Housing Starts & Purchase Apps Dive, Futher Raising Fears of 2010 Double Dip

From Calculated Risk:

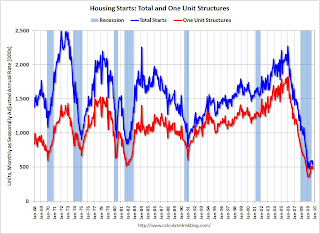

Housing Starts Decline Sharply in October

Click on graph for larger image in new window.

Total housing starts were at 529 thousand (SAAR) in October, down 10.6% from the revised September rate, and up from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have move sideways (or down) for five months.

Single-family starts were at 476 thousand (SAAR) in October, down 6.8% from the revised September rate, and 33 percent above the record low in January and February (357 thousand). Just like for total starts, single-family starts have been at this level for five months...

MBA: Purchase Applications Fall to 12 Year Low

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly SurveyThe Market Composite Index, a measure of mortgage loan application volume decreased 2.5 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index decreased 1.4 percent from the previous week and the seasonally adjusted Purchase Index decreased 4.7 percent from one week earlier. The seasonally adjusted Purchase Index has declined for six consecutive weeks and is at its lowest level since November 1997.

It appears the post home buyer tax credit slump is in full swing. The tax credit was extended and the eligibility expanded, but interest will probably wane (you can only pull so much demand forward)...

From CNBC:

Housing Slump May Worsen Next Year, Not Get Better

If you already took advantage of the government’s tax credit for first-time homebuyers-or are planning to do it anytime soon-you’ll probably agree with this prediction: Sales of existing homes will peak in the final quarter of 2009, then begin a year-long slide, which is likely to be a sharp one, according to some estimates.

AP

Until the unemployment rate falls, the housing market won't recover, economists said.

“Most of it [the tax credit] is simply shifting sales from one period to another,” says Global Insight economist Patrick Newport. “It doesn’t get rid of the fundamental problem; there's still a glut of houses.”

Newport, for instance, expects single-family home sales to hit an annual rate of 5.88 million units in the fourth quarter (vs. 5.30 in the third quarter). Thereafter, sales will fall to 5.65 million in the first quarter and average just 4.75 million in the second half of the year.

“We expect a little stall in 2010,” says David Crowe, chief economist at the National Association of Home Builders. “I agree, you do advance demand, so you steal it for the future.”...

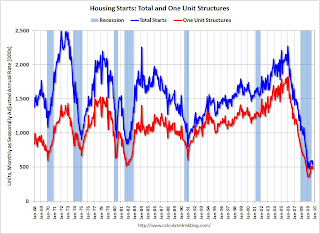

Housing Starts Decline Sharply in October

Click on graph for larger image in new window.

Total housing starts were at 529 thousand (SAAR) in October, down 10.6% from the revised September rate, and up from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have move sideways (or down) for five months.

Single-family starts were at 476 thousand (SAAR) in October, down 6.8% from the revised September rate, and 33 percent above the record low in January and February (357 thousand). Just like for total starts, single-family starts have been at this level for five months...

MBA: Purchase Applications Fall to 12 Year Low

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly SurveyThe Market Composite Index, a measure of mortgage loan application volume decreased 2.5 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index decreased 1.4 percent from the previous week and the seasonally adjusted Purchase Index decreased 4.7 percent from one week earlier. The seasonally adjusted Purchase Index has declined for six consecutive weeks and is at its lowest level since November 1997.

It appears the post home buyer tax credit slump is in full swing. The tax credit was extended and the eligibility expanded, but interest will probably wane (you can only pull so much demand forward)...

From CNBC:

Housing Slump May Worsen Next Year, Not Get Better

If you already took advantage of the government’s tax credit for first-time homebuyers-or are planning to do it anytime soon-you’ll probably agree with this prediction: Sales of existing homes will peak in the final quarter of 2009, then begin a year-long slide, which is likely to be a sharp one, according to some estimates.

AP

Until the unemployment rate falls, the housing market won't recover, economists said.

“Most of it [the tax credit] is simply shifting sales from one period to another,” says Global Insight economist Patrick Newport. “It doesn’t get rid of the fundamental problem; there's still a glut of houses.”

Newport, for instance, expects single-family home sales to hit an annual rate of 5.88 million units in the fourth quarter (vs. 5.30 in the third quarter). Thereafter, sales will fall to 5.65 million in the first quarter and average just 4.75 million in the second half of the year.

“We expect a little stall in 2010,” says David Crowe, chief economist at the National Association of Home Builders. “I agree, you do advance demand, so you steal it for the future.”...