ECONS INSANITY

This post is in reply to Chooi Si's questions. More specifically - to answer her second question in more detail than I already have in the comments of her post. Because it's Economics, and it's fun. And I feel like typing something factual and long.

QUESTION 2: WHY CAN'T HUMANS THINK OF SOMETHING TO STOP RECESSION?

-----------------------------------------------------------

AS A STUDENT OF ECONOMY (I'm quoting my Econs lecturer here, LOL), we know that this recession CAN be fixed. THEORETICALLY SPEAKING.

The problem is human nature. Greed.

The study of Economics is basically the allocation of our SCARCE resources to fulfill our UNLIMITED wants.

Many firms are set up with one goal in mind: profit. The government has to provide schools, public parks, hospitals, etc etc (Henceforth known as collective goods)because private firms will only want PROFIT (Good example: Form 6 vs SAM/Architecture diploma. Notice the difference in price?).

In times of recession, demands for goods and services drop because of the increase in prices. What happens is that production/supply>demand, so firms are faced with surplus stocks. WHAT they SHOULD do is to lower their prices so that they can sell their goods/services off. What's happening is that they still want to profit, so they'll produce less, and sell at the same price.

At the same time, they retrench workers, because they don't need as many to produce a smaller amount of goods/services, leaving those people UNEMPLOYED and with DECREASED INCOME. Less income = less disposable income (Money to be spent on wants, not needs) = less demand for goods, and the viscious cycle continues in this tune. Unfortunately.

The Australian government actually tried giving people cash last year - 1000 AUD for every individual to spend during Christmas (Therefore keeping the economy in motion), what happened was that people ended up using the money to pay off their loans/debts, which was the direct opposite of what the government planned, because moneys going back to banks is considered a leakage in the 5-sector circular flow, while the money was initially given to them as an injection. All of which cannot be told in this tiny comment box where I don't know if there's a word limit.

This 'comment' has turned into an Econs essay, in which I realized I can essentially link to the AD-AS model and the 5-sector circular flow. And I cannot fully explain this in a comment box, and will probably post something up about it on my blog eventually. If I have time, I'd totally discuss this with my Econs lecturer. Hee.

-----------------------------------------------------------------

Here I will begin the detailed answer, but before I do, I will explain some basic concepts of Economics.

There is something called the Business Cycle.

The Business Cycle graph basically looks like a Sin graph (As in, Cos Sin Tan in Maths). The peaks are the booms, the troughs (Minimum points) being the recession. As you move up the graph toward the peak, it's called an upturn, and when you move downwards towards the trough, it's a downturn. So if we talk about the movement of the graph, you start at 0, reach an upturn, the peak/boom, downturn, trough/recession then we go back up with an upturn all the way to the peak and then down to the trough, and it goes on in that vein for, like, forever. Refer to image 1.1

Image 1.1 Business Cycle graph

The number of years it takes to reach the peak or the trough is an unknown variable - it may take 1 year, 5 years, or even 50 years, and how long the economy stays in a situation is also a variable. It is said that in every 200 years, the world's economy suffers a MAJOR recession.

How do we equate the economic situation?

Every government has Macroeconomic objectives (Macro=large-scale, affects the country as a whole, while micro = individual). Australia's (the one I'm studying) being full employment, economic growth, price stability and external balance.

1. Full Employment (FE) is the situation in which UNEMPLOYMENT is kept to an acceptable minimum - that is, 5% in Australia. It is measured by some body in Australia whose name escapes me at a moment, using a survey in certain major cities in Australia.

2. Price Stability (PS) is the situation in which the sustained increase in the general price level is kept to an acceptable minimum of 2-3%. It is measured by the Consumer Price Index (CPI)

*The CPI is measured by using what is called 'a basket of goods', which is a basket of common consumer items, and prices are counted (ie. increase/decrease from previous month, how much, etc). BASICALLY, INFLATION.

3. Economic Growth (EG) is the rate of increase in the total production of goods and services within an economy. Sustained growth of 4-5% is acceptable. It's measured by the Gross Domestic Product (GDP)3.1 The GDP is the total market value of final goods and services produced within an economy in a given period. There are 2 types of GDP - Real GDP and Nominal GDP. Real GDP is GDP with the effects of inflation REMOVED, while Nominal GDP is GDP at market price, that is, with the effects of inflation included.

4. External Balance (EB) is a balance between money inflow and outflow resulting from Australia's transactions with the rest of the world. Which is kind of irrelevant in my DETAILED ANSWER TO CHOOI SI'S QUESTION!!1!

The economic situation is based on the data received from things that relate to the Macroeconomic Objectives - Employment (UE Rate, FE), Price Level (PS - CPI), Growth (GDP). There's something in the objective of EB that we call a Current Account Deficit (CAD), but a country usually has a CAD anyway, so we'll ignore that in this case.

In a boom situation, there is high employment, high production, and marked inflation. In a recession, it's the complete opposite - low employment, and low production. We usually do not comment on inflation in the case of a recession.

