Nation Getting More Mentally Unstable in 2017: Medication Sales to Soar!

Orange Idiot to Fiddle While Wall Street Burns...

Making America Broke Again: Trump & The Inevitable Financial Crisis

Trump can either ‘bite the bullet’ now if he really wants to improve the American economy or he can ‘kick the can down the road’ like his predecessors have, noted financial commentator Peter Schiff tells MintPress.

Barack Obama insisted throughout his time in office that the financial crisis that began in 2008 and fundamentally altered the U.S. economic landscape was a thing of the past. Despite Obama’s insistence that his economic “recovery” was successful and that critics of his economic policy were “peddling fiction,” many Americans were not convinced.

Donald Trump recognized this, and was ultimately propelled to the nation’s highest office due to his oft-repeated promise to “Make America Great Again” with a special emphasis on bolstering the American economy.

In the weeks since Trump took office, media attention has largely focused on the so-called “Muslim ban” as well as other executive actions targeting immigrants, limiting the actions of certain federal agencies, and escalating certain geopolitical tensions.

The media’s focus on these and other issues has allowed key developments in the implementation of the president’s economic policy to go largely unnoticed. In particular, there’s been relatively scant attention paid to the Trump administration’s decision to order a thorough review of banking regulations with the express intention of loosening them.

This decision, widely criticized by powerful central banks and proponents of Obama-era financial reform, represents the latest iteration of a growing spat between the financial establishment and the Trump administration. Each side accuses the other of depressing economic growth and increasing the likelihood of a major economic event or “correction” that would dwarf that of 2008.

Yet, as is often the case in such disputes, the truth of the matter lies somewhere in the middle and ultimately has relatively little to do with Trump.

Peter Schiff, CEO of Euro Pacific Capital and one of the few financial commentators to accurately predict the 2008 crisis, noted in an interview with MintPress News, “The crisis is going to come regardless of the actions Trump or Congress may take. I think [Trump’s potential loosening of regulations] is going to be irrelevant. It could accelerate the crisis or it could delay it.”

Regardless of who is to blame, however, there is no denying that a major economic crisis is once again on the horizon, one that will fundamentally change the economic landscape of the nation and trigger a series of wide-reaching consequences.

“The crisis is inevitable,” Schiff said.

Watch The Coming Crisis - A MintPress News Explainer:

Trump vs. the financial establishment

Trump has long made his disdain for the Dodd-Frank Wall Street Reform and Consumer Protection Act public knowledge, recently announcing his intentions to “do a number” on the bill and promising to loosen a large part of the restrictions it put into place. Immediately, members of the neoliberal political and financial establishment lashed out, arguing that Trump’s potential deregulation will directly cause another financial crisis.

Reuters reported that Mario Draghi, president of the European Central Bank and former vice chairman and managing director of Goldman Sachs International, argued during a Feb. 6 press conference that easing banking rules and regulations was not just troublesome but dangerous. He warned that doing so threatens the global economy’s “slow but steady recovery” from the 2008 crisis.

Draghi’s concerns were echoed by other prominent bankers in Europe, including Andreas Dombret, a board member of Germany’s powerful central bank, Bundesbank, who said that weakening or removing regulations would be a “big mistake” that would create a new economic crisis.

Major media outlets have followed this narrative with headlines like “How Donald Trump could create a financial crisis,” “Is President Trump about to unleash another financial crisis?” and “Why Donald Trump’s financial policy could recreate a 2008 crisis scenario.” These reports similarly point to Trump’s plan to lift or weaken Dodd-Frank regulations as a likely instigator of a coming crisis. Even Barney Frank, one of the bill’s co-authors, has said as much.

Yet Trump and his advisors hold a starkly different view of the situation, arguing that Dodd-Frank’s regulations are holding the economy back - a fact that Frank admitted last year when he called key elements of the bill “mistakes.”

While Trump’s plan to loosen regulations has been labeled a catalyst for another financial crisis, the Trump administration has taken to blaming central banks and their manipulation of interest rates and the money supply as major factors leading to economic instability. In addition, Trump’s chief trade advisor, Peter Navarro, recently accused Germany of currency manipulation, arguing that the country uses the euro to “exploit” the United States and European Union. He told the Financial Times that Germany’s trade surplus was due to the nation’s exploitation of the euro being “grossly undervalued.” Draghi, during his most recent press conference, rejected these claims outright, saying, “We are not currency manipulators.”

Aside from the partisan rhetoric, there remains little doubt on either side that another massive financial crisis is on the horizon. For instance, James Rickards, an economist who advises the Department of Defense and U.S. intelligence community, told MarketWatch: ”[T]he crisis is coming and the time to prepare is now. It could happen in 2018, 2019, or it could happen tomorrow. The conditions for collapse are all in place.”

Other big names in economics, such as Martin Wolf of the Financial Times, have voiced similar concerns, arguing that another financial crisis is “inevitable.”

Even Alan Greenspan, the former chairman of the Federal Reserve, warned in 2009 that “the [2008] crisis will happen again but it will be different.” Trump himself expressed these same concerns in an interview with the conservative news site Newsmax in 2011, telling Americans to prepare for “financial ruin” resulting from the massive national debt and overall weak economy.

With such a massive crisis looming, it’s clear that Dodd-Frank, at the very least, has fallen quite short of its stated mission of preventing another economic calamity. This leads to an important question: What has brought us to this point - the weakness of Dodd-Frank or the policy of central banks?

The failures of Dodd-Frank

In the aftermath of the 2008 crisis, public outrage and anger at the country’s financial sector was palpable. In order to temper public sentiment, a massive piece of legislation known as the Dodd-Frank Wall Street Reform and Consumer Protection Act was assembled with the stated goal of minimizing risk in the U.S. financial system chiefly through the creation of new regulatory agencies and the establishment of certain consumer protections. While the current consensus holds that Dodd-Frank made some individual institutions technically safer due to the constraints it imposes, it is still widely regarded as an imperfect piece of legislation.

Indeed, prior to taking office, Trump joined a host of other conservative politicians in slamming the landmark legislation, which he has recently deemed a “disaster.”

The evidence regarding the legislation’s ultimate impact paints anything but a rosy picture. Despite Dodd-Frank’s well-stated intentions, things have not gone according to plan. The legislation actually has produced very few - if any - meaningful regulations, as the agencies tasked with drafting new regulations quickly became the focus of massive financial industry lobbying efforts. For example, three years after Dodd-Frank’s passage, commercial banking lobbyists had met with Dodd-Frank regulatory agencies 901 times, compared to just 116 meetings with lobbyists of consumer protection groups.

