Brilliant (California) housing market analysis by my buddy SGL

Oh you should give the economy a chance! The only reason homes are this high is because people who already owned homes sold them to buy a bigger home...well if you bought a home five years ago for $200,000 it was worth $300,000 a year later. So you would go and look at $500,000 homes (which you would NOT have done had your first home appreciated correctly at 6% which means you'd only have $12,000 equity not $100,000!) but you can now because you can put $100,000 down on the new home, which makes the payments manageable. If they wanted to, they could have moved AGAIN a few years later when that $500,000 home went up to $750,000 in 2 or 3 years and now, combined, put $350,000 DOWN on a $1.1M home. So this musical chairs crap really drove the prices through the roof..meanwhile, the renters...who could not come up with 20% down to avoid PMI on a $650,000 800sf condo built in 1976 got blown out of the market. But what is helping this correction is those homeowners are assed out now.

Since the feeding frenzy is over, and interest rates have gone up a few points...they need to SELL their home in order to BUY the next bigger home...but nobody is buying. Inventories are rising, turnover is slowing, the affordability index for OC went from a high of 43% to its current 3%. And now what will happen, as the tide turns, and people see home owners offering a little off the top, or throwing in some upgrades...they will think to themselves..."Do I really want to buy in now? It's all ready gone down a little...it might go down more! Why would I want to be the idiot that buys in on the way DOWN!" And that will cause a herd mentality, in economics called "animal spirits," basically a rule that states that human nature has a powerful effect on the economy and most humans act in uniform fashion, like a herd (just like they did during the home bidding wars...just a herd mentality, had NOTHING to do with supply and demand). So once people start staying out of the market waiting for the correction, they will create a self fulfilling prophecy that will inadvertently cause the correction. Ten years ago LA County had a boom of 22% with an 11% downward correction, this time we have a 34% boom..so the correction will be at least 11%, probably more like 15% or 20%.

Oh, and I forgot to mention. The reason you aren't seeing prices falling yet, even rising in the housing market is due to used home prices. First, homeowners who want to move, want to move into a bigger or better home...so they are asking for an amount greater than what they paid for it, probably within the past five years...so some guy who bought in at $500,000 two years ago is asking for $750,000 because that's what his neighbor got when he sold his six months ago. What he's asking for is ridiculous, but it doesn't hurt him to ask. The worst thing that can happen, is...nothing. He's living in the house, no skin off his nose if he can't see for that. If he's motivated, he has $250,000 of leeway in his asking price. So he'll let it sit six months at $750K and then drop it by $25K...wait a few more months...then drop it another $25K...still no takers...etc...it'll take a year for him to get anywhere close to the REAL value of the house because he wants to make as much as he can, only makes sense.

The other pressure on homeowners not to drop the price, are real estate agents. They will advise sellers not to lower....cause guess what...that sale information is input into all the databases that track sales....so the next person looking to buy will say...well....why are you asking for $750K when your neigher, same model, sold for $657K! So he'll make his offer $675....and the real estate agent will lose money on commissions...so they advise everyone to HOLD THEIR GROUND...lol.

So..developers, who don't have anyone paying a mortgage yet, are the first to drop their price, which is already happening. They need to sell the property, until they do, it's just costing them money...not like a home with a homeowner in it who can afford to sit an wait to see what happens to the market.

-

There are two things going on now. Last year I would have only bored you with the housing data and my thoughts on that, but recently, more and more leading indicators are pointing to a recession on the horizon..the FAR FAR horizon…and for anyone looking at housing, that has to be considered as well now.

All I can tell you is that we almost bought over a year ago and I canned it. I tried to buy five years ago but I couldn’t get the funds.That property went from $214,000 to $675,000. Of course, I would have dumped it over year ago, and ironically, would be renting right now while I let that capital gain earn interest for me.

Barring that, after the insanity took off I saw what was coming, and I was not going to be a high-side buyer. I saw the emotional frenzy that drove the price of homes up, the unsupported fundamental lunacy. It's the same psychological reaction that drove the stock market up, without fundamentals. There are numerous papers on the subject, in economics called "animal spirits" when an area of the free-market system detaches from the fundamental drivers that support it, such as supply and demand, and either skyrockets or tanks.

In a nutshell though, I think someone should only buy in this market if they plan to hold the property for a substantial amount of time (I am estimating a minimum of 10 years) and that was based on normal economic growth. Now we have ADDITIONAL factors to consider. We are facing either a) recession, b) a stagflation period, or c) an inflationary period.

