into the abyss

The hammer drops

Oct 4th 2007

The Economist

America's houses are being repossessed at a record rate. What comes next?

At first sight, Maple Heights, just outside Cleveland, looks much like any other ageing suburb in the industrial mid-west: a patchwork of small colonial-style houses built after the second world war, with leafy streets and mown lawns. Up close, it is a community in collapse.

Every twelfth house stands empty, repossessed after its owner defaulted on a mortgage. There are no boarded windows (a local ordinance forbids them) and the city council cuts the grass around vacant homes. But the cracked panes, crumbling paint and rotting porches are hard to hide. Countless more homes sport “For Sale” signs as the remaining owners try to flee to better areas. With so many houses vacant, the property tax base has crumbled. Since 2003, the local government has laid off 35% of its staff.

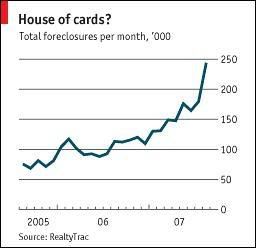

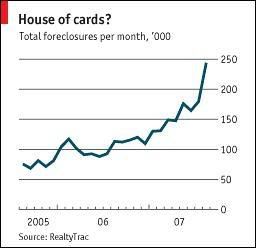

As America's housing bust grows ever deeper, the big question is how far Maple Heights is a harbinger of things to come. Nationally, people are defaulting on mortgages at a faster pace than at any point in recent decades. According to the Mortgage Bankers Association, some 5% of all mortgages are delinquent and the share rises to almost 15% for “subprime” mortgages-those lent to people with shaky credit histories. In the second quarter of 2007, almost 3% of subprime loans entered foreclosure (the process of default and repossession). RealtyTrac, a company that tracks foreclosures, reckons up to 1.5m households will enter the process this year (see chart), double last year's figure. And with some 2.5m adjustable-rate mortgages resetting to higher rates before the end of 2008, everyone knows there is much worse to come.

The pain will probably be concentrated in two main areas. One, typified by Maple Heights, is the Midwest-states such as Ohio and Michigan, where the subprime bust is battering an industrial economy already in long-term decline. The other is quite different: booming states, such as Florida and California, where the subprime bonanza fuelled the biggest housing bubbles. Until recently, the highest default rates were in the industrial heartland. But that is changing fast. More than a third of all adjustable subprime loans are in California, Nevada, Arizona and Florida. California alone has 17% of them, and the numbers are soaring. In Riverside and San Bernardino counties, two sprawling counties east of Los Angeles that comprise an area called the “Inland Empire”, 1,900 houses were repossessed in August. It was 31 a year earlier.

The good news is that high default rates may be less painful in places whose sub-prime problem sits atop an economic boom. Cleveland has been losing inhabitants for years. In contrast, almost 800,000 people piled into the Inland Empire between 2000 and 2006, swelling the population by a quarter. The area is the main distribution hub for Chinese imports, and it has added 50,000 jobs in the past year.

The bad news, though, is that foreclosure is costly and high rates of it can cause plenty of collateral damage. In Cleveland, lenders incur legal fees and other costs of around $25,000, or 25% of the value of a typical subprime loan. The process of repossession takes a year or more, during which delinquent borrowers have little reason to look after their homes. A glut of repossessed houses dampens prices, and not just by adding to the supply of homes for sale. Thanks to high commodity prices, vacant homes in poorer neighbourhoods are quickly stripped of their aluminium sidings and copper fixtures. Marginal houses become uninhabitable; crime rises; whole areas are blighted.

Add these costs to the human toll of people being turfed out of their homes, and it is no surprise that America's politicians are scrambling for ways to stem the foreclosures. (All the more so because hardest-hit areas include election swing states such as Ohio and Florida.) So far, the focus is on low-cost intervention: encouraging borrowers to seek counselling and lenders to show forbearance. The Senate has appropriated $100m to help community groups advise delinquent borrowers. A national foreclosure hotline offering free advice gets 2,000 calls a day.

These efforts will help. A rough estimate is that half the people who are likely to face foreclosure in the coming months could service a renegotiated loan. But Cleveland's experience suggests the process is not easy. According to Lou Tisler, head of Neighbourhood Housing Services of Greater Cleveland, a local community group, mortgage lenders are becoming more willing to renegotiate loans. But most people seek advice only after they have been in default for months. Many are only days away from the sheriff's sale at which their home is formally lost.