Nearly seven years after Dodd-Frank was passed, massive loopholes remain in derivatives trading, banks are still permitted to gamble with FDIC-insured money, and credit-rating agencies have yet to be reformed.

Further, in the years since the bill’s passage in 2010, the top five “too big to fail” banks continue to control the same share of U.S. banking assets they possessed prior to the crisis, while smaller banks and community banks suffered major losses, with some small banks losing as much as 20 percent of their share of national banking assets.

These smaller banks, which have great historical economic importance, essentially lost any competitive advantage to the nation’s banking behemoths. This is a concerning development, particularly because the big banks who largely caused the crisis suffered few ill effects while their smaller competition - who were largely uninvolved in derivatives trading and other activities that contributed to the crisis - has taken a major hit. A 2015 study conducted at the Harvard Kennedy School of Government confirmed this, finding that community banks had been absolutely crushed by Dodd-Frank regulations which caused the decrease in their markets shares to double.

To make matters worse, many of the “too big to fail” banks have ballooned in size since the passage of Dodd-Frank. For instance, in 2013, the country’s six largest banks owned an astounding 67 percent of all assets of the U.S. financial system, a 37 percent increase from 2008.

Many critics of Dodd-Frank, Trump included, have argued that the legislation was doomed to fail from the beginning. Indeed, the corruption scandals surrounding one of the bill’s co-authors suggest that this could be the case. Barney Frank, a former congressman from Massachusetts and chairman of the House Financial Services Committee, was embroiled in several notable financial scandals during his three decades in office, including some that took place during the 2008 financial crisis.

Prior to the crash, internal government documents obtained by government watchdog Judicial Watch showed that Frank was well aware that troubled lenders Fannie Mae and Freddie Mac were likely to fail, but did nothing to stop it. In addition, internal Treasury Department documents revealed that Frank sought to steer $12 million in federal bailout funds to OneUnited Bank, a bank located in Frank’s district, during the aftermath of the 2008 crisis. In 2015, Frank further cemented his shady ties to the financial sector by joining the board of Signature, a private bank with assets totalling $28.6 billion.

However, the true reason for Dodd-Frank’s failure is neither the corruption of one of its authors nor the weak and convoluted nature of the regulations it enforces. Dodd-Frank, whether it is ultimately repealed by the new administration or left largely intact, has failed to produce a recovery or prevent a future crisis because it ignores the true cause of the 2008 meltdown as well as that of the looming financial crisis: over a century of misguided and self-serving central bank policy.

As Schiff remarked when speaking to MintPress, “The Federal Reserve is the culprit.”

The real roots of the coming crisis: The Fed

After the economic crisis in 2008, central bankers made it a point to blame everything but their own policies, largely focusing their critiques on financial deregulation as the primary cause. While deregulation was certainly a factor that allowed the crisis to unfold, it was the monetary policy of the Federal Reserve that formed the underlying structural cause of the crisis.

In 2001, following the bursting of the “dotcom” bubble, the Fed lowered the federal funds rate a total of 11 times, creating a flood of liquidity in the markets. This liquidity, sometimes referred to as “cheap” money, spurred the flow of capital into high-yielding “subprime” mortgage loans. Soon after, a real estate bubble was born. As the Fed continued to slash interest rates, this bubble swelled to massive proportions and “cheap” loans were then repackaged into collateralized debt obligations. This development allowed major banks, including the now defunct Lehman Brothers and Bear Stearns, to leverage between 30-40 times their initial investment.

Everything seemed great for a time - that is, until homeownership reached a saturation point and the Fed decided to rapidly raise interest rates from a four-decade low of 1 percent in June of 2003 to 5.25 percent in June of 2006. These higher interest rates drastically changed the amount homeowners were paying on their mortgages, causing many to default - a contagion that would soon spread through financial markets and precipitate the crisis.

Despite the clear role of the Fed, many were taken by surprise when the economic crisis unfolded. However, some economists saw it coming, particularly those who were critical of central banking policy. As Libertarian organizer and activist Matt Kibbe noted in Forbes in 2011, a handful of well-known investment bankers and financial commentators associated with the Austrian school of Economics, including Jim Rogers, Peter Schiff, and James Grant, were among the few who predicted the crisis.

The difference between these individuals and those who were caught unaware was a focus on the analysis of the effect of human action on markets instead of Keynesian mathematical models, which focus on total spending in the economy and how that impacts economic output and inflation.

Central to the approach focusing on human action is the realization that the policies of the Fed create boom and bust cycles, or “bubbles,” by distorting information regarding price signals. Banks may have seemed like they were over-investing, but they were actually just responding to the Fed’s false signals.

“Private banks take their marching orders from the Fed,” Schiff told MintPress. “If you took the Fed out of the equation, then these banks would not behave in the manner that they do.”

While the Fed’s role in 2008 is now evident, nothing has been done to prevent central bank manipulation from causing yet another crisis. In the years since the 2008 crisis, the Fed has taken its manipulation of the dollar and interest rates to new extremes. Like it did between 2001 and 2007, the Fed has expanded the money supply and kept interest rates at historic lows since the 2008 crisis, again making “cheap” money to fuel markets. However, as 2008 taught Americans, “cheap” money can only remain so for so long until the bubble bursts. Unlike 2008, however, the stakes are now much, much higher.

The Fed’s money printing stimulus following the 2008 crisis, known as quantitative easing, or QE, has added an unprecedented $3 trillion to the money supply. While that money was meant to stimulate the American economy, it ultimately has gone to inflating stock markets. Additionally, interest rates are at historic lows, and the Fed is hesitant to hike them despite the necessity of doing so, chiefly because - like 2008 - raising the interest rates will ultimately cause the bubble to burst. Considering the “too big to fail” banks are now much larger than they were in 2008, the conditions are set for a perfect storm.

And when that inevitable storm hits, Schiff noted that central bankers are likely to respond to the next crisis much as they did in 2008. He explained:

“[Central bankers] will certainly take the opportunity to blame Trump. They are going to blame it on the deregulation, which is what they did last time. It was an abundance of liquidity that caused that last crisis - that’s what created 2008 crisis. What the Fed has been doing since then has actually laid the foundation for the next crisis.”

No Easy Way Out: Trump’s role in the impending crash

With the roots of the next crisis established prior to Trump’s assumption of the presidency, combined with the ineffectiveness of post-2008 regulations, the Trump administration faces an uphill battle - especially if the next crisis takes place during the next four years. All of the news coverage and comments from prominent figures in the financial establishment once again seem to be shifting the blame from central bank policy to Trump’s review of banking regulations, suggesting that the financial elite’s scapegoat for the next crisis has already been selected.

Schiff said the financial establishment “will try to pretend that everything else was great under Obama and then act like Trump ruined it.”