-

A) If the Feds continue to raise interest rates, that slows economic growth, slows the economy, and makes houses more expensive as mortgage interest rates will rise. That effectively puts downward pressure on salaries and job growth, upward pressure on unemployment. So people will make the same or less money but homes will depreciate (or the bubble will go pop), substantially in hot markets like California. Some estimates are upwards of 20%. So this would be a recession, a very bad long one. Bad and long because the government has run out of the tools they use to recover from it, i.e. increasing government spending which pumps cash into the economy, tax cuts, and lower interest rates. In order to survive this last recession, our gov't already did that. They offered tax cuts, they lowered the interest rate to 1%, and they spent like crazy. Those three helped us keep this last recession very mild. But now we have moved from a national surplus to a national deficit in the trillions. Further tax cuts or spending increases would make that even worse. The interest rate is already very low. So...we are out of recovery tools should we head into another recession.

In addition, a great number of individuals took out HELOC's and other types of loans against the equity in their house so they could a) pay off credit cards, b) buy a nice shiny new Suburban, c) do house upgrades or landscaping, or d) take that nice European vacation they've been meaning to take for years now...well, those interest rates are going to go up to. So imagine how fast someone who didn't have much paid-in equity in the first place, then took a loan out on this ridiculous run up of equity and SPENT it...how quickly they would become upside down on the note. I remember about two years ago when I lived in an older housing tract driving around, like 1 in 10 houses was having their lawn landscaped, walls built, ponds, etc...

And what else really bothers me is people make these tremendously important decisions using "best-case-scenario" figures. For example, they assume they will, for the next 30 years, have two incomes or the one income they currently have, what if they plan on having children? Those little buggers cost a fortune. And if you already have or plan to have, how about setting some money aside for their education, books and tuition, how about a 529B or some other better long term tax-deferred investment for that? If a daughter, her wedding? How about your retirement, or do they plan to have their (uneducated-due to lack of tuition funds) kids take care of them? And yes I know money can be made outside of college, but lets consider the MAJORITY of people. Pensions and Social Security are history, time to plan now...are they putting any aside for that? What about if a revenue generator in the house loses his job? Gets sick? How about if the car gets wrecked and you need another? Parents get ill? SOOOO many variables, so people stretch themselves paper-wafer-thin based on NOTHING bad EVER happening in the future. So the moment it does...POP...goes the REO, and the house is gone.

Case in point, my wife's receptionist at work...dating a man for five years, married for one, have 8 children between them, 7 from prior marriages. Guy decided to get a different wife. Both cars and house in his name even though they paid for all the upgrades together. They bought in the past few years, he can't make the payment without her income...he doesn't care...his solution? He just stopped paying it. He's going to let it go into foreclosure.

-

On to the next possibility...

B) Stagflation is the worst scenario, I believe. Our inflation rate is currently averaging around 4%. About half of that is normal inflation due to an expanding economy. The other half is from ridiculously high oil/energy prices. The trickle down DOES occur. For example, at this company, we have at least two vendors that I am aware of that charge us a new ENERGY SURPLUS fee in the tens of thousands of dollars for the raw material, basically aluminum that goes into the handrails you hold onto when you are on a treadmill. It costs THEM more to run the smelters, etc... to make the aluminum pipes because it costs them more to buy the fuel for the burners, so they pass that to us. This company takes that hit to the margin, directly. All fitness equipment companies being under the same pressure (all things being equal), they will all raise their prices to the market to make up the loss, which means more cost to Bally's to buy our machines...Bally's in turn will tweak their monthly membership rates to make up the hit to THEIR margin, say a few bucks a month, which comes out of YOUR pocket....so we get inflation. Now imagine the net effect of that on EVERYTHING....bread, milk, Taco Bell, DVD's, Ben & Jerry's....

The problem is, inflation driven by the economy is controllable, we just raise interest rates, the economy slows down, businesses stop borrowing money and expanding so they stop passing along their additional costs of doing so to the consumer. So, the Feds could just raise the interest rate to keep that in check. Unfortunately, raising interest rates here for the overnight loan rate don't do skippy to Saudi Arabia , Venezuela , etc... If we raise a rate here, the bank charges a company more to borrow, so they are less likely to borrow, situation controlled. But the price of oil is not moved one way or the other by rising interest rates here in the U.S. Therefore, the effect of raising interest rates will slow down our economy but NOT slow down inflation which is being mostly driven by the cost of oil which is an outside influencer. Luckily we are getting a respite in oil right now, but I don't know how long that will last. All major oil exporting countries are relatively at peace right now, no Hurricanes have taken out a major oil port, no dictator is doing a coup, no major pipelines or tankers are dumping into the ocean...relatively quiet. So we will see. Of course, I have an entire dissertation on the future of oil and the impact of energy on civilizations if you ever want to hear that...

I will make one point here however...all those countries that are net exporters of oil, that we buy from...what happens with all that money they make from the oil? Billions of dollars...well, they build roads and schools, companies start-up, cities expand, the standard of living starts to creep up...wonderful for them. They sell oil to us, make billions, and their country starts expanding. Guess what happens next? Well, once you start expanding from all that money...you start to consume more and more of your own oil to support that economic expansion. Eventually...you consume all of it. Eventually, you stop exporting and start importing. This is the future for most current exporters. Bad news for us.

