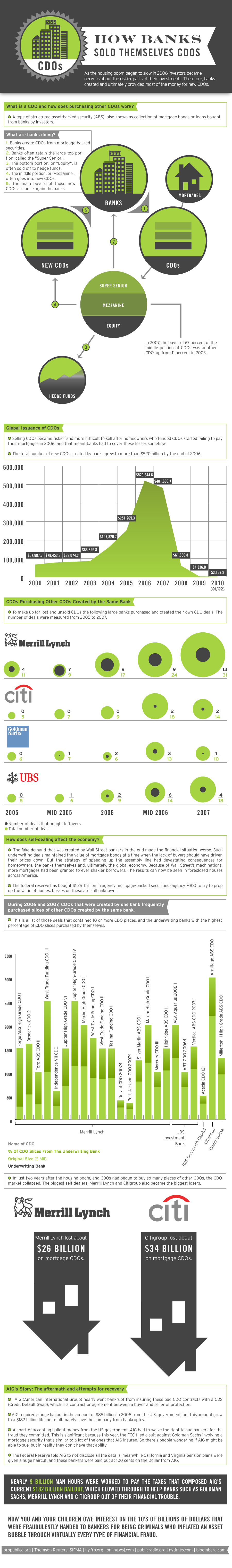

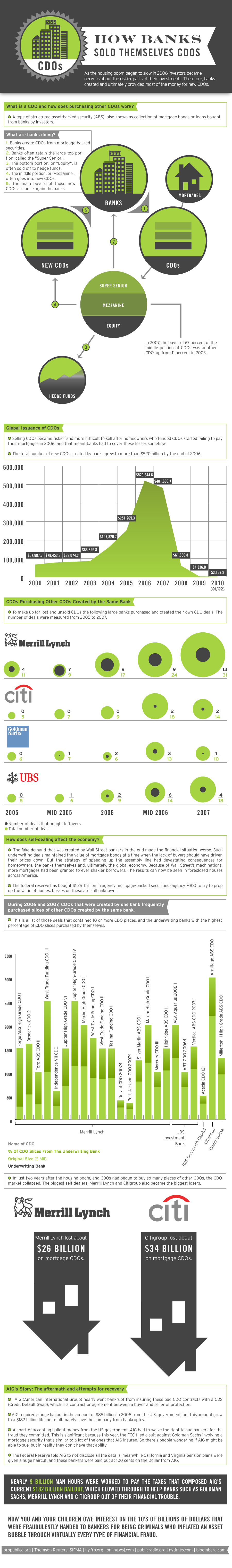

More Charts on What Went Wrong.

You know you have a problem when you are buying your own junk and actually believing your own lie. This chart shows how banks ended up repackaging and buying their own own securities during the housing boom. To boost demand for complex mortgage securities called "collateralized debt obligations" (CDOs) some banks resorted to selling these same deals to their own company.

"In analysis by research firm Thetica Systems, commissioned by ProPublica, shows that in the last years of the boom, CDOs had become the dominant purchaser of key, risky parts of other CDOs, largely replacing real investors like pension funds. By 2007, 67 percent of those slices were bought by other CDOs, up from 36 percent just three years earlier. The banks often orchestrated these purchases. In the last two years of the boom, nearly half of all CDOs sponsored by market leader Merrill Lynch bought significant portions of other Merrill CDOs."

"In analysis by research firm Thetica Systems, commissioned by ProPublica, shows that in the last years of the boom, CDOs had become the dominant purchaser of key, risky parts of other CDOs, largely replacing real investors like pension funds. By 2007, 67 percent of those slices were bought by other CDOs, up from 36 percent just three years earlier. The banks often orchestrated these purchases. In the last two years of the boom, nearly half of all CDOs sponsored by market leader Merrill Lynch bought significant portions of other Merrill CDOs."