What was this '5-sector circular flow diagram' you were talking about?

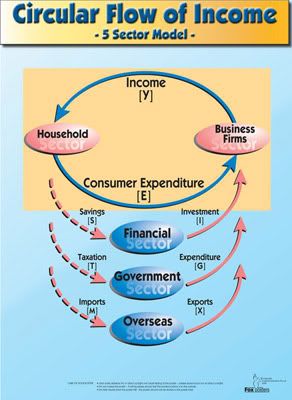

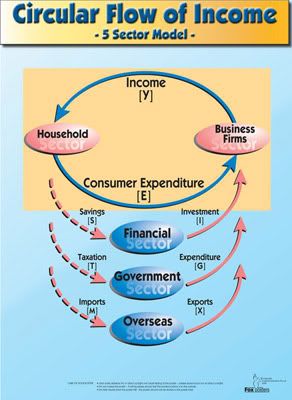

THIS is the 5-sector circular flow model. Basically, you have households, firms, the Financial Sector, Government Sector and Foreign sector. The pink dotted lines indicate leakages from the 2-sector circular flow model, while the solid pink lines are the injections.

Leakages = Money taken OUT of the 2-sector circular flow

Injections = Money put back in to the 2-sector circular flow

SO, TO ACTUALLY ANSWER THE QUESTION

I am going to ADD to what I previously wrote, not rewrite the whole thing.

The reason as to why we're not seeing any improvements in our economy is not because nothing is being done - it is because what is being done takes time to take effect. You read of 'stimulus packages' in the newspapers - Obama's doing it, the Europeans are doing it, Kevin Rudd's doing it, even Najib's doing it. This is governments using the fiscal policy, with what is called a budget deficit.

The fiscal policy is basically the government's manipulation of Taxation (T) and Government Spending (G). For a budget deficit (Which literally means that the government's finances will be in the negatives), governments reduce taxes and increase government spending. This means pumping in money into industries to increase production which will then increase employment, income, demand and consumption. Lowering taxes basically increases an individual's disposable income (Spending money), increasing consumption as well. The fiscal policy marks the increase in Aggregate Demand (AD).

The problem with the fiscal policy? Like all things in life, it takes time. The fiscal policy is notorious as to having a time lag, and it'll take a while before you see the effects of the policy taking place in your economy. Therefore, people, BE PATIENT.

On a less theoretical, Economical way of answering you, THIS RECESSION WILL END... EVENTUALLY. THE LAWS OF THE BUSINESS CYCLE SAYS SO. THE ONLY QUESTION IS - HOW LONG WILL THIS TAKE? WILL VARIOUS COUNTRIES' MACROECONOMIC POLICIES BE ENOUGH TO PULL US OUT OF THIS RECESSION FAST ENOUGH, LONG ENOUGH?

By the way, do not be fooled by the doom and gloom of recession, and the seeming sparkles of perfection of booms. Booms are NOT good in the long run. Best time in the economy? UPTURNS.

I should totally write a thesis of this one day.

QUESTION 2: WHY CAN'T HUMANS THINK OF SOMETHING TO STOP RECESSION?

-----------------------------------------------------------

AS A STUDENT OF ECONOMY (I'm quoting my Econs lecturer here, LOL), we know that this recession CAN be fixed. THEORETICALLY SPEAKING.

The problem is human nature. Greed.

The study of Economics is basically the allocation of our SCARCE resources to fulfill our UNLIMITED wants.

Many firms are set up with one goal in mind: profit. The government has to provide schools, public parks, hospitals, etc etc (Henceforth known as collective goods)because private firms will only want PROFIT (Good example: Form 6 vs SAM/Architecture diploma. Notice the difference in price?).

In times of recession, demands for goods and services drop because of the increase in prices. What happens is that production/supply>demand, so firms are faced with surplus stocks. WHAT they SHOULD do is to lower their prices so that they can sell their goods/services off. What's happening is that they still want to profit, so they'll produce less, and sell at the same price.

At the same time, they retrench workers, because they don't need as many to produce a smaller amount of goods/services, leaving those people UNEMPLOYED and with DECREASED INCOME. Less income = less disposable income (Money to be spent on wants, not needs) = less demand for goods, and the viscious cycle continues in this tune. Unfortunately.

The Australian government actually tried giving people cash last year - 1000 AUD for every individual to spend during Christmas (Therefore keeping the economy in motion), what happened was that people ended up using the money to pay off their loans/debts, which was the direct opposite of what the government planned, because moneys going back to banks is considered a leakage in the 5-sector circular flow, while the money was initially given to them as an injection. All of which cannot be told in this tiny comment box where I don't know if there's a word limit.

This 'comment' has turned into an Econs essay, in which I realized I can essentially link to the AD-AS model and the 5-sector circular flow. And I cannot fully explain this in a comment box, and will probably post something up about it on my blog eventually. If I have time, I'd totally discuss this with my Econs lecturer. Hee.

