Potential For A Double Dip Unlike Any Before in Recent Memory?

There are two classic examples most often given for rapid-succession recessions:

1. The Double Dip Recessions of the early 1980s, and

2. The Double Dip Recessions of the 1930s

In both of those cases, the causes are attributed to intentional economic policy tightening: Both of the early 80s recessions were the result of the ongoing WIN (Whip Inflation Now) campaigns going into hyperdrive under the Paul Volcker Fed. The second 1930s recession was the result of government deciding that it was eminently important to address the exploding national debt which had grown and grown in the years following the onset of the 1929 recession, as government tax revenues declined at the same time government stimulus programs were being rolled out.

In the current environment, most monetary and government officials agree that the recovery is still too weak to begin hiking interest rates or taking stimulus measures off the table. In fact, the Federal Reserve has stated time and time again that rates are likely to stay very low for an unusually long time.

Of course, there are still many inflation hawks that could move this time table up, should they get their way. But, for now, it appears that rates will stay extraordinarily low, and most economists do not see any start to tightening until the end of this year, at the earliest. The arguments for not making the same mistake that was made in the 1930s are numerous, and loud. And as for inflation forcing the Federal Reserve's hand to raise interest rates into the double digits, as was done in the early 1980s? That inflation is nowhere to be found at the moment, and the data still shows that a more likely outcome is for subdued to outright declining rates of inflation for an extended period of time.

So, if inflation is going to stay low for at least a good while longer and there will be no need to drastically and/or rapidly raise interest rates, and if the government is unlikely to go on a major belt tightening anytime soon, why then has there been so much talk of risk of double dip recession?

It's all about oversupply, ongoing credit crunch, consumer deleveraging, and yep, still largely centered in housing.

All of the recoveries in the Post WWII era have largely been fueled by recoveries in housing, as housing-related activity (construction, finance, etc.) makes up a very large share of our GDP. Being that the current recovery is actually already seeing a pronounced Double Dip in housing, even before the slated Double Dip in recasts & resets (actually more like a Triple Dip - see image and related story below) gets fully underway, alarm bells over the potential for a double dip unlike anyone still alive has ever seen should totally be going off right now.

Bloomberg:

U.S. Economy: Pending Sales of Existing Homes Decline

March 4 (Bloomberg) -- Fewer Americans than expected signed contracts to purchase previously owned homes in January, indicating the extension of a tax credit is doing little to lure buyers.

The index of purchase agreements, or pending home sales, dropped 7.6 percent after a revised 0.8 percent increase in December, the National Association of Realtors announced in Washington. Other reports today showed factory orders increased and first-time jobless claims declined.

The drop in contract signings adds to evidence the housing market at the center of the worst recession since the 1930s is struggling to rebound after reports last week showed unexpected declines in purchases of new and existing homes. The market may get another blow this month when the Federal Reserve ends planned purchases of mortgage-backed securities.

“When you take away all the support from the housing market, the underlying demand for housing is a lot weaker than we thought,” said Mark Vitner, a senior economist at Wells Fargo Securities LLC in Charlotte, North Carolina. “We clearly pushed some demand forward, and there wasn’t that much demand to pull forward anyway. The housing recovery is going to be very, very slow.”

...

Pending home sales are considered a leading indicator because they track contract signings. The Realtors’ existing- home sales report tallies closings, which typically occur a month or two later. The pending sales data go back to January 2001, and the group began publishing the index in March 2005.

Reports last week showed the housing market may be faltering. Sales of previously owned homes unexpectedly dropped 7.2 percent in January after a record decline a month earlier, according to Realtors group’s report Feb. 26. New-home sales slumped to an all-time low, the Commerce Department said Feb. 24.

Credit Extended

President Barack Obama and Congress extended the first-time buyer credit in early November to cover deals signed by April 30 and closed by June 30, and expanded it to include some current homeowners.

Among other concerns for the housing outlook, the Fed said it plans to end a program later this month to purchase mortgage- backed securities, which helped contain borrowing costs.

The rate on a 30-year fixed mortgage dropped to 4.71 percent in early December, the lowest level since Freddie Mac started keeping weekly records in 1972. The rate has hovered around 5 percent since then.