So, at any rate, the net effect is an economy slowing down (due to rising interest rates) but without slowing inflation. So...less jobs, less/same pay, a little uncertainty, but with the cost of bread rising. Not good. At least in a recession the cost of things stay the same or go DOWN...so the average guy who is out of work, or looking for work, or on unemployment because of the recession is not paying MORE every month for the same loaf of bread while more and more jobs disappear from the market because of the recession.

-

C) Inflationary period. In my mind this is actually the best case scenario, but definitely just the lesser of three evils. For the reasons that create A) and B) it may be wise for the government to allow inflation to continue and but NOT continue to raise interest rates or at least be more moderate about it. In that way, the economy will continue to grow, business to expand, more jobs, higher pay through growth, etc... The upside is a couple things. First...let's say homes in a particular area are 20% overvalued. With inflation rising, let's assume home prices stay flat or decline only slightly...something the NAR loves to say. Well, let's say we achieve an inflation rate of 5%...then in four years, those houses are no longer overvalued. They are market. The inflation rate of 5% would force businesses to offer a minimum increase of 5% "cost-of-living" payroll increases every year, conceptually, so in four years they could afford that once over valued house. Additionally, the national debt should not be looked at as a number. It should be looked at as a percentage of GDP. Now anyone can argue that the percentage is too high or too low, and that's fine. Ultimately though, for our purposes, the point is that the percent of debt the country carries against the income the country generates will be lower as the income rises. So assume we stop or slow down our deficit spending, but the GDP keeps going up, then we have less debt than we had before as a percentage of income. It's just like an individual...if I have $20,000 a year in income (GDP per capita) with $10,000 on my credit cards (Deficit), I am in some serious trouble, but if my income goes up to $100,000, well then, that debt doesn't look so bad...if I wanted to, I could pay it off pretty quickly...in fact some might argue I could take on more debt if I wanted, but only with that new income. The government might let inflation do that for them...raise the national income to make the deficit, in relation, smaller.

The problem with this scenario is that there are a lot of "IF'S."

First, the housing bubble has to NOT burst. I for one am beyond believing that it won't. I think we are getting into some serious housing trouble here. Second, we have to assume that the inflation rate, driven by energy prices and any latent affect the past interest rate increases the government has done (it takes 1-2 years for an increase to trickle down) does not create an inflation rate higher than what we can absorb slowly over time....a drip feed is desirable so to speak. Third, we have to assume businesses will continue to grow and in so doing can afford the 5%+/- every year that employees would need to catch up to housing. Finally, we have to assume that those "animal spirits" don't catch fire and bring us down. But I think they just might. Word of this housing bubble is spreading, more and more homeowners are in denial about having to lower their prices. Someone will blink and the whole house of cards will start to tumble. By that I mean, Realtors and home owners are fond of looking at what their neighbor sold for...I've even read stories on realtors telling people to not lower their price, or groups of homeowner associations advising people who wish to sell to not offer lower than "x" percentage, or, in one case, someone was selling for quite a bit lower and the neighbors actually got upset and confronted them telling them they were going to pull the whole neighborhood value down. Anyway, the "blink" is inevitable because there are many times when someone HAS to sell, they simply have no choice. And in so doing, MUST come down to a fair market value. It will take several of those in a neighborhood to lower the "Average" value but once they start selling, at least the visibility is there and the leverage is there for home buyers to reference to.

Once that happens, buyers, who are already hanging out on the sidelines at halftime, will wait even LONGER, because nobody wants to buy on the downward slide. So buyers will attempt to "time" the market and buy on the bottom. THIS, in and of itself, creates a self-fulfilling prophecy that could drive home prices even lower than what they would normally be at with normal rates of appreciation. And why do I believe animal spirits will come into play? Because they are what drove the dot.com spike AND the crash (when everyone had an e-trade account and no stock was a loser and everyone had a "tip" and everyone's uncle knew a great new startup), and they are what drove this insane home price appreciation through the roof. Not shortage of land, not population increases, raw material costs...none of that did it...it was Mrs. Betty Homemaker on the 6:00pm news in front of a CBS camera crew writing an essay on why she wants to buy this home and what it means for her and her family to give to the seller who is entertaining 20 offers and can't decide since all of them are offering OVER her list value. True story. When the herd sees that on TV...the herd responds....and they all piled into the market, scrambling to buy houses like if they didn't get in now they would NEVER get in and they and their children would be destitute lowly renters for all eternity...it is THAT kind of clouded judgment and insanity that drove this thing. Now...for the clear minded...that take a minute to sit back and study the trends...the fundamentals...as in all chaos, there is opportunity.