Cleveland's experience also shows the limits of the small-scale public bail-outs to help “victims”. Politicians have a weakness for such schemes. Ohio's state government was the first to set up an explicit foreclosure rescue fund: it has promised $4.6m to help distressed homeowners who earn up to 125% of their county's median income. The state will put up to $3,000 towards mortgage refinancing. Some 250 people have been helped thus far; the goal is 1,500. But with 150,000 Ohio mortgages resetting over the next 12 months, the bail-out is a drop in the bucket. The only type of rescue that would prevent a surge in foreclosures would be a huge federal bailout which no politicians (as yet) are contemplating.

And the hard truth is that in many cases preventing foreclosure is a bad idea. Not all defaulting borrowers are suffering families. In the bubbliest property markets, many mortgages are held by investors, who were speculating on higher prices. In Florida, a quarter of all defaulting loans are held by non-residents. Even in Cleveland, many subprime borrowers are in houses that they cannot-and will not be able to-afford. Foreclosure is, unfortunately, the right outcome for perhaps half of America's problem mortgages.

That suggests politicians should put more emphasis on making the process more efficient. Already there are vast differences between states. In New York it takes at least 15 months for a house to be repossessed, according to Rick Sharga of RealtyTrac; in California it takes at least four months, while in Texas delinquent homeowners can lose their house less than a month after receiving a formal notice of default. That is extreme, but relatively speedy repossessions might at least reduce some of the collateral damage.

All told, the biggest unknown about America's subprime bust is how quickly, and how far, house prices will have to sink. Nationally, house prices have fallen by some 3%, while the glut of unsold homes has risen to ten months' supply. In the areas hardest-hit by defaults, the glut is far bigger. But rather than prices adjusting further, sales have simply dried up. In the Inland Empire the number of houses sold has halved in the past year. Michael Ciaravino, the mayor of Maple Heights, points out that only three houses have sold in the past two months, compared to a monthly total of between 15 and 50 a few years ago. Once prices halve, he reckons, the market will clear, new families will come in and his suburb will recover. The question, for Maple Heights and America, is how much damage is done in the meantime.

http://www.economist.com/world/na/displaystory.cfm?story_id=9905451

Oct 4th 2007

The Economist

America's houses are being repossessed at a record rate. What comes next?

At first sight, Maple Heights, just outside Cleveland, looks much like any other ageing suburb in the industrial mid-west: a patchwork of small colonial-style houses built after the second world war, with leafy streets and mown lawns. Up close, it is a community in collapse.

Every twelfth house stands empty, repossessed after its owner defaulted on a mortgage. There are no boarded windows (a local ordinance forbids them) and the city council cuts the grass around vacant homes. But the cracked panes, crumbling paint and rotting porches are hard to hide. Countless more homes sport “For Sale” signs as the remaining owners try to flee to better areas. With so many houses vacant, the property tax base has crumbled. Since 2003, the local government has laid off 35% of its staff.

As America's housing bust grows ever deeper, the big question is how far Maple Heights is a harbinger of things to come. Nationally, people are defaulting on mortgages at a faster pace than at any point in recent decades. According to the Mortgage Bankers Association, some 5% of all mortgages are delinquent and the share rises to almost 15% for “subprime” mortgages-those lent to people with shaky credit histories. In the second quarter of 2007, almost 3% of subprime loans entered foreclosure (the process of default and repossession). RealtyTrac, a company that tracks foreclosures, reckons up to 1.5m households will enter the process this year (see chart), double last year's figure. And with some 2.5m adjustable-rate mortgages resetting to higher rates before the end of 2008, everyone knows there is much worse to come.

The pain will probably be concentrated in two main areas. One, typified by Maple Heights, is the Midwest-states such as Ohio and Michigan, where the subprime bust is battering an industrial economy already in long-term decline. The other is quite different: booming states, such as Florida and California, where the subprime bonanza fuelled the biggest housing bubbles. Until recently, the highest default rates were in the industrial heartland. But that is changing fast. More than a third of all adjustable subprime loans are in California, Nevada, Arizona and Florida. California alone has 17% of them, and the numbers are soaring. In Riverside and San Bernardino counties, two sprawling counties east of Los Angeles that comprise an area called the “Inland Empire”, 1,900 houses were repossessed in August. It was 31 a year earlier.

