Did someone say something about credit cards....

American Consumers Cutting up that Final Credit Card: The End of a 30 Year Consumption Era and the Nervous Breakdown of the Spending Psychosis.

Imagine sitting in a messy room. Chopped plastic all around you as you sit there clasping a set of red scissors. Only one more credit card sits in the middle of the room starring back at you. Can I do it you ask? Is it possible to go forward in life with no credit cards? As you make the final cut, a new era has begun. The American consumer is now psychologically maxed out.

Now this is very different from what has occurred in previous recessions where American consumers merely took a few steps back to reassess how they would once again go back to spending once happy days were here again. This is something more on par with what occurred during the 1930s when American consumers actually changed their way of life. We haven’t seen that occur since then but now many Americans have but no choice and to make this change. Some are welcoming it but many are resentful.

Normally credit card companies would fight like starving vultures over a carcass for additional customers. Yet in a sign of the times, American Express is offering few select cardholders $300 to close their accounts:

“(Yahoo!) Card holders have until the end of February to accept the offer and must close their accounts in March or April. Each card holder will receive a $300 pre-paid American Express card.

American Express, often seen as catering to relatively wealthy customers and companies, has been expanding its credit card business in recent years by reaching out to a wider range of clients.

But that strategy has backfired. The company’s earnings tumbled in the fourth quarter as credit losses jumped and debt-burdened consumers slashed spending.”

The irony here is that customers that elect to take up this offer will receive essentially an American Express pre-paid card that looks and feels like a credit card but isn’t anything like one. No cold turkey here. We are weaning ourselves off the debt treadmill even if it means getting surrogate plastic to help us out. It is a confrontation that has been 30 years in the making but the seeds were planted back many decades ago.