-

So to FINALLY answer your question. Buy a house now if they...

• Can afford the monthly mortgage payment and still cover life's inevitabilities (kids, weddings, retirement, etc...)

• Do not use creative financing tools

• Love the house so much, is so happy with it, that ten years in it would be no problem

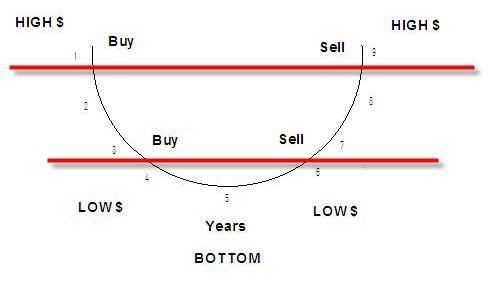

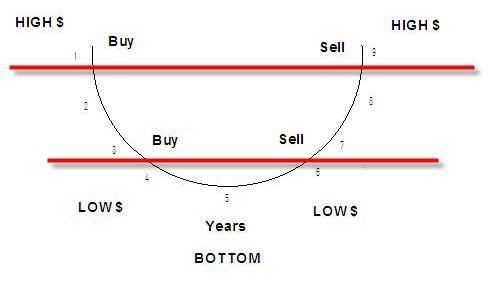

• Consider the meaning of my chart below

Otherwise, consider Plan B. Find somewhere to rent and invest the rest of the money in a mix of short and long term investments. Instead of paying 5-6% for the house, MAKE 5-6% on your money while you wait for the market to change. Right now, renting is cheaper than owning. Even with the tax breaks, in this SoCal and other over heated markets, renting is cheaper. Houses have the mortgage interest, property taxes, homeowners association dues, maintenance, higher utility bills, homeowner insurance premiums and of course all the ancillary "upgrades" you inevitably do like new cabinets, faucets, etc... Renting has none of that. In addition, you can move wherever your job or life takes you.

In addition, let’s take some real case scenarios. Columbus Homes is building a raft of new condos and houses on the Tustin Air Base. They have been averaging $700K+ for the cheapest ones. Recently, starting about two months ago, they began a ‘Summer of Love’ campaign. They are now offering $25K to $50K towards closing costs and upgrades. First, this is the FIRST thing realtors and sellers do…offer upgrades and freebies. It prevents that “blinking” where the average price in the neighborhood drops, but still entices buyers to get in. Ultimately, that is a price cut, I don’t care how anyone looks at it. The problem is, Dataquick and the agencies that report the housing market ignore “incentives” completely which skews the numbers in favor of the sellers. Hovnanian, Avenue One and 3 Chapman are both offering incentives, a $10,000 furniture package…another one is offering no HOA dues for a year. We visited some lofts in Long Beach ….they offered us 10% off the listed price, $5K towards furniture and $15K in upgrades for a second bathroom. NONE of that information is actually LISTED anywhere. So as far as the surveys and market watch companies are concerned, those lofts are the same price they have always been. In reality, since they were $700K, they have actually dropped $90K. Now….if we look back at the $25K that Columbus Homes is offering in closing and upgrades…that is 17 months of rent for me. So in two months, they have already paid 1.5 years of my rent if I were to buy now as opposed to having bought a few months ago before this promotion. At $90K, that’s FIVE YEARS of rent that I saved if I bought now as opposed to someone who bought six months ago or whenever before they were offering those incentives. So you can see..it doesn’t take much of a drop in price to recover whatever you lose in rent, not including what you are saving in renting versus all the costs of home ownership.

So consider renting, then you can take the time to study the market. For me, I drew a line in the sand since I am not going to try and time the market. I know what houses were going for five years ago and I know what they SHOULD be going for right now, and I want a 25%-35% drop in prices to feel that I am paying market. Of course, as a year or two go by, with inflation of 4%, that would be 21%-31%, etc... But eventually, the inflation rate and the depreciation rate will meet in the middle for the house I want. So figure out what you want exactly, beds and baths, cities, amenities, lot size, how old or new, etc...just think of a house you would be willing to live in for a long time. Figure out what the price of THAT house SHOULD be. Find out what it cost 10 years ago and do a 6.7% annual appreciation rate on it. That’s about what it should be now. Then wait. When the price comes close or into your range, then go find them and buy it. If it continues to depreciate the next morning, who cares? The point is, you now own a house you love, that is perfect for what you wanted at a "fair and reasonable" price and additional devaluing means nothing because it will eventually stop....turn around...and start to rise...and then start appreciating in short order.