This isn’t to say that Trump’s potential removal of banking regulations won’t exacerbate or speed up the onset of the coming crisis. James Rickards told MarketWatch it’s likely that a crisis can only be prevented by reinstating the Glass-Steagall Act, which separated investment and commercial banking, breaking up the big banks, banning most derivatives, and enacting tougher law enforcement of bank wrongdoing. But considering the makeup of his Cabinet and team of economic advisors, Trump is unlikely to push for any of these changes.

Writing for the Libertarian Institute in November, Eric Schuler noted, “The next recession is likely to commence during Trump’s tenure. But while he may prove to be an unwitting catalyst of the next crisis, his policies will not be the primary cause.”

Instead, Trump is more likely to focus on loosening existing banking regulations than imposing any new ones. Though they do not account for the root cause of the crisis, the president’s actions in this regard could potentially accelerate the bursting of the bubble. However, this is difficult to gauge due to the fact that this new, looming crisis is long overdue.

Trump is ultimately faced with no easy choices. He can either allow the Fed to further inflate the bubble or he can try to bring about a market correction by forcing interest rates to increase in order to establish the foundations for positive economic growth. Both possibilities promise to bring unemployment and economic difficulties for the average American - particularly in the short term. Regardless of how Trump proceeds, he is likely to encounter major conflicts in fulfilling his campaign promise to “Make America Great Again,” as any major economic downturn could potentially lead to widespread, popular unrest throughout the nation.

Trump can either “bite the bullet” now if he really wants to improve the American economy, Schiff said, or he can “kick the can down the road” like his predecessors have.

Even if Trump chooses to delay the inevitable, the next crisis, already long delayed, is increasingly likely to unfold regardless of any action the president may take. And that crisis is likely to define his presidency.

Making America Broke Again: Trump & The Inevitable Financial Crisis

Americans Just Broke the Psychologists’ Stress Record

A national survey of anxiety finds a statistically significant increase for the first time since it was launched in 2007.

If misery loves company, it should be thrilled: Americans left and right are under so much stress it's now registering on the American Psychological Association's anxiety meter.

For 10 years, the APA has been running its "Stress in America" survey, usually finding that stress is caused by three primary factors-money, work, and the economy. Those factors clearly play a role in the current national mood. Younger Americans are worried about college debt, older ones about retirement, and everyone, it seems, about the economic prospects of the next generation. In the study, respondents with incomes below $50,000 reported higher stress levels than those with higher incomes.

Still, over the course of the decade, the psychologists found that stress in American life, on the whole, has been gradually decreasing.

Then came the election. The APA's members were picking up the campaign as a new stressor in their patients. The group added some election-related questions to its annual poll, conducted in August, and released the results in October. The findings: At 52 percent, more than half of Americans, both Democrats and Republicans, were anxious about the vote.

So last month, just before President Donald Trump's inauguration, the APA conducted an additional poll to check on the nation's mental health. The picture isn't pretty.

"The results of the January 2017 poll show a statistically significant increase in stress for the first time since the survey was first conducted in 2007," the APA said on Wednesday in a report on the survey of 1,019 adults living in the U.S., conducted from Jan. 5 to Jan. 19 by Harris Poll.

Americans' stress levels in January were worse than in August, in the middle of the angriest, most personal campaign in recent memory, when some believed the anxiety would abate after the election. At 57 percent, more than half of respondents said the current political climate was a very or somewhat significant source of stress. Stressors for everyone, including Republicans, were the fast pace of unfolding events and especially the uncertainty of the current political climate, said Vaile Wright, director of research and special projects at the APA.

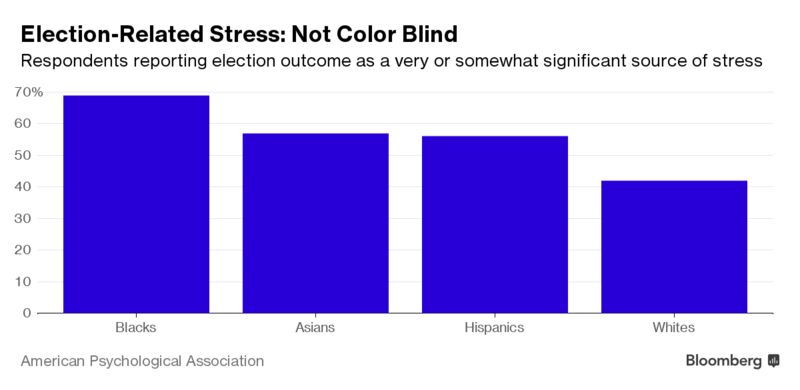

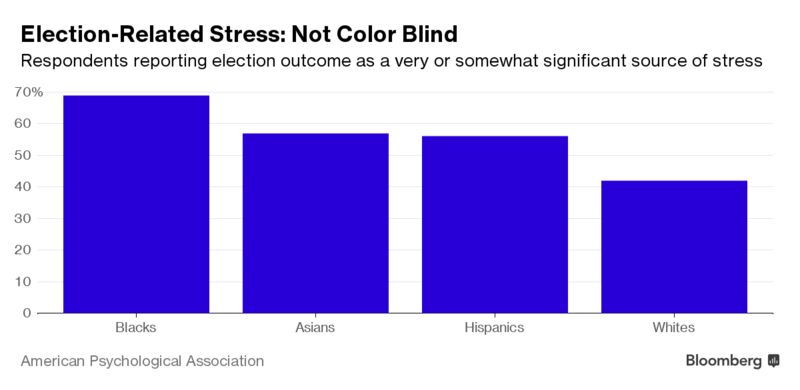

Many of the demographics break down along predictable lines:

But the stress is broader than race or party alone can describe. A full two-thirds of respondents to the survey said they are stressed out about the nation's future, and while that includes 76 percent of Democrats, it reflects the feelings of 59 percent of Republicans as well.

"I don't think it can be just be boiled down to the side that won vs. the side that didn't," Wright said. "There is something going on across the aisle."