Foreclosures pose another threat. Foreclosure filings rose 15 percent in January compared with a year earlier and exceeded 300,000 for the 11th straight month, RealtyTrac Inc. said Feb. 11...

Calculated Risk

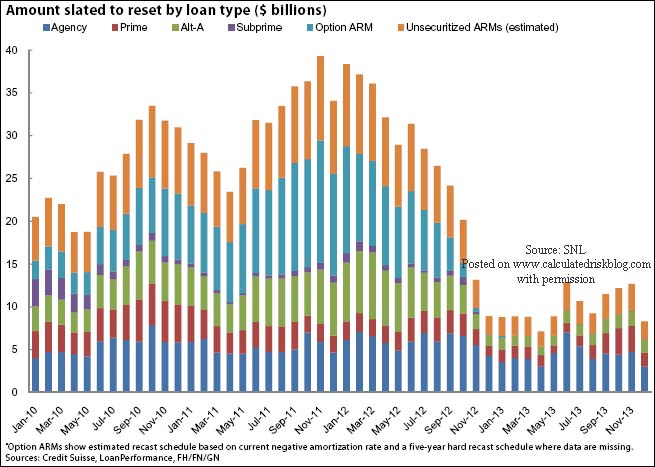

New Credit Suisse ARM Recast Chart

...This graph shows the amount of ARMs resetting and recasting over the next few years. Resets are not a huge worry right now - because interest rates are so low - but if interest rates rise, this could lead to more defaults in the future.

Recasts - when the loans reamortize - are a concern, although it is unclear how large the payment shock will be. For borrowers with negative equity, any payment shock might be lead to default. As I wrote last year in A comment on Option ARMs It is a little confusing. You can't just look at a chart of coming recasts and know when borrowers will default. The real problem for Option ARMs is negative equity, and the surge in defaults is happening before the loans recast.

But the recasts will matter too, since many of these borrowers used these mortgages as "affordability products", and bought the most expensive homes they could "afford" (based on monthly payments only). When the recasts arrive, these borrowers will have few options.

Hosted on Calculated Risk (Click for full size)

1. The Double Dip Recessions of the early 1980s, and

2. The Double Dip Recessions of the 1930s

In both of those cases, the causes are attributed to intentional economic policy tightening: Both of the early 80s recessions were the result of the ongoing WIN (Whip Inflation Now) campaigns going into hyperdrive under the Paul Volcker Fed. The second 1930s recession was the result of government deciding that it was eminently important to address the exploding national debt which had grown and grown in the years following the onset of the 1929 recession, as government tax revenues declined at the same time government stimulus programs were being rolled out.

In the current environment, most monetary and government officials agree that the recovery is still too weak to begin hiking interest rates or taking stimulus measures off the table. In fact, the Federal Reserve has stated time and time again that rates are likely to stay very low for an unusually long time.

Of course, there are still many inflation hawks that could move this time table up, should they get their way. But, for now, it appears that rates will stay extraordinarily low, and most economists do not see any start to tightening until the end of this year, at the earliest. The arguments for not making the same mistake that was made in the 1930s are numerous, and loud. And as for inflation forcing the Federal Reserve's hand to raise interest rates into the double digits, as was done in the early 1980s? That inflation is nowhere to be found at the moment, and the data still shows that a more likely outcome is for subdued to outright declining rates of inflation for an extended period of time.

So, if inflation is going to stay low for at least a good while longer and there will be no need to drastically and/or rapidly raise interest rates, and if the government is unlikely to go on a major belt tightening anytime soon, why then has there been so much talk of risk of double dip recession?

It's all about oversupply, ongoing credit crunch, consumer deleveraging, and yep, still largely centered in housing.

All of the recoveries in the Post WWII era have largely been fueled by recoveries in housing, as housing-related activity (construction, finance, etc.) makes up a very large share of our GDP. Being that the current recovery is actually already seeing a pronounced Double Dip in housing, even before the slated Double Dip in recasts & resets (actually more like a Triple Dip - see image and related story below) gets fully underway, alarm bells over the potential for a double dip unlike anyone still alive has ever seen should totally be going off right now.