I actually drew this chart below, I’ve had in my head for a long time so I wanted to kind of visualize it. Assume right now is position 1 on the curve. If you buy now, then over the course of 10 years the house will depreciate, bottom, recover, and eventually at position 9 start appreciating. Assume each position is a year, that would be 9 years. You need additional time in appreciation because you have to cover your closing costs, twice, the initial closing costs and ideally the new closing costs when you move as well as the realtor commissions so I assume ten years, but I could off by a few years either way. Additionally, I do not know when position 1 started…I assume we are at it right now, probably really started in Q106 perhaps even more like 1.5 right now. So you can see that the longer you wait from position 1 to 2 to 3 to 4…the less time you have to wait to realize an appreciation on the other side of the curve. For example, in position 4…..you will still have depreciation, but you only wait two years to “break-even” and start realizing some gains which would occur at position 6. So the top red line is someone buying now and the amount of time needed to get that investment back, and someone waiting a little, lower red line, and the time to get that investment back. Therefore, I am not suggesting anyone attempt to time the market, simply to know exactly what they want and buy it when it becomes a fair and reasonable price with my three bullet points above included in that consideration. And finally…consider a), b) and c) related to the economy.

Since the feeding frenzy is over, and interest rates have gone up a few points...they need to SELL their home in order to BUY the next bigger home...but nobody is buying. Inventories are rising, turnover is slowing, the affordability index for OC went from a high of 43% to its current 3%. And now what will happen, as the tide turns, and people see home owners offering a little off the top, or throwing in some upgrades...they will think to themselves..."Do I really want to buy in now? It's all ready gone down a little...it might go down more! Why would I want to be the idiot that buys in on the way DOWN!" And that will cause a herd mentality, in economics called "animal spirits," basically a rule that states that human nature has a powerful effect on the economy and most humans act in uniform fashion, like a herd (just like they did during the home bidding wars...just a herd mentality, had NOTHING to do with supply and demand). So once people start staying out of the market waiting for the correction, they will create a self fulfilling prophecy that will inadvertently cause the correction. Ten years ago LA County had a boom of 22% with an 11% downward correction, this time we have a 34% boom..so the correction will be at least 11%, probably more like 15% or 20%.

Oh, and I forgot to mention. The reason you aren't seeing prices falling yet, even rising in the housing market is due to used home prices. First, homeowners who want to move, want to move into a bigger or better home...so they are asking for an amount greater than what they paid for it, probably within the past five years...so some guy who bought in at $500,000 two years ago is asking for $750,000 because that's what his neighbor got when he sold his six months ago. What he's asking for is ridiculous, but it doesn't hurt him to ask. The worst thing that can happen, is...nothing. He's living in the house, no skin off his nose if he can't see for that. If he's motivated, he has $250,000 of leeway in his asking price. So he'll let it sit six months at $750K and then drop it by $25K...wait a few more months...then drop it another $25K...still no takers...etc...it'll take a year for him to get anywhere close to the REAL value of the house because he wants to make as much as he can, only makes sense.

The other pressure on homeowners not to drop the price, are real estate agents. They will advise sellers not to lower....cause guess what...that sale information is input into all the databases that track sales....so the next person looking to buy will say...well....why are you asking for $750K when your neigher, same model, sold for $657K! So he'll make his offer $675....and the real estate agent will lose money on commissions...so they advise everyone to HOLD THEIR GROUND...lol.

So..developers, who don't have anyone paying a mortgage yet, are the first to drop their price, which is already happening. They need to sell the property, until they do, it's just costing them money...not like a home with a homeowner in it who can afford to sit an wait to see what happens to the market.

-

There are two things going on now. Last year I would have only bored you with the housing data and my thoughts on that, but recently, more and more leading indicators are pointing to a recession on the horizon..the FAR FAR horizon…and for anyone looking at housing, that has to be considered as well now.

All I can tell you is that we almost bought over a year ago and I canned it. I tried to buy five years ago but I couldn’t get the funds.That property went from $214,000 to $675,000. Of course, I would have dumped it over year ago, and ironically, would be renting right now while I let that capital gain earn interest for me.

Barring that, after the insanity took off I saw what was coming, and I was not going to be a high-side buyer. I saw the emotional frenzy that drove the price of homes up, the unsupported fundamental lunacy. It's the same psychological reaction that drove the stock market up, without fundamentals. There are numerous papers on the subject, in economics called "animal spirits" when an area of the free-market system detaches from the fundamental drivers that support it, such as supply and demand, and either skyrockets or tanks.

In a nutshell though, I think someone should only buy in this market if they plan to hold the property for a substantial amount of time (I am estimating a minimum of 10 years) and that was based on normal economic growth. Now we have ADDITIONAL factors to consider. We are facing either a) recession, b) a stagflation period, or c) an inflationary period.