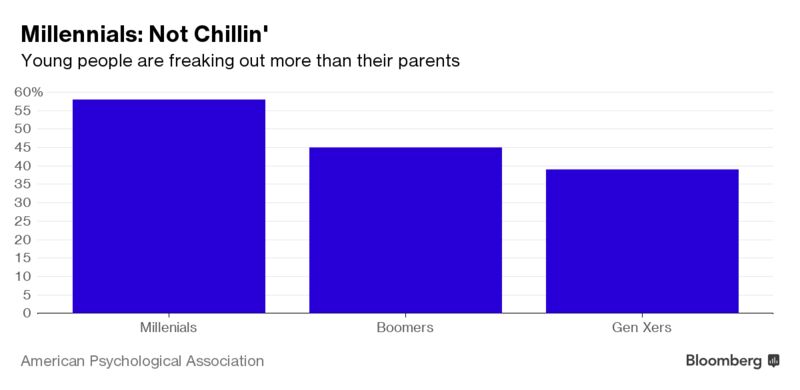

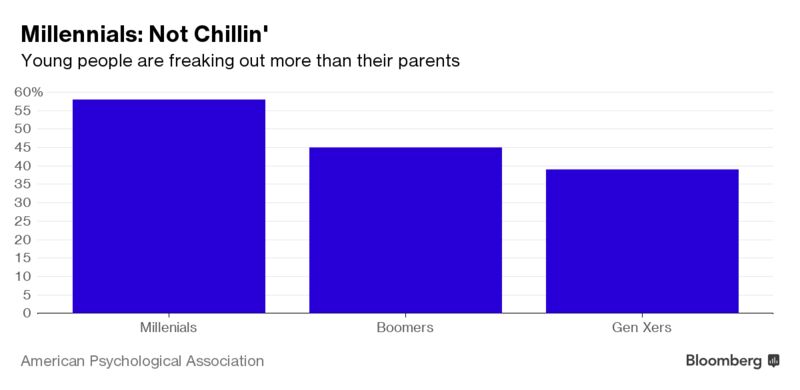

As for age, millennials reported more stress than their parents or grandparents. No surprise there-they strongly preferred the Democratic candidate, Hillary Clinton.

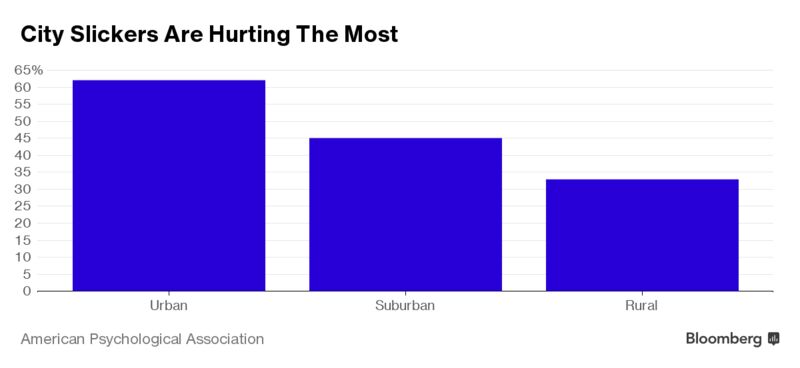

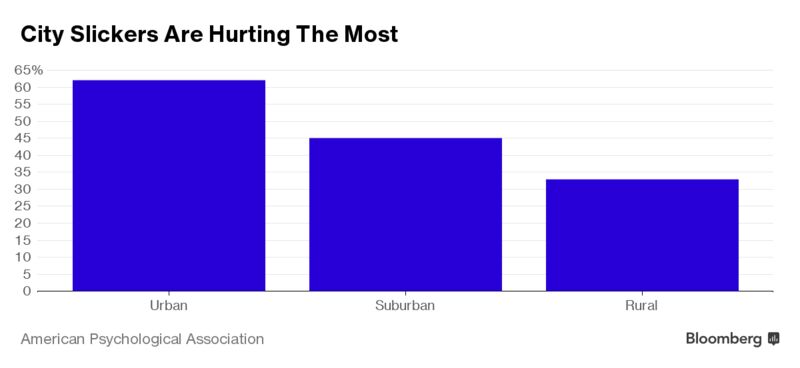

Urban dwellers are doing significantly worse than their suburban and rural counterparts. That makes sense, Wright noted, given the strong support President Trump enjoyed as a candidate outside big cities.

Education matters, too, and maybe not the way you would imagine: 53 percent of those with more than a high school education report the election outcome as a very or somewhat significant source of stress, compared with 38 percent of those with just high school or less. While this again correlates with voter preferences, it's also somewhat surprising, because higher education levels generally translate into more job opportunities.

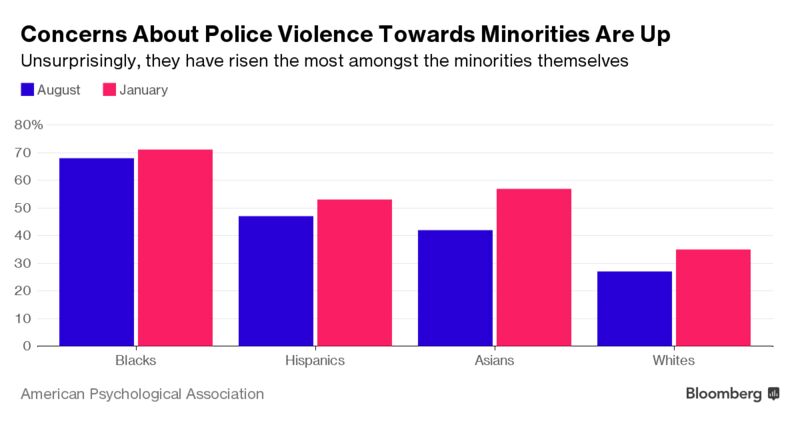

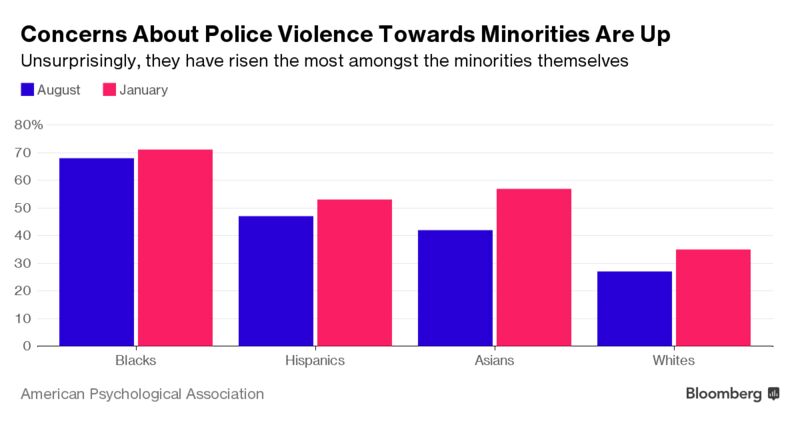

The report also notes the rise of personal safety as a concern among its respondents, 34 percent of whom are worried about it, the highest level since 2008, when it was 31 percent. In 2014, stress over personal safety had dipped to its lowest level, 23 percent. More than half the country is worried about terrorism: some 59 percent, up from the August poll's finding of 51 percent and significantly higher than the 10-year average of 34 percent. And nearly half the respondents reported stress related to police violence against minorities-44 percent, up from August's 36 percent-with the breakdown along racial lines.