-----------------------------------------------------------------

Here I will begin the detailed answer, but before I do, I will explain some basic concepts of Economics.

There is something called the Business Cycle.

The Business Cycle graph basically looks like a Sin graph (As in, Cos Sin Tan in Maths). The peaks are the booms, the troughs (Minimum points) being the recession. As you move up the graph toward the peak, it's called an upturn, and when you move downwards towards the trough, it's a downturn. So if we talk about the movement of the graph, you start at 0, reach an upturn, the peak/boom, downturn, trough/recession then we go back up with an upturn all the way to the peak and then down to the trough, and it goes on in that vein for, like, forever. Refer to image 1.1

Image 1.1 Business Cycle graph

The number of years it takes to reach the peak or the trough is an unknown variable - it may take 1 year, 5 years, or even 50 years, and how long the economy stays in a situation is also a variable. It is said that in every 200 years, the world's economy suffers a MAJOR recession.

How do we equate the economic situation?

Every government has Macroeconomic objectives (Macro=large-scale, affects the country as a whole, while micro = individual). Australia's (the one I'm studying) being full employment, economic growth, price stability and external balance.

1. Full Employment (FE) is the situation in which UNEMPLOYMENT is kept to an acceptable minimum - that is, 5% in Australia. It is measured by some body in Australia whose name escapes me at a moment, using a survey in certain major cities in Australia.

2. Price Stability (PS) is the situation in which the sustained increase in the general price level is kept to an acceptable minimum of 2-3%. It is measured by the Consumer Price Index (CPI)

*The CPI is measured by using what is called 'a basket of goods', which is a basket of common consumer items, and prices are counted (ie. increase/decrease from previous month, how much, etc). BASICALLY, INFLATION.

3. Economic Growth (EG) is the rate of increase in the total production of goods and services within an economy. Sustained growth of 4-5% is acceptable. It's measured by the Gross Domestic Product (GDP)3.1 The GDP is the total market value of final goods and services produced within an economy in a given period. There are 2 types of GDP - Real GDP and Nominal GDP. Real GDP is GDP with the effects of inflation REMOVED, while Nominal GDP is GDP at market price, that is, with the effects of inflation included.

4. External Balance (EB) is a balance between money inflow and outflow resulting from Australia's transactions with the rest of the world. Which is kind of irrelevant in my DETAILED ANSWER TO CHOOI SI'S QUESTION!!1!

The economic situation is based on the data received from things that relate to the Macroeconomic Objectives - Employment (UE Rate, FE), Price Level (PS - CPI), Growth (GDP). There's something in the objective of EB that we call a Current Account Deficit (CAD), but a country usually has a CAD anyway, so we'll ignore that in this case.

In a boom situation, there is high employment, high production, and marked inflation. In a recession, it's the complete opposite - low employment, and low production. We usually do not comment on inflation in the case of a recession.

What was this '5-sector circular flow diagram' you were talking about?

THIS is the 5-sector circular flow model. Basically, you have households, firms, the Financial Sector, Government Sector and Foreign sector. The pink dotted lines indicate leakages from the 2-sector circular flow model, while the solid pink lines are the injections.

Leakages = Money taken OUT of the 2-sector circular flow

Injections = Money put back in to the 2-sector circular flow

SO, TO ACTUALLY ANSWER THE QUESTION

I am going to ADD to what I previously wrote, not rewrite the whole thing.

The reason as to why we're not seeing any improvements in our economy is not because nothing is being done - it is because what is being done takes time to take effect. You read of 'stimulus packages' in the newspapers - Obama's doing it, the Europeans are doing it, Kevin Rudd's doing it, even Najib's doing it. This is governments using the fiscal policy, with what is called a budget deficit.

The fiscal policy is basically the government's manipulation of Taxation (T) and Government Spending (G). For a budget deficit (Which literally means that the government's finances will be in the negatives), governments reduce taxes and increase government spending. This means pumping in money into industries to increase production which will then increase employment, income, demand and consumption. Lowering taxes basically increases an individual's disposable income (Spending money), increasing consumption as well. The fiscal policy marks the increase in Aggregate Demand (AD).

The problem with the fiscal policy? Like all things in life, it takes time. The fiscal policy is notorious as to having a time lag, and it'll take a while before you see the effects of the policy taking place in your economy. Therefore, people, BE PATIENT.

On a less theoretical, Economical way of answering you, THIS RECESSION WILL END... EVENTUALLY. THE LAWS OF THE BUSINESS CYCLE SAYS SO. THE ONLY QUESTION IS - HOW LONG WILL THIS TAKE? WILL VARIOUS COUNTRIES' MACROECONOMIC POLICIES BE ENOUGH TO PULL US OUT OF THIS RECESSION FAST ENOUGH, LONG ENOUGH?

By the way, do not be fooled by the doom and gloom of recession, and the seeming sparkles of perfection of booms. Booms are NOT good in the long run. Best time in the economy? UPTURNS.

I should totally write a thesis of this one day.