New Data Out Today: Ixnay on Imminent Recoveray + Recession Even Yet Again Deeper Than We Were Told

First, just a quick mod note -

The participation level in this community has been more than a bit light as of late. Have you all had more than enough of the recession, already, or did you find yourself a full time job with all the OT you can stomach? ;) Let me know if you think it's actually time to put the closing of the community up to a vote. (I'll also consider a lack of reply to this post as a "yes, put it up to a vote" - as by not replying to this question shows an individual's level of interest in keeping it open). I'm happy keeping it open, but those of us who post need to know if they are actually being read, or not. Frankly, some more discussions in here wouldn't be a bad thing..

Services Sector (67-90% of US economy, depending on how one looks at it)

Actually Fell Back Deeper Into Contraction in July...

From Econoday.com

Released on 8/5/2009 10:00:00 AM For July, 2009 PriorConsensusConsensus RangeActual Composite ISM- Level47.0 48.2 46.6 to 49.0 46.4

Highlights

Right at the moment when improvement seemed in hand, the ISM's non-manufacturing report proved disappointing in a clear indication that the road to recovery is bumpy. The composite headline index came up well short of expectations at 46.4 to indicate continuing month-to-month contraction for the bulk of the nation's businesses. The change from June isn't that significant but still the minus 6 tenths difference indicates that conditions in July actually fell back, though very slightly. New orders moved closely in line with the composite index, at 48.1 for a 5 tenths decline. The business activity index fell nearly 3 points to 46.1 while the employment index, in a key indication for Friday's jobs report, continues to show steep contraction and unfortunately at an accelerating rate, at 41.5 vs. 43.4.

The kicker in this report is prices which really fell back, down more than 12 points to 41.3 in a decline reflecting the month's dip in energy prices but also indicating a general lack of pricing power not consistent with economic strength. Though this report may pop back in August, economic activity in July, again, looks to have been weaker than June. This report's a negative for stocks and commodities and may raise demand for safe-haven assets.

Job Losses For First Half of 2009 May Get Revised Significantly Higher

CNBC/Bob Pisani

Job Losses-What Numbers Can You Trust?

Are job losses greater than those being reported?

TrimTabs, in a press release this morning, are estimating the U.S. economy lost 488,000 jobs in July, more than the estimate of 328,000 jobs lost.

The nonfarm payroll report will be released on Friday.

They also expect the Bureau of Labor Statistics to revise its job loss estimates sharply higher for the first half of 2009, based on the latest unemployment insurance survey results.

TrimTabs' employment estimates are based on analysis of daily income tax deposits to the U.S. Treasury from all salaried U.S. employees.

They claim that their estimates have been more accurate than those of the BLS.

"The personal income report the Bureau of Economic Analysis released Tuesday contained huge downward revisions to wage and salary growth," said Biderman. "Now that the BEA is using unemployment insurance reports from the first quarter to estimate current wage and salary growth, its data confirms what we have been reporting for months."

Personal Income Data Now Out Point To Deepening Recession Entering Second Half 09

SA/Don Fishback

June Personal Income Data Points to Anything but an End to the Recession

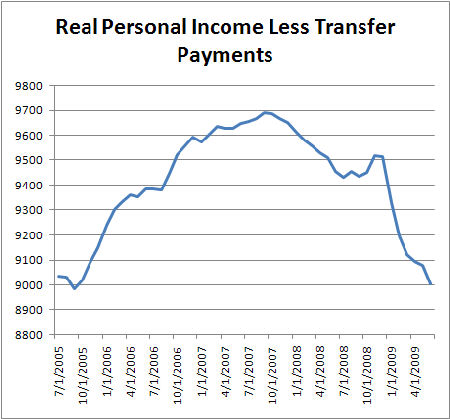

Tuesday morning the Bureau of Economic Analysis came out with the personal income data for June, and it wasn’t just bad, it was breathtakingly ugly. The actual measure is real personal income less transfer payments. Basically, it’s an inflation-adjusted measure of income actually earned by people that takes out income derived from payments received from the government, such as unemployment benefits. It’s a key component used by the NBER in dating recessions.

One look at this chart and you can see that there is no sign of an uptick. In fact, it’s the exact opposite. At the beginning of 2009, you had two months where personal income fell off a cliff. Then you had a respite of decelerating declines. Yes, the declines were declines, but they were smaller percentage declines for 3 consecutive months. That trend of smaller declines changed in June, as the pace of the decline picked up speed once again.

The reason why this particular data point is so important from a recession-dating perspective is that in every recession since this data series began in 1959, real personal income starts to rise either prior to or precisely when the recession ends...