These worries aren't necessarily tied to what's actually unfolding on the ground. Violent crime, for example, was up in 2015 from 2014 but down from 2011, when fewer people were worried about it.

Stress, however, is not always about reality.

"Whether we're actually in more danger or we just believe we could be doesn't matter," Wright said. "Perception drives behavior."

Americans Just Broke the Psychologists’ Stress Record

Rich People Literally See the World Differently

The way you view the world depends on the culture you come from - in a granular, second-by-second sense. If you present a Westerner and an East Asian with the same visual scene, for instance, the former is more likely to focus on individual objects, and the latter will likely take in more of the scene as a whole. East Asians are more holistic in their thinking, the research indicates; Westerners are more analytic.

The same thing is happening with people who are from the same country, but belong to different social classes. With America’s top one percent of earners earning 81 times the average of the bottom 50 percent, the research shows how the wealthy and the working classes really do live in different cultures, and thus see the world in different ways.

One of the most powerful examples comes from Michael Varnum, a neuroscientist at Arizona State University. In a 2015 paper on empathy, he and his colleagues recruited 58 participants for a brain-imaging study: First, the participants filled out a self-report on their social class (level of parents’ education, family income, and the like) before sitting down for an EEG session. In the brain-imaging task, participants were shown neutral and pained faces while they were told to look for something else (the faces were a “distractor,” in the psych argot, so hopefully the participants wouldn’t know they were being tested for empathy).

In something of a dark irony, the respondents of higher socioeconomic status rated themselves as more empathic - a “better-than-average effect” that Varnum followed up on in a separate study - when in reality the opposite was true. The results “show that people who are higher in socioeconomic status have diminished neural responses to others’ pain,” the authors write. “These findings suggest that empathy, at least some early component of it, is reduced among those who are higher in status.” And unlike self-reports, brain imaging sidesteps “social desirability bias,” where people want to give replies that make them look good or more empathic. “If you’re looking at pictures of people in pain or not in pain, it’s pretty unlikely that you know how to enhance those brain responses,” Varnum tells Science of Us. Moreover, in a 2016 study, Varnum and colleagues found evidence suggesting that people from lower social classes have a more sensitive mirror neuron system - which is thought to simulate the things you see others experience - when watching a video of hand movements. “Our cognitive systems, the degree to which they’re attuned to other people in the environment, is affected by our own social class,” he says.

Another study, out last October in Psychological Science, further shows how attention breaks down along class lines. A research team lead by NYU doctoral candidate Pia Dietze measured participants’ attunement to people or things in three different experiments. In the first, they stopped 61 people on New York City streets, and asked them to put on a Google Glass device and walk around one block for about a minute, looking at whatever captured their gaze - with higher-class participants having reliably shorter “social gazes,” or the amount of time dwelling at each individual person. In a second experiment, a total of 158 undergrads were recruited to look at 41 photographs of different cities. Here, working-class participants had a 25 percent longer dwell time, on average, than upper-middle-class peers. In a third experiment, almost 400 participants recruited online had to determine if icons depicting people or objects changed in the course of milliseconds - and consistent with the other results, working-class people were faster in catching changes in faces than upper-middle-class participants. Together, the results show “social class cultures can influence social attention (attention towards human) in a deep and pervasive manner,” Dietze says. Your class shapes the “ecology” that you grow up in, and that anchors your habits of attention.

There are multiple interpretations for why lower-class people are more attuned to people around them. It may be that growing up poorer means that you have to rely on others more; it may also mean that you live in a less-secure environment, so you need to attend to others to keep yourself safe. Varnum and Dietze presented at this year’s meeting of Society for Personality and Social Psychology, where I met them, and Varnum says that each study speaks to a broader notion of how higher-status people are more focused on their own goals and desires. They also ignore people a little more, maybe because they can afford to. “If you have more power and status, you may not have to care as much about what people are thinking and feeling; and also, if you’re in a resource-scarce environment, where things are a little more unpredictable and maybe a little more dangerous, it would be very adaptive to pay attention to others, how they’re feeling and what they’re going to do,” he says. In many ways, privilege is invisible; it also shapes what’s visible to us.

Rich People Literally See the World Differently

Making America Broke Again: Trump & The Inevitable Financial Crisis

Trump can either ‘bite the bullet’ now if he really wants to improve the American economy or he can ‘kick the can down the road’ like his predecessors have, noted financial commentator Peter Schiff tells MintPress.

Barack Obama insisted throughout his time in office that the financial crisis that began in 2008 and fundamentally altered the U.S. economic landscape was a thing of the past. Despite Obama’s insistence that his economic “recovery” was successful and that critics of his economic policy were “peddling fiction,” many Americans were not convinced.

Donald Trump recognized this, and was ultimately propelled to the nation’s highest office due to his oft-repeated promise to “Make America Great Again” with a special emphasis on bolstering the American economy.

In the weeks since Trump took office, media attention has largely focused on the so-called “Muslim ban” as well as other executive actions targeting immigrants, limiting the actions of certain federal agencies, and escalating certain geopolitical tensions.

The media’s focus on these and other issues has allowed key developments in the implementation of the president’s economic policy to go largely unnoticed. In particular, there’s been relatively scant attention paid to the Trump administration’s decision to order a thorough review of banking regulations with the express intention of loosening them.

This decision, widely criticized by powerful central banks and proponents of Obama-era financial reform, represents the latest iteration of a growing spat between the financial establishment and the Trump administration. Each side accuses the other of depressing economic growth and increasing the likelihood of a major economic event or “correction” that would dwarf that of 2008.

Yet, as is often the case in such disputes, the truth of the matter lies somewhere in the middle and ultimately has relatively little to do with Trump.

Peter Schiff, CEO of Euro Pacific Capital and one of the few financial commentators to accurately predict the 2008 crisis, noted in an interview with MintPress News, “The crisis is going to come regardless of the actions Trump or Congress may take. I think [Trump’s potential loosening of regulations] is going to be irrelevant. It could accelerate the crisis or it could delay it.”

Regardless of who is to blame, however, there is no denying that a major economic crisis is once again on the horizon, one that will fundamentally change the economic landscape of the nation and trigger a series of wide-reaching consequences.

“The crisis is inevitable,” Schiff said.

Watch The Coming Crisis - A MintPress News Explainer:

Trump vs. the financial establishment

Trump has long made his disdain for the Dodd-Frank Wall Street Reform and Consumer Protection Act public knowledge, recently announcing his intentions to “do a number” on the bill and promising to loosen a large part of the restrictions it put into place. Immediately, members of the neoliberal political and financial establishment lashed out, arguing that Trump’s potential deregulation will directly cause another financial crisis.