-

A) If the Feds continue to raise interest rates, that slows economic growth, slows the economy, and makes houses more expensive as mortgage interest rates will rise. That effectively puts downward pressure on salaries and job growth, upward pressure on unemployment. So people will make the same or less money but homes will depreciate (or the bubble will go pop), substantially in hot markets like California. Some estimates are upwards of 20%. So this would be a recession, a very bad long one. Bad and long because the government has run out of the tools they use to recover from it, i.e. increasing government spending which pumps cash into the economy, tax cuts, and lower interest rates. In order to survive this last recession, our gov't already did that. They offered tax cuts, they lowered the interest rate to 1%, and they spent like crazy. Those three helped us keep this last recession very mild. But now we have moved from a national surplus to a national deficit in the trillions. Further tax cuts or spending increases would make that even worse. The interest rate is already very low. So...we are out of recovery tools should we head into another recession.

In addition, a great number of individuals took out HELOC's and other types of loans against the equity in their house so they could a) pay off credit cards, b) buy a nice shiny new Suburban, c) do house upgrades or landscaping, or d) take that nice European vacation they've been meaning to take for years now...well, those interest rates are going to go up to. So imagine how fast someone who didn't have much paid-in equity in the first place, then took a loan out on this ridiculous run up of equity and SPENT it...how quickly they would become upside down on the note. I remember about two years ago when I lived in an older housing tract driving around, like 1 in 10 houses was having their lawn landscaped, walls built, ponds, etc...

And what else really bothers me is people make these tremendously important decisions using "best-case-scenario" figures. For example, they assume they will, for the next 30 years, have two incomes or the one income they currently have, what if they plan on having children? Those little buggers cost a fortune. And if you already have or plan to have, how about setting some money aside for their education, books and tuition, how about a 529B or some other better long term tax-deferred investment for that? If a daughter, her wedding? How about your retirement, or do they plan to have their (uneducated-due to lack of tuition funds) kids take care of them? And yes I know money can be made outside of college, but lets consider the MAJORITY of people. Pensions and Social Security are history, time to plan now...are they putting any aside for that? What about if a revenue generator in the house loses his job? Gets sick? How about if the car gets wrecked and you need another? Parents get ill? SOOOO many variables, so people stretch themselves paper-wafer-thin based on NOTHING bad EVER happening in the future. So the moment it does...POP...goes the REO, and the house is gone.

Case in point, my wife's receptionist at work...dating a man for five years, married for one, have 8 children between them, 7 from prior marriages. Guy decided to get a different wife. Both cars and house in his name even though they paid for all the upgrades together. They bought in the past few years, he can't make the payment without her income...he doesn't care...his solution? He just stopped paying it. He's going to let it go into foreclosure.

-

On to the next possibility...

B) Stagflation is the worst scenario, I believe. Our inflation rate is currently averaging around 4%. About half of that is normal inflation due to an expanding economy. The other half is from ridiculously high oil/energy prices. The trickle down DOES occur. For example, at this company, we have at least two vendors that I am aware of that charge us a new ENERGY SURPLUS fee in the tens of thousands of dollars for the raw material, basically aluminum that goes into the handrails you hold onto when you are on a treadmill. It costs THEM more to run the smelters, etc... to make the aluminum pipes because it costs them more to buy the fuel for the burners, so they pass that to us. This company takes that hit to the margin, directly. All fitness equipment companies being under the same pressure (all things being equal), they will all raise their prices to the market to make up the loss, which means more cost to Bally's to buy our machines...Bally's in turn will tweak their monthly membership rates to make up the hit to THEIR margin, say a few bucks a month, which comes out of YOUR pocket....so we get inflation. Now imagine the net effect of that on EVERYTHING....bread, milk, Taco Bell, DVD's, Ben & Jerry's....

The problem is, inflation driven by the economy is controllable, we just raise interest rates, the economy slows down, businesses stop borrowing money and expanding so they stop passing along their additional costs of doing so to the consumer. So, the Feds could just raise the interest rate to keep that in check. Unfortunately, raising interest rates here for the overnight loan rate don't do skippy to Saudi Arabia , Venezuela , etc... If we raise a rate here, the bank charges a company more to borrow, so they are less likely to borrow, situation controlled. But the price of oil is not moved one way or the other by rising interest rates here in the U.S. Therefore, the effect of raising interest rates will slow down our economy but NOT slow down inflation which is being mostly driven by the cost of oil which is an outside influencer. Luckily we are getting a respite in oil right now, but I don't know how long that will last. All major oil exporting countries are relatively at peace right now, no Hurricanes have taken out a major oil port, no dictator is doing a coup, no major pipelines or tankers are dumping into the ocean...relatively quiet. So we will see. Of course, I have an entire dissertation on the future of oil and the impact of energy on civilizations if you ever want to hear that...

