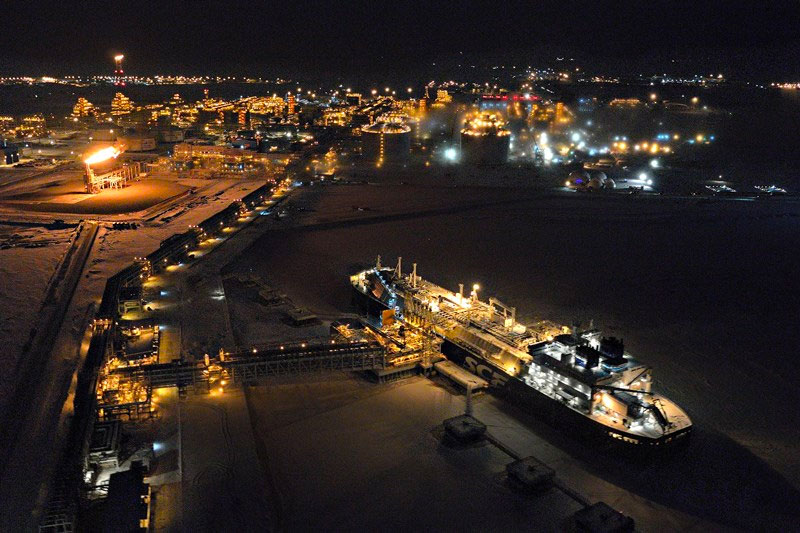

Yamal LNG Arctic Shipping - niche speciality

Video still of the ‘Vladimir Rusanov’ LNG carrier on sea trials

Some shipping companies have taken the decision to make Arctic voyages part of their core business, not only Russian ones, but Asian companies have gained a foothold in a lucrative sector. A significant proportion of this predicted increase in trade along the NSR is a growth in LNG energy delivered through the Arctic. This has been made possible by the design & construction of new ice-breaking Liquefied Natural Gas (LNG) tankers, as well as continued multidecadal reduction in sea-ice in the Arctic region.

The use and development of the NSR is underpinned by LNG out-shipments from the Yamal LNG project, (Sabetta port). The first million tons of LNG, (part of a 5.5 million tons per annum), has already been shipped so far, according to OAO Yamal LNG, which is only in its first phase, (known as a train in LNG parlance). When the whole 3 train capacity project, comes online, there will be about an annual total of 16.5 million tons of liquefied natural gas originating from the South Tambey field on the Yamal Peninsula.

http://en.portnews.ru/news/254710/

Then there is another planned LNG project the Arctic LNG-2, (in Russian) which might come online in 2023, with a similar LNG capacity to the Yamal project. Overall, 40 million tons of LNG might be transported by 2025, when both projects fully come online.

Total estimates for NSR LNG, ore and wood shipments, (with additional information on license obligations and company future plans included). Most of the traffic is predicted to for up to 2030 are concentrated in three regions: the Gulf of Ob, Yenisei Bay & up to Pevek.

NSR estimates - Cargo Russian Ministry of Natural Resources - http://portnews.ru/upload/basefiles/1624_ppchrpopgpnpopz.pdf

A number of companies have undertaken pilot voyages to test out the effectiveness & viability of the NSR in particular (Japan, China - 2012, South Korea - 2013). Unsurprisingly, Asian companies have taken a keen interest in Russian LNG energy and as such, LNG partnerships are being put into place, connected to the Yamal LNG project. The most recent Russian Arctic partnership is with the Japanese company, MOL, who jointly with the Chinese company COSCO, ordered a specialist LNG tanker, the ‘Vladimir Rusanov’, which will go into service shortly.

As Japan’s first icebreaking LNG carrier gets ready for sailing, company Mitsui signs cooperation deal on Northern Sea Route

We expect a significant trade growth in energy delivered through the Arctic shipping route, the Japanese shipping company says.

thebarentsobserver.com

The first of its era: ice-breaking LNG tanker: ‘Christophe de Margerie’ Double Acting Tanker, (DAT function): http://www.sovcomflot.ru/en/fleet/business_scope/projects/item1658.html

Length: 299m;

Ice-strengthened to ‘Arc 7’ RMRS level;

Autonomous voyage (through ice up to 1.5 m going ahead & 2,1 metres when navigating stern-first)

Engine power of 45 MW, (3 Azipod propulsion units - 15MW each)

Cargo capacity: 172,600 cubic meters of LNG

Capable of operating down to minus 50 Celsius;

Price tag: a lot (mucho dinero)

These LNG tankers provide a shuttle service to transhipments hubs, for conventional LNG tankers to pick up and re-export to the final destination. Destinations so far from the Yamal LNG terminal include France, the Netherlands & the UK, which then were then re-exported to South Korea, UK, USA, Spain, Jordan and India. Existing hubs already used include the UK, France and Dutch LNG terminals. On the Asian side, MOL is also a stakeholder in a planned LNG transhipment hub (Reloading terminal) in Kamchatka, for the Asian LNG market. For the time being, Yamal LNG out-shipments will remain a seasonal export to the East, (from July to December) mostly due to the rigorous winter conditions.

Teekay's first of 6 LNG tankers - ’Eduard Toll’ voyage westwards through part of the NSR

http://teekay.com/blog/2018/01/31/eduard-toll-teekays-first-icebreaker-lng-carrier-newbuilding-delivered/

Estimated numbers of Yamal Max LNG carriers (ordered, built)

Although it was widely stated in the media that Russian lawmakers would adopt legislation giving Russian-flagged ships the exclusive right to transport oil and gas along the NSR, this clearly has not happened, as the “Christophe de Margerie” is on the Cypriot register, although operated by SCF, a Russian company.

The operational design of the Yamal LNG carriers have their origins in the first double acting tanker, (DAT), 'Tempera' back in 2002. This type of ship is particular to the Arctic, it sails in ahead direction in light ice or open water conditions, but when thicker ship is encountered, the ship moves in an astern direction, the stern having ice-breaking characteristics, of long-life, special reinforced double skinned steel.

Instead of using the traditional rudder and fixed propeller configuration, a DAT ship has a moveable Azipod system, (rotating 360°), which can 'push' away the ice & more importantly give a ship the vital manoeuverability needed in ice. In essence, DAT ships are icebreakers in their own right.

Teekay routes for LNG

However, they are expensive shuttle tankers, more suited to operating in the Arctic ice, which means they operate best on going to a reloading terminal in Europe (Manoir, France or one of the two UK LNG terminals for example), or to an Asian terminal, where the LNG is offloaded, which is subsequently picked up another convention LNG tanker.

Since they carry LNG, these ships can use the 'boil-off' as fuel, needing less polluting conventional heavy fuel, as the use of LNG can significantly reduce the emissions of harmful gases into the atmosphere, (reduction of sulphur oxides (SOx) by 90%, nitrogen oxides (NOx) reduced by 80% and carbon dioxide (CO2) emissions by by 15%).

An amended shorter version of article "Being bullish about the Arctic"