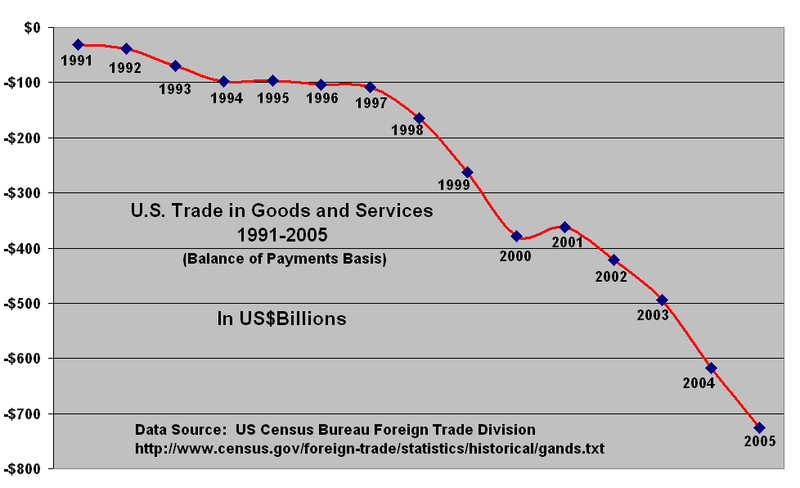

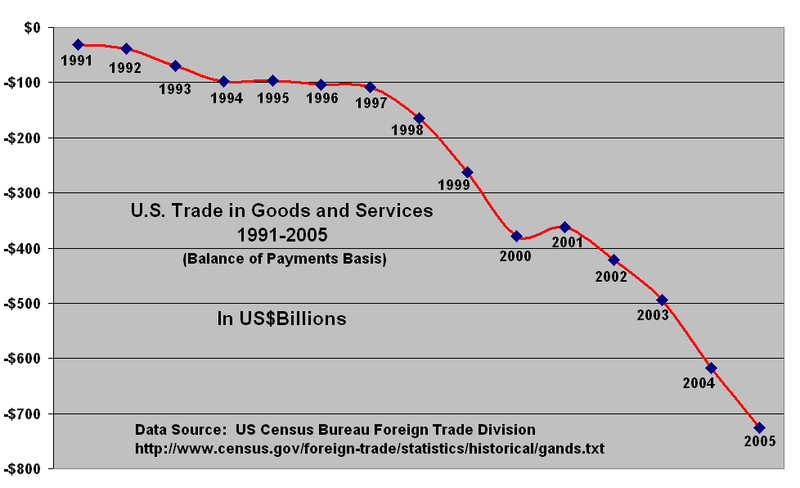

Consumption has always been a part of the American psyche. Yet much of the major break in customary trends occurred in the early 1990s when we started consuming more than we were producing. And much of the above was financed via debt. The focus shifted from actual production to consumption yet much of the consumption was not financed by productivity but by debt. All we need to do is look at consumer debt over this time span:

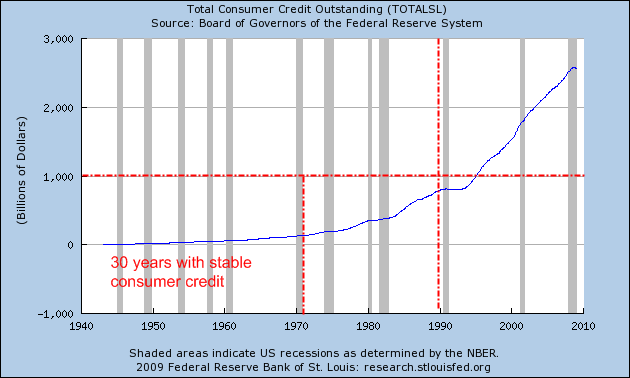

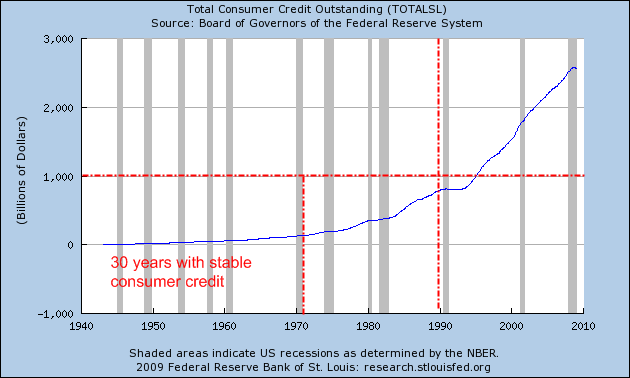

It is interesting that in terms of consumer debt, we had a relatively stable period from 1940 to 1970. Nearly an entire generation with only marginal growth in consumer credit. Credit cards started making a push in the 1950s with Diners Club and American Express. This was then followed by other big names like Visa or when Citibank merged its Everything Card with Master Charge in 1969. From that point on Americans have been using credit cards taking the amount of credit card debt alone to $963 billion. Keep in mind that with consumer credit, people have also committed to automobile loans and other such installment debt.

Yet there is now sufficient evidence that this trend is breaking. A recent Washington Post-ABC post poll found that the burns in the consumer psychology are going to be deep and won’t recede like the tide. What was found in the article is crucial to helping us understand how deep this recession will be:

“Two-thirds of those polled said they’ve cut back on their spending, including nearly a third who have pulled back “sharply.” Americans across income groups said they are opening their wallets less often these days, with those with lower family incomes more likely to say they’ve sharply slashed their spending. One-third said someone in their household has lost a job or had their pay or hours cut in recent months.

Also contributing to the new spate of penny-pinching are widespread concerns about how much longer the recession will last. Overall, 70 percent of Americans anticipate a downturn lasting well into 2010 or longer; more than a third see it lasting two or more years. Those who see an extended recession are more likely to say they’ve pared back their typical buying habits.”

This is crucial to understand. Since roughly 70 percent of our GDP is based on consumption, we should be listening to what the consumer is saying. First, two-thirds have cut back on their spending. What the poll also tells us is that some of this cutting back has come from job losses or cuts in hours. That is why only looking at the 7.6% headline unemployment rate does not highlight the entire picture. Over half of Americans are changing their consumption patterns.