Bloomberg:

U.S. Economy: Pending Sales of Existing Homes Decline

March 4 (Bloomberg) -- Fewer Americans than expected signed contracts to purchase previously owned homes in January, indicating the extension of a tax credit is doing little to lure buyers.

The index of purchase agreements, or pending home sales, dropped 7.6 percent after a revised 0.8 percent increase in December, the National Association of Realtors announced in Washington. Other reports today showed factory orders increased and first-time jobless claims declined.

The drop in contract signings adds to evidence the housing market at the center of the worst recession since the 1930s is struggling to rebound after reports last week showed unexpected declines in purchases of new and existing homes. The market may get another blow this month when the Federal Reserve ends planned purchases of mortgage-backed securities.

“When you take away all the support from the housing market, the underlying demand for housing is a lot weaker than we thought,” said Mark Vitner, a senior economist at Wells Fargo Securities LLC in Charlotte, North Carolina. “We clearly pushed some demand forward, and there wasn’t that much demand to pull forward anyway. The housing recovery is going to be very, very slow.”

...

Pending home sales are considered a leading indicator because they track contract signings. The Realtors’ existing- home sales report tallies closings, which typically occur a month or two later. The pending sales data go back to January 2001, and the group began publishing the index in March 2005.

Reports last week showed the housing market may be faltering. Sales of previously owned homes unexpectedly dropped 7.2 percent in January after a record decline a month earlier, according to Realtors group’s report Feb. 26. New-home sales slumped to an all-time low, the Commerce Department said Feb. 24.

Credit Extended

President Barack Obama and Congress extended the first-time buyer credit in early November to cover deals signed by April 30 and closed by June 30, and expanded it to include some current homeowners.

Among other concerns for the housing outlook, the Fed said it plans to end a program later this month to purchase mortgage- backed securities, which helped contain borrowing costs.

The rate on a 30-year fixed mortgage dropped to 4.71 percent in early December, the lowest level since Freddie Mac started keeping weekly records in 1972. The rate has hovered around 5 percent since then.

Foreclosures pose another threat. Foreclosure filings rose 15 percent in January compared with a year earlier and exceeded 300,000 for the 11th straight month, RealtyTrac Inc. said Feb. 11...

Calculated Risk

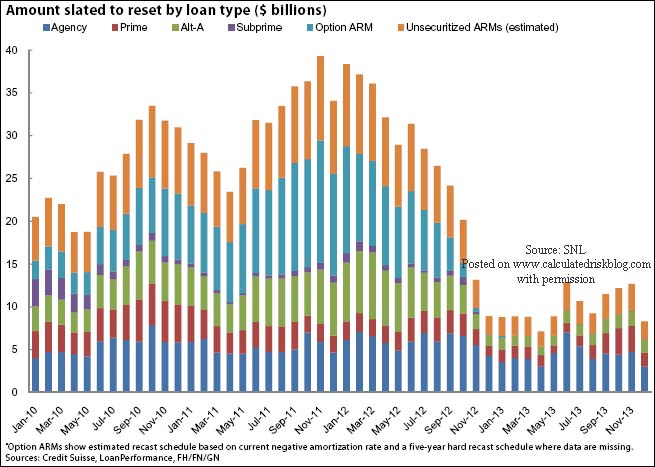

New Credit Suisse ARM Recast Chart

...This graph shows the amount of ARMs resetting and recasting over the next few years. Resets are not a huge worry right now - because interest rates are so low - but if interest rates rise, this could lead to more defaults in the future.

Recasts - when the loans reamortize - are a concern, although it is unclear how large the payment shock will be. For borrowers with negative equity, any payment shock might be lead to default. As I wrote last year in A comment on Option ARMs It is a little confusing. You can't just look at a chart of coming recasts and know when borrowers will default. The real problem for Option ARMs is negative equity, and the surge in defaults is happening before the loans recast.

But the recasts will matter too, since many of these borrowers used these mortgages as "affordability products", and bought the most expensive homes they could "afford" (based on monthly payments only). When the recasts arrive, these borrowers will have few options.

Hosted on Calculated Risk (Click for full size)