I will make one point here however...all those countries that are net exporters of oil, that we buy from...what happens with all that money they make from the oil? Billions of dollars...well, they build roads and schools, companies start-up, cities expand, the standard of living starts to creep up...wonderful for them. They sell oil to us, make billions, and their country starts expanding. Guess what happens next? Well, once you start expanding from all that money...you start to consume more and more of your own oil to support that economic expansion. Eventually...you consume all of it. Eventually, you stop exporting and start importing. This is the future for most current exporters. Bad news for us.

So, at any rate, the net effect is an economy slowing down (due to rising interest rates) but without slowing inflation. So...less jobs, less/same pay, a little uncertainty, but with the cost of bread rising. Not good. At least in a recession the cost of things stay the same or go DOWN...so the average guy who is out of work, or looking for work, or on unemployment because of the recession is not paying MORE every month for the same loaf of bread while more and more jobs disappear from the market because of the recession.

-

C) Inflationary period. In my mind this is actually the best case scenario, but definitely just the lesser of three evils. For the reasons that create A) and B) it may be wise for the government to allow inflation to continue and but NOT continue to raise interest rates or at least be more moderate about it. In that way, the economy will continue to grow, business to expand, more jobs, higher pay through growth, etc... The upside is a couple things. First...let's say homes in a particular area are 20% overvalued. With inflation rising, let's assume home prices stay flat or decline only slightly...something the NAR loves to say. Well, let's say we achieve an inflation rate of 5%...then in four years, those houses are no longer overvalued. They are market. The inflation rate of 5% would force businesses to offer a minimum increase of 5% "cost-of-living" payroll increases every year, conceptually, so in four years they could afford that once over valued house. Additionally, the national debt should not be looked at as a number. It should be looked at as a percentage of GDP. Now anyone can argue that the percentage is too high or too low, and that's fine. Ultimately though, for our purposes, the point is that the percent of debt the country carries against the income the country generates will be lower as the income rises. So assume we stop or slow down our deficit spending, but the GDP keeps going up, then we have less debt than we had before as a percentage of income. It's just like an individual...if I have $20,000 a year in income (GDP per capita) with $10,000 on my credit cards (Deficit), I am in some serious trouble, but if my income goes up to $100,000, well then, that debt doesn't look so bad...if I wanted to, I could pay it off pretty quickly...in fact some might argue I could take on more debt if I wanted, but only with that new income. The government might let inflation do that for them...raise the national income to make the deficit, in relation, smaller.

The problem with this scenario is that there are a lot of "IF'S."

First, the housing bubble has to NOT burst. I for one am beyond believing that it won't. I think we are getting into some serious housing trouble here. Second, we have to assume that the inflation rate, driven by energy prices and any latent affect the past interest rate increases the government has done (it takes 1-2 years for an increase to trickle down) does not create an inflation rate higher than what we can absorb slowly over time....a drip feed is desirable so to speak. Third, we have to assume businesses will continue to grow and in so doing can afford the 5%+/- every year that employees would need to catch up to housing. Finally, we have to assume that those "animal spirits" don't catch fire and bring us down. But I think they just might. Word of this housing bubble is spreading, more and more homeowners are in denial about having to lower their prices. Someone will blink and the whole house of cards will start to tumble. By that I mean, Realtors and home owners are fond of looking at what their neighbor sold for...I've even read stories on realtors telling people to not lower their price, or groups of homeowner associations advising people who wish to sell to not offer lower than "x" percentage, or, in one case, someone was selling for quite a bit lower and the neighbors actually got upset and confronted them telling them they were going to pull the whole neighborhood value down. Anyway, the "blink" is inevitable because there are many times when someone HAS to sell, they simply have no choice. And in so doing, MUST come down to a fair market value. It will take several of those in a neighborhood to lower the "Average" value but once they start selling, at least the visibility is there and the leverage is there for home buyers to reference to.

Once that happens, buyers, who are already hanging out on the sidelines at halftime, will wait even LONGER, because nobody wants to buy on the downward slide. So buyers will attempt to "time" the market and buy on the bottom. THIS, in and of itself, creates a self-fulfilling prophecy that could drive home prices even lower than what they would normally be at with normal rates of appreciation. And why do I believe animal spirits will come into play? Because they are what drove the dot.com spike AND the crash (when everyone had an e-trade account and no stock was a loser and everyone had a "tip" and everyone's uncle knew a great new startup), and they are what drove this insane home price appreciation through the roof. Not shortage of land, not population increases, raw material costs...none of that did it...it was Mrs. Betty Homemaker on the 6:00pm news in front of a CBS camera crew writing an essay on why she wants to buy this home and what it means for her and her family to give to the seller who is entertaining 20 offers and can't decide since all of them are offering OVER her list value. True story. When the herd sees that on TV...the herd responds....and they all piled into the market, scrambling to buy houses like if they didn't get in now they would NEVER get in and they and their children would be destitute lowly renters for all eternity...it is THAT kind of clouded judgment and insanity that drove this thing. Now...for the clear minded...that take a minute to sit back and study the trends...the fundamentals...as in all chaos, there is opportunity.