Reuters reported that Mario Draghi, president of the European Central Bank and former vice chairman and managing director of Goldman Sachs International, argued during a Feb. 6 press conference that easing banking rules and regulations was not just troublesome but dangerous. He warned that doing so threatens the global economy’s “slow but steady recovery” from the 2008 crisis.

Draghi’s concerns were echoed by other prominent bankers in Europe, including Andreas Dombret, a board member of Germany’s powerful central bank, Bundesbank, who said that weakening or removing regulations would be a “big mistake” that would create a new economic crisis.

Major media outlets have followed this narrative with headlines like “How Donald Trump could create a financial crisis,” “Is President Trump about to unleash another financial crisis?” and “Why Donald Trump’s financial policy could recreate a 2008 crisis scenario.” These reports similarly point to Trump’s plan to lift or weaken Dodd-Frank regulations as a likely instigator of a coming crisis. Even Barney Frank, one of the bill’s co-authors, has said as much.

Yet Trump and his advisors hold a starkly different view of the situation, arguing that Dodd-Frank’s regulations are holding the economy back - a fact that Frank admitted last year when he called key elements of the bill “mistakes.”

While Trump’s plan to loosen regulations has been labeled a catalyst for another financial crisis, the Trump administration has taken to blaming central banks and their manipulation of interest rates and the money supply as major factors leading to economic instability. In addition, Trump’s chief trade advisor, Peter Navarro, recently accused Germany of currency manipulation, arguing that the country uses the euro to “exploit” the United States and European Union. He told the Financial Times that Germany’s trade surplus was due to the nation’s exploitation of the euro being “grossly undervalued.” Draghi, during his most recent press conference, rejected these claims outright, saying, “We are not currency manipulators.”

Aside from the partisan rhetoric, there remains little doubt on either side that another massive financial crisis is on the horizon. For instance, James Rickards, an economist who advises the Department of Defense and U.S. intelligence community, told MarketWatch: ”[T]he crisis is coming and the time to prepare is now. It could happen in 2018, 2019, or it could happen tomorrow. The conditions for collapse are all in place.”

Other big names in economics, such as Martin Wolf of the Financial Times, have voiced similar concerns, arguing that another financial crisis is “inevitable.”

Even Alan Greenspan, the former chairman of the Federal Reserve, warned in 2009 that “the [2008] crisis will happen again but it will be different.” Trump himself expressed these same concerns in an interview with the conservative news site Newsmax in 2011, telling Americans to prepare for “financial ruin” resulting from the massive national debt and overall weak economy.

With such a massive crisis looming, it’s clear that Dodd-Frank, at the very least, has fallen quite short of its stated mission of preventing another economic calamity. This leads to an important question: What has brought us to this point - the weakness of Dodd-Frank or the policy of central banks?

The failures of Dodd-Frank

In the aftermath of the 2008 crisis, public outrage and anger at the country’s financial sector was palpable. In order to temper public sentiment, a massive piece of legislation known as the Dodd-Frank Wall Street Reform and Consumer Protection Act was assembled with the stated goal of minimizing risk in the U.S. financial system chiefly through the creation of new regulatory agencies and the establishment of certain consumer protections. While the current consensus holds that Dodd-Frank made some individual institutions technically safer due to the constraints it imposes, it is still widely regarded as an imperfect piece of legislation.

Indeed, prior to taking office, Trump joined a host of other conservative politicians in slamming the landmark legislation, which he has recently deemed a “disaster.”

The evidence regarding the legislation’s ultimate impact paints anything but a rosy picture. Despite Dodd-Frank’s well-stated intentions, things have not gone according to plan. The legislation actually has produced very few - if any - meaningful regulations, as the agencies tasked with drafting new regulations quickly became the focus of massive financial industry lobbying efforts. For example, three years after Dodd-Frank’s passage, commercial banking lobbyists had met with Dodd-Frank regulatory agencies 901 times, compared to just 116 meetings with lobbyists of consumer protection groups.

Nearly seven years after Dodd-Frank was passed, massive loopholes remain in derivatives trading, banks are still permitted to gamble with FDIC-insured money, and credit-rating agencies have yet to be reformed.

Further, in the years since the bill’s passage in 2010, the top five “too big to fail” banks continue to control the same share of U.S. banking assets they possessed prior to the crisis, while smaller banks and community banks suffered major losses, with some small banks losing as much as 20 percent of their share of national banking assets.

These smaller banks, which have great historical economic importance, essentially lost any competitive advantage to the nation’s banking behemoths. This is a concerning development, particularly because the big banks who largely caused the crisis suffered few ill effects while their smaller competition - who were largely uninvolved in derivatives trading and other activities that contributed to the crisis - has taken a major hit. A 2015 study conducted at the Harvard Kennedy School of Government confirmed this, finding that community banks had been absolutely crushed by Dodd-Frank regulations which caused the decrease in their markets shares to double.

To make matters worse, many of the “too big to fail” banks have ballooned in size since the passage of Dodd-Frank. For instance, in 2013, the country’s six largest banks owned an astounding 67 percent of all assets of the U.S. financial system, a 37 percent increase from 2008.

Many critics of Dodd-Frank, Trump included, have argued that the legislation was doomed to fail from the beginning. Indeed, the corruption scandals surrounding one of the bill’s co-authors suggest that this could be the case. Barney Frank, a former congressman from Massachusetts and chairman of the House Financial Services Committee, was embroiled in several notable financial scandals during his three decades in office, including some that took place during the 2008 financial crisis.

Prior to the crash, internal government documents obtained by government watchdog Judicial Watch showed that Frank was well aware that troubled lenders Fannie Mae and Freddie Mac were likely to fail, but did nothing to stop it. In addition, internal Treasury Department documents revealed that Frank sought to steer $12 million in federal bailout funds to OneUnited Bank, a bank located in Frank’s district, during the aftermath of the 2008 crisis. In 2015, Frank further cemented his shady ties to the financial sector by joining the board of Signature, a private bank with assets totalling $28.6 billion.

However, the true reason for Dodd-Frank’s failure is neither the corruption of one of its authors nor the weak and convoluted nature of the regulations it enforces. Dodd-Frank, whether it is ultimately repealed by the new administration or left largely intact, has failed to produce a recovery or prevent a future crisis because it ignores the true cause of the 2008 meltdown as well as that of the looming financial crisis: over a century of misguided and self-serving central bank policy.

As Schiff remarked when speaking to MintPress, “The Federal Reserve is the culprit.”

