Rome continues to not burn

Lawyers: The wrongful-death case will be going to trial. The court date has been set for January 2025, seven years after my aunt’s death. There’s no way to know how long the appeals process will take.

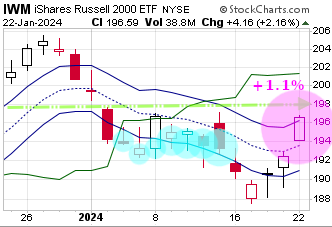

Oh boy! Another good month in imaginary stock-trading. I bought repeatedly at the lower blue line, then sold at the upper blue line for a nice +1.1% profit over 12 market days! This trade-set could have been a +5.0% gainer if only I had had more imaginary money for purchases on the other four days (see below). I am done with my bullish trade; Rome may now begin burning ad libitum.

For 2024 I have decided to record purchases and sales as translucent circles, centered on the trade-price and sized so their area is proportional to the transaction size. This makes it harder to read the prices but easier to see the sizes. (Price is generally the previous day’s blue line or the open, whichever is better.)

This pale green dotted/dashed line represents a trend to which prices keep returning. It replaces (at least temporarily) the dashed orange line that we were watching for much of last year.

Oh dear. This has been a terrible quarter for imaginary stock-trading. I was actually starting to feel good about things during the last week of October, which should have been my clue to quickly close the short before the good mood evaporated. But no; I was greedy and added twice more to my position due to “Fear Of Missing Out”. So instead I missed out on the big run-up during Q4! Oh well; there are some traders online, who have far more experience than I, who have also reported bad fourth quarters that ruined their trading years.

The economy is so bad in China, they stopped publishing ‘youth unemployment’ after it hit 21.3% back in June. In December, the government of China started publishing a new ‘non-student youth unemployment’ figure, which was 14.9%.

On Jan 16 we were told that manufacturing in New York State, which had been expected to be down -5.0%, was instead down -43.7% for its worst performance since 2020.

And so the stock market is… up? Yes, Rome refuses to burn and we’re seeing new all-time highs these days. But I expect that the market will roll over and start facing reality after faking everyone out and maximizing their pain. Late 2024 could be really bad for bullish investors.

I am continuing to hold that 180% short position that I told you about on Nov 08. Since I allow myself to go to 300%, that means I had only 120% unused buying power available for this month’s contrarian long bet. But actually, my spreadsheet showed lots more available money than that. When you sell short, you get the cash immediately for the shares you borrowed and sold - and that cash can be used to buy something else! Except, as discussed on Aug 29, I don’t believe I can actually short stock for the profit levels being shown on this blog. If I buy TZA instead of shorting IWM, that is a ‘purchase’ and so the money is not available for re-use.

Standard advice is never to hold TZA for more than a day and especially never hold it for many days in a row when the market is moving against you, because the daily re-leveraging will surely eat your profits alive. If I had really shorted IWM last quarter, my current unrealized loss would be -27.8%. But if I had stupidly bought TZA at those times, which you should never ever do, then my unrealized loss today would be a whopping -22.7%. Which, um, isn’t as bad. You know, there’s a lot of bad advice floating around on the Internet.

Finally, here is a summary of last year. Remember when Silicon Valley Bank went bankrupt in March, giving us that dashed orange line that continued to be meaningful for months? Well, the market might possibly bounce off that line yet again on its next downswing. The new dashed/dotted green line connects the last two peaks, but I don’t know yet how meaningful it will be.

Note that the last three peaks have been getting higher, while the last three troughs have been getting lower and are nearly aligned. This is the Broadening Top pattern, which Bulkowski says is a “poor performer” and not worth betting on. Hopefully the market will now mosey back down to the bottom of this range so I can close my short and be done with this thing. Maybe in six weeks?