M3 figures - which include broad range of bank accounts and are tracked by British and European monetarists for warning signals about the direction of the US economy a year or so in advance - began shrinking last summer. The pace has since quickened.

The stock of money fell from $14.2 trillion to $13.9 trillion in the three months to April, amounting to an annual rate of contraction of 9.6pc. The assets of insitutional money market funds fell at a 37pc rate, the sharpest drop ever.

"It’s frightening," said Professor Tim Congdon from International Monetary Research. "The plunge in M3 has no precedent since the Great Depression. The dominant reason for this is that regulators across the world are pressing banks to raise capital asset ratios and to shrink their risk assets. This is why the US is not recovering properly," he said...

Larry Summers, President Barack Obama’s top economic adviser, has asked Congress to "grit its teeth" and approve a fresh fiscal boost of $200bn to keep growth on track. "We are nearly 8m jobs short of normal employment. For millions of Americans the economic emergency grinds on," he said.

David Rosenberg from Gluskin Sheff said the White House appears to have reversed course just weeks after Mr Obama vowed to rein in a budget deficit of $1.5 trillion (9.4pc of GDP) this year and set up a commission to target cuts. "You truly cannot make this stuff up. The US governnment is freaked out about the prospect of a double-dip," he said.

The White House request is a tacit admission that the economy is already losing thrust and may stall later this year as stimulus from the original $800bn package starts to fade...

Mr Congdon said the Obama policy risks repeating the strategic errors of Japan, which pushed debt to dangerously high levels with one fiscal boost after another during its Lost Decade, instead of resorting to full-blown "Friedmanite" monetary stimulus.

"Fiscal policy does not work. The US has just tried the biggest fiscal experiment in history and it has failed. What matters is the quantity of money and in extremis that can be increased easily by quantititave easing. If the Fed doesn’t act, a double-dip recession is a virtual certainty," he said...

Also as mentioned before, recent research keeps showing how GDI (Gross Domestic Income) is probably a more reliable leading and coincident indicator of recessions than is GDP (Gross Domestic Product).

Today's revisions to first quarter GDI & GDP expose how this recovery, while being touted in some quarters as being a "V-shaped recovery," is actually still quite humble, given its depth.

Also more clearly shown, is how the NBER may be inclined to date the recovery quarter as Q4 of last year, rather than Q3, as GDI continued to contract noticeably over the third quarter of last year. This could conceivably date the recession as running from Dec. 2007 through Sep. 2009, denoting it to be by far the longest since the recession of 1929-1933.

Calculated Risk

Gross Domestic Income shows more sluggish recovery

Most of the revisions in the "Second Estimate" GDP report this morning were small; the headline GDP number was revised down to 3.0% from 3.2% (annualized real growth rate).

There are really two measures of GDP: 1) real GDP, and 2) real Gross Domestic Income (GDI). The BEA also released GDI today. Recent research suggests that GDI is often more accurate than GDP.

For a discussion on GDI, see from Fed economist Jeremy Nalewaik, “Income and Product Side Estimates of US Output Growth,” Brookings Papers on Economic Activity...

Click on graph for larger image in new window.

It appears that GDP bottomed in Q2 2009 and GDI in Q3 2009. Real GDP is only 1.2% below the pre-recession peak - but real GDI is still 2.3% below the previous peak.

GDI suggests the recovery has been more sluggish than the headline GDP report and better explains the weakness in the labor market...

Seeking Alpha Editor's Pick

Andy Sutton: The Consequences of M3

M3 growth has collapsed. We had pointed this out several months ago and again more recently amidst a barrage of protest emails that the printing press always wins the battle with the deflationary black hole. To date, the black hole is winning hands down. The reasons are nebulous and complex, but the point is that our broadest monetary aggregate is now shrinking. This does not bode well for our economic prospects moving forward.

True to form, even the mainstream press is starting to take notice, long after the trend has been well established. Ambrose Evans Pritchard dedicated a piece yesterday to the collapse in M3 growth, something that hasn’t been seen in the US since the Great Depression. Monetarists the world around are frightened about this trend, and with good reason. US interest rates are already essentially zero. The massive monetary and fiscal stimulus has been epic in nature. And all this has still not prevented the actual textbook deflationary trend we now find ourselves in...

Telegraph.co.uk

US money supply plunges at 1930s pace as Obama eyes fresh stimulus

The M3 money supply in the United States is contracting at an accelerating rate that now matches the average decline seen from 1929 to 1933, despite near zero interest rates and the biggest fiscal blitz in history.

The M3 figures - which include broad range of bank accounts and are tracked by British and European monetarists for warning signals about the direction of the US economy a year or so in advance - began shrinking last summer. The pace has since quickened.

The stock of money fell from $14.2 trillion to $13.9 trillion in the three months to April, amounting to an annual rate of contraction of 9.6pc. The assets of insitutional money market funds fell at a 37pc rate, the sharpest drop ever.

"It’s frightening," said Professor Tim Congdon from International Monetary Research. "The plunge in M3 has no precedent since the Great Depression. The dominant reason for this is that regulators across the world are pressing banks to raise capital asset ratios and to shrink their risk assets. This is why the US is not recovering properly," he said...

Larry Summers, President Barack Obama’s top economic adviser, has asked Congress to "grit its teeth" and approve a fresh fiscal boost of $200bn to keep growth on track. "We are nearly 8m jobs short of normal employment. For millions of Americans the economic emergency grinds on," he said.

David Rosenberg from Gluskin Sheff said the White House appears to have reversed course just weeks after Mr Obama vowed to rein in a budget deficit of $1.5 trillion (9.4pc of GDP) this year and set up a commission to target cuts. "You truly cannot make this stuff up. The US governnment is freaked out about the prospect of a double-dip," he said.

The White House request is a tacit admission that the economy is already losing thrust and may stall later this year as stimulus from the original $800bn package starts to fade...

Mr Congdon said the Obama policy risks repeating the strategic errors of Japan, which pushed debt to dangerously high levels with one fiscal boost after another during its Lost Decade, instead of resorting to full-blown "Friedmanite" monetary stimulus.

"Fiscal policy does not work. The US has just tried the biggest fiscal experiment in history and it has failed. What matters is the quantity of money and in extremis that can be increased easily by quantititave easing. If the Fed doesn’t act, a double-dip recession is a virtual certainty," he said...