The real roots of the coming crisis: The Fed

After the economic crisis in 2008, central bankers made it a point to blame everything but their own policies, largely focusing their critiques on financial deregulation as the primary cause. While deregulation was certainly a factor that allowed the crisis to unfold, it was the monetary policy of the Federal Reserve that formed the underlying structural cause of the crisis.

In 2001, following the bursting of the “dotcom” bubble, the Fed lowered the federal funds rate a total of 11 times, creating a flood of liquidity in the markets. This liquidity, sometimes referred to as “cheap” money, spurred the flow of capital into high-yielding “subprime” mortgage loans. Soon after, a real estate bubble was born. As the Fed continued to slash interest rates, this bubble swelled to massive proportions and “cheap” loans were then repackaged into collateralized debt obligations. This development allowed major banks, including the now defunct Lehman Brothers and Bear Stearns, to leverage between 30-40 times their initial investment.

Everything seemed great for a time - that is, until homeownership reached a saturation point and the Fed decided to rapidly raise interest rates from a four-decade low of 1 percent in June of 2003 to 5.25 percent in June of 2006. These higher interest rates drastically changed the amount homeowners were paying on their mortgages, causing many to default - a contagion that would soon spread through financial markets and precipitate the crisis.

Despite the clear role of the Fed, many were taken by surprise when the economic crisis unfolded. However, some economists saw it coming, particularly those who were critical of central banking policy. As Libertarian organizer and activist Matt Kibbe noted in Forbes in 2011, a handful of well-known investment bankers and financial commentators associated with the Austrian school of Economics, including Jim Rogers, Peter Schiff, and James Grant, were among the few who predicted the crisis.

The difference between these individuals and those who were caught unaware was a focus on the analysis of the effect of human action on markets instead of Keynesian mathematical models, which focus on total spending in the economy and how that impacts economic output and inflation.

Central to the approach focusing on human action is the realization that the policies of the Fed create boom and bust cycles, or “bubbles,” by distorting information regarding price signals. Banks may have seemed like they were over-investing, but they were actually just responding to the Fed’s false signals.

“Private banks take their marching orders from the Fed,” Schiff told MintPress. “If you took the Fed out of the equation, then these banks would not behave in the manner that they do.”

While the Fed’s role in 2008 is now evident, nothing has been done to prevent central bank manipulation from causing yet another crisis. In the years since the 2008 crisis, the Fed has taken its manipulation of the dollar and interest rates to new extremes. Like it did between 2001 and 2007, the Fed has expanded the money supply and kept interest rates at historic lows since the 2008 crisis, again making “cheap” money to fuel markets. However, as 2008 taught Americans, “cheap” money can only remain so for so long until the bubble bursts. Unlike 2008, however, the stakes are now much, much higher.

The Fed’s money printing stimulus following the 2008 crisis, known as quantitative easing, or QE, has added an unprecedented $3 trillion to the money supply. While that money was meant to stimulate the American economy, it ultimately has gone to inflating stock markets. Additionally, interest rates are at historic lows, and the Fed is hesitant to hike them despite the necessity of doing so, chiefly because - like 2008 - raising the interest rates will ultimately cause the bubble to burst. Considering the “too big to fail” banks are now much larger than they were in 2008, the conditions are set for a perfect storm.

And when that inevitable storm hits, Schiff noted that central bankers are likely to respond to the next crisis much as they did in 2008. He explained:

“[Central bankers] will certainly take the opportunity to blame Trump. They are going to blame it on the deregulation, which is what they did last time. It was an abundance of liquidity that caused that last crisis - that’s what created 2008 crisis. What the Fed has been doing since then has actually laid the foundation for the next crisis.”

No Easy Way Out: Trump’s role in the impending crash

With the roots of the next crisis established prior to Trump’s assumption of the presidency, combined with the ineffectiveness of post-2008 regulations, the Trump administration faces an uphill battle - especially if the next crisis takes place during the next four years. All of the news coverage and comments from prominent figures in the financial establishment once again seem to be shifting the blame from central bank policy to Trump’s review of banking regulations, suggesting that the financial elite’s scapegoat for the next crisis has already been selected.

Schiff said the financial establishment “will try to pretend that everything else was great under Obama and then act like Trump ruined it.”

This isn’t to say that Trump’s potential removal of banking regulations won’t exacerbate or speed up the onset of the coming crisis. James Rickards told MarketWatch it’s likely that a crisis can only be prevented by reinstating the Glass-Steagall Act, which separated investment and commercial banking, breaking up the big banks, banning most derivatives, and enacting tougher law enforcement of bank wrongdoing. But considering the makeup of his Cabinet and team of economic advisors, Trump is unlikely to push for any of these changes.

Writing for the Libertarian Institute in November, Eric Schuler noted, “The next recession is likely to commence during Trump’s tenure. But while he may prove to be an unwitting catalyst of the next crisis, his policies will not be the primary cause.”

Instead, Trump is more likely to focus on loosening existing banking regulations than imposing any new ones. Though they do not account for the root cause of the crisis, the president’s actions in this regard could potentially accelerate the bursting of the bubble. However, this is difficult to gauge due to the fact that this new, looming crisis is long overdue.

Trump is ultimately faced with no easy choices. He can either allow the Fed to further inflate the bubble or he can try to bring about a market correction by forcing interest rates to increase in order to establish the foundations for positive economic growth. Both possibilities promise to bring unemployment and economic difficulties for the average American - particularly in the short term. Regardless of how Trump proceeds, he is likely to encounter major conflicts in fulfilling his campaign promise to “Make America Great Again,” as any major economic downturn could potentially lead to widespread, popular unrest throughout the nation.

Trump can either “bite the bullet” now if he really wants to improve the American economy, Schiff said, or he can “kick the can down the road” like his predecessors have.

Even if Trump chooses to delay the inevitable, the next crisis, already long delayed, is increasingly likely to unfold regardless of any action the president may take. And that crisis is likely to define his presidency.

Making America Broke Again: Trump & The Inevitable Financial Crisis

Americans Just Broke the Psychologists’ Stress Record

A national survey of anxiety finds a statistically significant increase for the first time since it was launched in 2007.

If misery loves company, it should be thrilled: Americans left and right are under so much stress it's now registering on the American Psychological Association's anxiety meter.

For 10 years, the APA has been running its "Stress in America" survey, usually finding that stress is caused by three primary factors-money, work, and the economy. Those factors clearly play a role in the current national mood. Younger Americans are worried about college debt, older ones about retirement, and everyone, it seems, about the economic prospects of the next generation. In the study, respondents with incomes below $50,000 reported higher stress levels than those with higher incomes.