More here:

www.mybudget360.com/american-consumers-cutting-up-that-final-credit-card-the-end-of-a-30-year-consumption-era-and-the-nervous-breakdown-of-the-spending-psychosis/

Imagine sitting in a messy room. Chopped plastic all around you as you sit there clasping a set of red scissors. Only one more credit card sits in the middle of the room starring back at you. Can I do it you ask? Is it possible to go forward in life with no credit cards? As you make the final cut, a new era has begun. The American consumer is now psychologically maxed out.

Now this is very different from what has occurred in previous recessions where American consumers merely took a few steps back to reassess how they would once again go back to spending once happy days were here again. This is something more on par with what occurred during the 1930s when American consumers actually changed their way of life. We haven’t seen that occur since then but now many Americans have but no choice and to make this change. Some are welcoming it but many are resentful.

Normally credit card companies would fight like starving vultures over a carcass for additional customers. Yet in a sign of the times, American Express is offering few select cardholders $300 to close their accounts:

“(Yahoo!) Card holders have until the end of February to accept the offer and must close their accounts in March or April. Each card holder will receive a $300 pre-paid American Express card.

American Express, often seen as catering to relatively wealthy customers and companies, has been expanding its credit card business in recent years by reaching out to a wider range of clients.

But that strategy has backfired. The company’s earnings tumbled in the fourth quarter as credit losses jumped and debt-burdened consumers slashed spending.”

The irony here is that customers that elect to take up this offer will receive essentially an American Express pre-paid card that looks and feels like a credit card but isn’t anything like one. No cold turkey here. We are weaning ourselves off the debt treadmill even if it means getting surrogate plastic to help us out. It is a confrontation that has been 30 years in the making but the seeds were planted back many decades ago.

Consumption has always been a part of the American psyche. Yet much of the major break in customary trends occurred in the early 1990s when we started consuming more than we were producing. And much of the above was financed via debt. The focus shifted from actual production to consumption yet much of the consumption was not financed by productivity but by debt. All we need to do is look at consumer debt over this time span:

It is interesting that in terms of consumer debt, we had a relatively stable period from 1940 to 1970. Nearly an entire generation with only marginal growth in consumer credit. Credit cards started making a push in the 1950s with Diners Club and American Express. This was then followed by other big names like Visa or when Citibank merged its Everything Card with Master Charge in 1969. From that point on Americans have been using credit cards taking the amount of credit card debt alone to $963 billion. Keep in mind that with consumer credit, people have also committed to automobile loans and other such installment debt.

Yet there is now sufficient evidence that this trend is breaking. A recent Washington Post-ABC post poll found that the burns in the consumer psychology are going to be deep and won’t recede like the tide. What was found in the article is crucial to helping us understand how deep this recession will be:

“Two-thirds of those polled said they’ve cut back on their spending, including nearly a third who have pulled back “sharply.” Americans across income groups said they are opening their wallets less often these days, with those with lower family incomes more likely to say they’ve sharply slashed their spending. One-third said someone in their household has lost a job or had their pay or hours cut in recent months.

Also contributing to the new spate of penny-pinching are widespread concerns about how much longer the recession will last. Overall, 70 percent of Americans anticipate a downturn lasting well into 2010 or longer; more than a third see it lasting two or more years. Those who see an extended recession are more likely to say they’ve pared back their typical buying habits.”

This is crucial to understand. Since roughly 70 percent of our GDP is based on consumption, we should be listening to what the consumer is saying. First, two-thirds have cut back on their spending. What the poll also tells us is that some of this cutting back has come from job losses or cuts in hours. That is why only looking at the 7.6% headline unemployment rate does not highlight the entire picture. Over half of Americans are changing their consumption patterns.

More here:

www.mybudget360.com/american-consumers-cutting-up-that-final-credit-card-the-end-of-a-30-year-consumption-era-and-the-nervous-breakdown-of-the-spending-psychosis/