The participation level in this community has been more than a bit light as of late. Have you all had more than enough of the recession, already, or did you find yourself a full time job with all the OT you can stomach? ;) Let me know if you think it's actually time to put the closing of the community up to a vote. (I'll also consider a lack of reply to this post as a "yes, put it up to a vote" - as by not replying to this question shows an individual's level of interest in keeping it open). I'm happy keeping it open, but those of us who post need to know if they are actually being read, or not. Frankly, some more discussions in here wouldn't be a bad thing..

Services Sector (67-90% of US economy, depending on how one looks at it)

Actually Fell Back Deeper Into Contraction in July...

From Econoday.com

Released on 8/5/2009 10:00:00 AM For July, 2009 PriorConsensusConsensus RangeActual Composite ISM- Level47.0 48.2 46.6 to 49.0 46.4

Highlights

Right at the moment when improvement seemed in hand, the ISM's non-manufacturing report proved disappointing in a clear indication that the road to recovery is bumpy. The composite headline index came up well short of expectations at 46.4 to indicate continuing month-to-month contraction for the bulk of the nation's businesses. The change from June isn't that significant but still the minus 6 tenths difference indicates that conditions in July actually fell back, though very slightly. New orders moved closely in line with the composite index, at 48.1 for a 5 tenths decline. The business activity index fell nearly 3 points to 46.1 while the employment index, in a key indication for Friday's jobs report, continues to show steep contraction and unfortunately at an accelerating rate, at 41.5 vs. 43.4.

The kicker in this report is prices which really fell back, down more than 12 points to 41.3 in a decline reflecting the month's dip in energy prices but also indicating a general lack of pricing power not consistent with economic strength. Though this report may pop back in August, economic activity in July, again, looks to have been weaker than June. This report's a negative for stocks and commodities and may raise demand for safe-haven assets.

Job Losses For First Half of 2009 May Get Revised Significantly Higher

CNBC/Bob Pisani

Job Losses-What Numbers Can You Trust?

Are job losses greater than those being reported?

TrimTabs, in a press release this morning, are estimating the U.S. economy lost 488,000 jobs in July, more than the estimate of 328,000 jobs lost.

The nonfarm payroll report will be released on Friday.

They also expect the Bureau of Labor Statistics to revise its job loss estimates sharply higher for the first half of 2009, based on the latest unemployment insurance survey results.

TrimTabs' employment estimates are based on analysis of daily income tax deposits to the U.S. Treasury from all salaried U.S. employees.

They claim that their estimates have been more accurate than those of the BLS.

"The personal income report the Bureau of Economic Analysis released Tuesday contained huge downward revisions to wage and salary growth," said Biderman. "Now that the BEA is using unemployment insurance reports from the first quarter to estimate current wage and salary growth, its data confirms what we have been reporting for months."

Personal Income Data Now Out Point To Deepening Recession Entering Second Half 09

SA/Don Fishback

June Personal Income Data Points to Anything but an End to the Recession

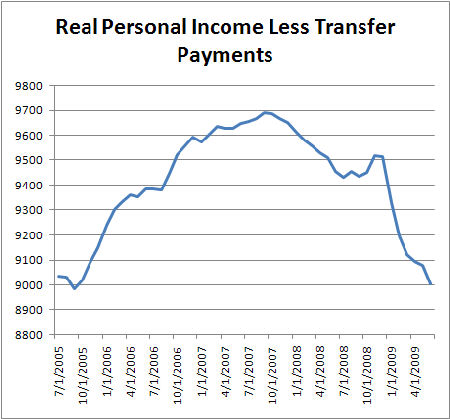

Tuesday morning the Bureau of Economic Analysis came out with the personal income data for June, and it wasn’t just bad, it was breathtakingly ugly. The actual measure is real personal income less transfer payments. Basically, it’s an inflation-adjusted measure of income actually earned by people that takes out income derived from payments received from the government, such as unemployment benefits. It’s a key component used by the NBER in dating recessions.

One look at this chart and you can see that there is no sign of an uptick. In fact, it’s the exact opposite. At the beginning of 2009, you had two months where personal income fell off a cliff. Then you had a respite of decelerating declines. Yes, the declines were declines, but they were smaller percentage declines for 3 consecutive months. That trend of smaller declines changed in June, as the pace of the decline picked up speed once again.

The reason why this particular data point is so important from a recession-dating perspective is that in every recession since this data series began in 1959, real personal income starts to rise either prior to or precisely when the recession ends...