Lots of risk, little reward

After 2 months of silence, my blog shall speak again!

Latest trade was not so hot. The market took too long to get going with its downswing, so I didn’t have enough buying power left when we got to the bottom, so I only got +0.9% for all that time and risk (the maximum drawdown was -9.1% on Aug 25). Still, I managed to walk out of the casino with a profit even though the cards did not break my way.

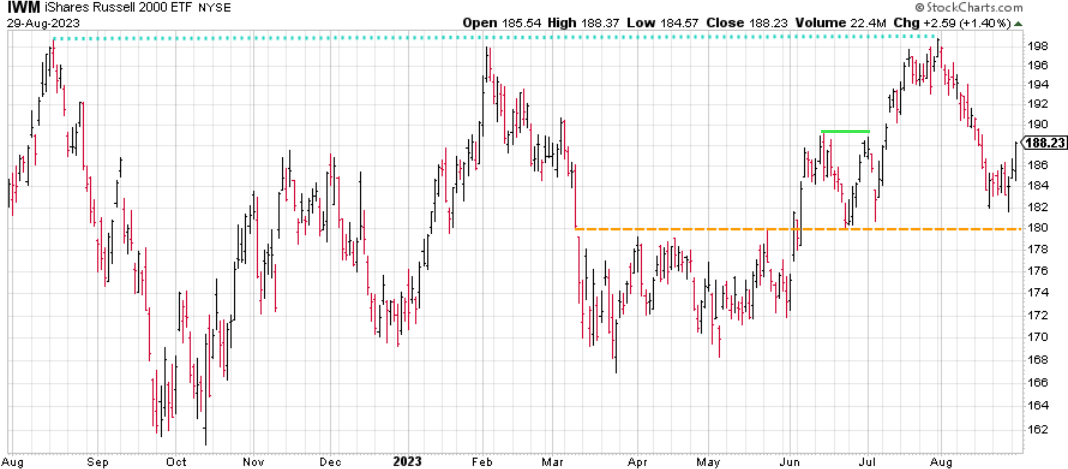

From Jul 11 until Aug 03 there was an upswing that I could have traded for a +1.7% gain, but I skipped it because of that green line. One of these days I have to review the data supporting that line - it seems to skip too many good trades. But the red line came very close on Aug 25, and I have somewhat more faith in that line, so I think I’ll skip the contrarian trade on the next downswing. Meanwhile, we’re going up, so I should start short-selling tomorrow.

2022 Comparison Start+/-IWMTNA/TZA Jan 05🐻+0.34%+0.30% Jan 07🐂-1.89%-2.69% Feb 10🐻+1.78%+1.90% Feb 22🐂+1.47%+1.53% Mar 02🐻+0.39%+0.87% Mar 08🐂+0.75%+1.17% Mar 17🐻+2.34%+5.84% Apr 06🐂+3.03%+3.09% Apr 21🐂-8.29%-10.78% Apr 21🐻-+0.38% May 27🐻+5.71%+5.14% Jun 13🐂+6.92%+7.20% Jun 30🐂+1.27%+1.35% Jul 08🐻+0.39%+0.40% Jul 14🐂+0.78%+0.41% Jul 19🐻-3.49%-5.53% Aug 22🐂+5.84%+6.25% Oct 04🐻+1.04%+1.11% Oct 14🐻+5.96%+7.27% Nov 09🐂+0.37%- Dec 05🐂+2.77%+3.04% Dec 15🐂+4.23%+4.17% TOTAL31.71%32.42%

On Jun 25 I wrote, “I also don’t account for interest on cash balances (over 4½% now at IB!), margin interest (7½%), nor the fee for borrowing shares (¼% per day, so 62½% annualized)… a short trade that drags on for a month would yield significantly less than my charts are showing. Perhaps some improvement in simulation accuracy is warranted.” Years ago, I used to trade TNA and TZA in an IRA account, instead of doing IWM in a margin account as shown here. Those tickers are basically pre-packaged short-selling/trading on margin, with insurance against losing more than 100%. Everyone says those fees and insurance are very expensive and surely it would be better to borrow from your own broker? If I had used TNA for the trade-set that ended today, the profit would have been only +0.5%, not +0.9%.

Let’s review the trading for 2022, comparing the use of IWM (🐂 long on margin, 🐻 short borrowed shares) vs. TNA (3× 🐂) or TZA (3× 🐻) for each trade-set. So instead of betting 300% of my money on IWM, I would bet 100% on TNA.

Bottom line up front: it’s a wash. Using TNA/TZA (with prepackaged fees) gives roughly the same results as using IWM and imagining that there won’t be any fees. So it seems that, if I ever try this with real money again, I should either use TNA/TZA or demand that my broker beat their effective cost.

The two approaches mostly trade on the same days, but TNA/TZA trades more often because the ±0.75⋆ATR prices that I look for come up more often on these leveraged investments, perhaps because they are preferred by irrational gamblers who are too willing to trade at prices that are far from true value. These extra hits add more heft to some of my trade-sets, so they gain more vs. the IWM versions.

For simplicity, I think I will continue to show IWM trades here until the end of the year, but with confidence that equivalent results to these paper-trades could realistically be obtained, by using TNA/TZA in a retirement account.

I’ve been watching that dashed orange line since Mar 10 and yammering about it since Jun 02. We didn’t bounce off it again this time, but maybe we’ll come back to it next month. If so, that will create a 4-month-wide head-and-shoulders pattern.

On Jun 29 I wrote, “For my next trick, I will predict a double-top: price will hit $189.24 around Jul 5 or so. I will not be betting on this prediction.” See solid green line. It actually got back to $188.84 on Jul 03. That’s 0.2% lower than I predicted, which is not good enough! Good thing I didn’t bet on it.

Speaking of double-tops, look at that beautiful dotted-turquoise line! Nearly a year later and the same price recurred to within a penny - that’s an error of just 50 ppm! - but only the dividend-adjusted IWM chart shows this 50-week double-top, which would be a very bearish sign if other stock funds agreed.

Lawyers: they’re back! Still with nothing to say about the deposition, but apparently they’ve managed to make contact with my sister in Israel.