Still, over the course of the decade, the psychologists found that stress in American life, on the whole, has been gradually decreasing.

Then came the election. The APA's members were picking up the campaign as a new stressor in their patients. The group added some election-related questions to its annual poll, conducted in August, and released the results in October. The findings: At 52 percent, more than half of Americans, both Democrats and Republicans, were anxious about the vote.

So last month, just before President Donald Trump's inauguration, the APA conducted an additional poll to check on the nation's mental health. The picture isn't pretty.

"The results of the January 2017 poll show a statistically significant increase in stress for the first time since the survey was first conducted in 2007," the APA said on Wednesday in a report on the survey of 1,019 adults living in the U.S., conducted from Jan. 5 to Jan. 19 by Harris Poll.

Americans' stress levels in January were worse than in August, in the middle of the angriest, most personal campaign in recent memory, when some believed the anxiety would abate after the election. At 57 percent, more than half of respondents said the current political climate was a very or somewhat significant source of stress. Stressors for everyone, including Republicans, were the fast pace of unfolding events and especially the uncertainty of the current political climate, said Vaile Wright, director of research and special projects at the APA.

Many of the demographics break down along predictable lines:

But the stress is broader than race or party alone can describe. A full two-thirds of respondents to the survey said they are stressed out about the nation's future, and while that includes 76 percent of Democrats, it reflects the feelings of 59 percent of Republicans as well.

"I don't think it can be just be boiled down to the side that won vs. the side that didn't," Wright said. "There is something going on across the aisle."

As for age, millennials reported more stress than their parents or grandparents. No surprise there-they strongly preferred the Democratic candidate, Hillary Clinton.

Urban dwellers are doing significantly worse than their suburban and rural counterparts. That makes sense, Wright noted, given the strong support President Trump enjoyed as a candidate outside big cities.

Education matters, too, and maybe not the way you would imagine: 53 percent of those with more than a high school education report the election outcome as a very or somewhat significant source of stress, compared with 38 percent of those with just high school or less. While this again correlates with voter preferences, it's also somewhat surprising, because higher education levels generally translate into more job opportunities.

The report also notes the rise of personal safety as a concern among its respondents, 34 percent of whom are worried about it, the highest level since 2008, when it was 31 percent. In 2014, stress over personal safety had dipped to its lowest level, 23 percent. More than half the country is worried about terrorism: some 59 percent, up from the August poll's finding of 51 percent and significantly higher than the 10-year average of 34 percent. And nearly half the respondents reported stress related to police violence against minorities-44 percent, up from August's 36 percent-with the breakdown along racial lines.

These worries aren't necessarily tied to what's actually unfolding on the ground. Violent crime, for example, was up in 2015 from 2014 but down from 2011, when fewer people were worried about it.

Stress, however, is not always about reality.

"Whether we're actually in more danger or we just believe we could be doesn't matter," Wright said. "Perception drives behavior."

Americans Just Broke the Psychologists’ Stress Record

Rich People Literally See the World Differently

The way you view the world depends on the culture you come from - in a granular, second-by-second sense. If you present a Westerner and an East Asian with the same visual scene, for instance, the former is more likely to focus on individual objects, and the latter will likely take in more of the scene as a whole. East Asians are more holistic in their thinking, the research indicates; Westerners are more analytic.

The same thing is happening with people who are from the same country, but belong to different social classes. With America’s top one percent of earners earning 81 times the average of the bottom 50 percent, the research shows how the wealthy and the working classes really do live in different cultures, and thus see the world in different ways.

One of the most powerful examples comes from Michael Varnum, a neuroscientist at Arizona State University. In a 2015 paper on empathy, he and his colleagues recruited 58 participants for a brain-imaging study: First, the participants filled out a self-report on their social class (level of parents’ education, family income, and the like) before sitting down for an EEG session. In the brain-imaging task, participants were shown neutral and pained faces while they were told to look for something else (the faces were a “distractor,” in the psych argot, so hopefully the participants wouldn’t know they were being tested for empathy).

In something of a dark irony, the respondents of higher socioeconomic status rated themselves as more empathic - a “better-than-average effect” that Varnum followed up on in a separate study - when in reality the opposite was true. The results “show that people who are higher in socioeconomic status have diminished neural responses to others’ pain,” the authors write. “These findings suggest that empathy, at least some early component of it, is reduced among those who are higher in status.” And unlike self-reports, brain imaging sidesteps “social desirability bias,” where people want to give replies that make them look good or more empathic. “If you’re looking at pictures of people in pain or not in pain, it’s pretty unlikely that you know how to enhance those brain responses,” Varnum tells Science of Us. Moreover, in a 2016 study, Varnum and colleagues found evidence suggesting that people from lower social classes have a more sensitive mirror neuron system - which is thought to simulate the things you see others experience - when watching a video of hand movements. “Our cognitive systems, the degree to which they’re attuned to other people in the environment, is affected by our own social class,” he says.

Another study, out last October in Psychological Science, further shows how attention breaks down along class lines. A research team lead by NYU doctoral candidate Pia Dietze measured participants’ attunement to people or things in three different experiments. In the first, they stopped 61 people on New York City streets, and asked them to put on a Google Glass device and walk around one block for about a minute, looking at whatever captured their gaze - with higher-class participants having reliably shorter “social gazes,” or the amount of time dwelling at each individual person. In a second experiment, a total of 158 undergrads were recruited to look at 41 photographs of different cities. Here, working-class participants had a 25 percent longer dwell time, on average, than upper-middle-class peers. In a third experiment, almost 400 participants recruited online had to determine if icons depicting people or objects changed in the course of milliseconds - and consistent with the other results, working-class people were faster in catching changes in faces than upper-middle-class participants. Together, the results show “social class cultures can influence social attention (attention towards human) in a deep and pervasive manner,” Dietze says. Your class shapes the “ecology” that you grow up in, and that anchors your habits of attention.

There are multiple interpretations for why lower-class people are more attuned to people around them. It may be that growing up poorer means that you have to rely on others more; it may also mean that you live in a less-secure environment, so you need to attend to others to keep yourself safe. Varnum and Dietze presented at this year’s meeting of Society for Personality and Social Psychology, where I met them, and Varnum says that each study speaks to a broader notion of how higher-status people are more focused on their own goals and desires. They also ignore people a little more, maybe because they can afford to. “If you have more power and status, you may not have to care as much about what people are thinking and feeling; and also, if you’re in a resource-scarce environment, where things are a little more unpredictable and maybe a little more dangerous, it would be very adaptive to pay attention to others, how they’re feeling and what they’re going to do,” he says. In many ways, privilege is invisible; it also shapes what’s visible to us.

Rich People Literally See the World Differently