The good news is that high default rates may be less painful in places whose sub-prime problem sits atop an economic boom. Cleveland has been losing inhabitants for years. In contrast, almost 800,000 people piled into the Inland Empire between 2000 and 2006, swelling the population by a quarter. The area is the main distribution hub for Chinese imports, and it has added 50,000 jobs in the past year.

The bad news, though, is that foreclosure is costly and high rates of it can cause plenty of collateral damage. In Cleveland, lenders incur legal fees and other costs of around $25,000, or 25% of the value of a typical subprime loan. The process of repossession takes a year or more, during which delinquent borrowers have little reason to look after their homes. A glut of repossessed houses dampens prices, and not just by adding to the supply of homes for sale. Thanks to high commodity prices, vacant homes in poorer neighbourhoods are quickly stripped of their aluminium sidings and copper fixtures. Marginal houses become uninhabitable; crime rises; whole areas are blighted.

Add these costs to the human toll of people being turfed out of their homes, and it is no surprise that America's politicians are scrambling for ways to stem the foreclosures. (All the more so because hardest-hit areas include election swing states such as Ohio and Florida.) So far, the focus is on low-cost intervention: encouraging borrowers to seek counselling and lenders to show forbearance. The Senate has appropriated $100m to help community groups advise delinquent borrowers. A national foreclosure hotline offering free advice gets 2,000 calls a day.

These efforts will help. A rough estimate is that half the people who are likely to face foreclosure in the coming months could service a renegotiated loan. But Cleveland's experience suggests the process is not easy. According to Lou Tisler, head of Neighbourhood Housing Services of Greater Cleveland, a local community group, mortgage lenders are becoming more willing to renegotiate loans. But most people seek advice only after they have been in default for months. Many are only days away from the sheriff's sale at which their home is formally lost.

Cleveland's experience also shows the limits of the small-scale public bail-outs to help “victims”. Politicians have a weakness for such schemes. Ohio's state government was the first to set up an explicit foreclosure rescue fund: it has promised $4.6m to help distressed homeowners who earn up to 125% of their county's median income. The state will put up to $3,000 towards mortgage refinancing. Some 250 people have been helped thus far; the goal is 1,500. But with 150,000 Ohio mortgages resetting over the next 12 months, the bail-out is a drop in the bucket. The only type of rescue that would prevent a surge in foreclosures would be a huge federal bailout which no politicians (as yet) are contemplating.

And the hard truth is that in many cases preventing foreclosure is a bad idea. Not all defaulting borrowers are suffering families. In the bubbliest property markets, many mortgages are held by investors, who were speculating on higher prices. In Florida, a quarter of all defaulting loans are held by non-residents. Even in Cleveland, many subprime borrowers are in houses that they cannot-and will not be able to-afford. Foreclosure is, unfortunately, the right outcome for perhaps half of America's problem mortgages.

That suggests politicians should put more emphasis on making the process more efficient. Already there are vast differences between states. In New York it takes at least 15 months for a house to be repossessed, according to Rick Sharga of RealtyTrac; in California it takes at least four months, while in Texas delinquent homeowners can lose their house less than a month after receiving a formal notice of default. That is extreme, but relatively speedy repossessions might at least reduce some of the collateral damage.

All told, the biggest unknown about America's subprime bust is how quickly, and how far, house prices will have to sink. Nationally, house prices have fallen by some 3%, while the glut of unsold homes has risen to ten months' supply. In the areas hardest-hit by defaults, the glut is far bigger. But rather than prices adjusting further, sales have simply dried up. In the Inland Empire the number of houses sold has halved in the past year. Michael Ciaravino, the mayor of Maple Heights, points out that only three houses have sold in the past two months, compared to a monthly total of between 15 and 50 a few years ago. Once prices halve, he reckons, the market will clear, new families will come in and his suburb will recover. The question, for Maple Heights and America, is how much damage is done in the meantime.

http://www.economist.com/world/na/displaystory.cfm?story_id=9905451