-

So to FINALLY answer your question. Buy a house now if they...

• Can afford the monthly mortgage payment and still cover life's inevitabilities (kids, weddings, retirement, etc...)

• Do not use creative financing tools

• Love the house so much, is so happy with it, that ten years in it would be no problem

• Consider the meaning of my chart below

Otherwise, consider Plan B. Find somewhere to rent and invest the rest of the money in a mix of short and long term investments. Instead of paying 5-6% for the house, MAKE 5-6% on your money while you wait for the market to change. Right now, renting is cheaper than owning. Even with the tax breaks, in this SoCal and other over heated markets, renting is cheaper. Houses have the mortgage interest, property taxes, homeowners association dues, maintenance, higher utility bills, homeowner insurance premiums and of course all the ancillary "upgrades" you inevitably do like new cabinets, faucets, etc... Renting has none of that. In addition, you can move wherever your job or life takes you.

In addition, let’s take some real case scenarios. Columbus Homes is building a raft of new condos and houses on the Tustin Air Base. They have been averaging $700K+ for the cheapest ones. Recently, starting about two months ago, they began a ‘Summer of Love’ campaign. They are now offering $25K to $50K towards closing costs and upgrades. First, this is the FIRST thing realtors and sellers do…offer upgrades and freebies. It prevents that “blinking” where the average price in the neighborhood drops, but still entices buyers to get in. Ultimately, that is a price cut, I don’t care how anyone looks at it. The problem is, Dataquick and the agencies that report the housing market ignore “incentives” completely which skews the numbers in favor of the sellers. Hovnanian, Avenue One and 3 Chapman are both offering incentives, a $10,000 furniture package…another one is offering no HOA dues for a year. We visited some lofts in Long Beach ….they offered us 10% off the listed price, $5K towards furniture and $15K in upgrades for a second bathroom. NONE of that information is actually LISTED anywhere. So as far as the surveys and market watch companies are concerned, those lofts are the same price they have always been. In reality, since they were $700K, they have actually dropped $90K. Now….if we look back at the $25K that Columbus Homes is offering in closing and upgrades…that is 17 months of rent for me. So in two months, they have already paid 1.5 years of my rent if I were to buy now as opposed to having bought a few months ago before this promotion. At $90K, that’s FIVE YEARS of rent that I saved if I bought now as opposed to someone who bought six months ago or whenever before they were offering those incentives. So you can see..it doesn’t take much of a drop in price to recover whatever you lose in rent, not including what you are saving in renting versus all the costs of home ownership.

So consider renting, then you can take the time to study the market. For me, I drew a line in the sand since I am not going to try and time the market. I know what houses were going for five years ago and I know what they SHOULD be going for right now, and I want a 25%-35% drop in prices to feel that I am paying market. Of course, as a year or two go by, with inflation of 4%, that would be 21%-31%, etc... But eventually, the inflation rate and the depreciation rate will meet in the middle for the house I want. So figure out what you want exactly, beds and baths, cities, amenities, lot size, how old or new, etc...just think of a house you would be willing to live in for a long time. Figure out what the price of THAT house SHOULD be. Find out what it cost 10 years ago and do a 6.7% annual appreciation rate on it. That’s about what it should be now. Then wait. When the price comes close or into your range, then go find them and buy it. If it continues to depreciate the next morning, who cares? The point is, you now own a house you love, that is perfect for what you wanted at a "fair and reasonable" price and additional devaluing means nothing because it will eventually stop....turn around...and start to rise...and then start appreciating in short order.

I actually drew this chart below, I’ve had in my head for a long time so I wanted to kind of visualize it. Assume right now is position 1 on the curve. If you buy now, then over the course of 10 years the house will depreciate, bottom, recover, and eventually at position 9 start appreciating. Assume each position is a year, that would be 9 years. You need additional time in appreciation because you have to cover your closing costs, twice, the initial closing costs and ideally the new closing costs when you move as well as the realtor commissions so I assume ten years, but I could off by a few years either way. Additionally, I do not know when position 1 started…I assume we are at it right now, probably really started in Q106 perhaps even more like 1.5 right now. So you can see that the longer you wait from position 1 to 2 to 3 to 4…the less time you have to wait to realize an appreciation on the other side of the curve. For example, in position 4…..you will still have depreciation, but you only wait two years to “break-even” and start realizing some gains which would occur at position 6. So the top red line is someone buying now and the amount of time needed to get that investment back, and someone waiting a little, lower red line, and the time to get that investment back. Therefore, I am not suggesting anyone attempt to time the market, simply to know exactly what they want and buy it when it becomes a fair and reasonable price with my three bullet points above included in that consideration. And finally…consider a), b) and c) related to the economy.