о мерах по стимуляции бизнеса

New Federal Reserve data shows how the rich have gotten richer

[ By Matthew Yglesias | Jun 13, 2019 | via Vox ]

(кликабельно)The top 1 percent of the US wealth distribution has increased its net worth by 650 percent since 1989, while the bottom 50 percent saw its wealth grow by a much more modest 170 percent during the same period.

That’s the message of a new data series from the Federal Reserve called Distributional Financial Accounts. that attempts to provide more granular information about who owns what than we’ve previously had.

The story that the rich have gotten richer and inequality has grown is not new. But the Fed data does let us peek under the hood to help understand why inequality has grown so much.

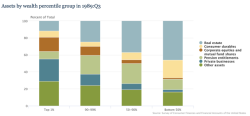

Start with this chart which shows what portfolios looked like on different rungs of the economic ladder back in 1989. You’ll see that the bottom half of the income distribution had a huge share of its wealth tied up in real estate while owning essentially no shares of corporate stock. The top 1 percent, by contrast, wasn’t just rich - it was specifically rich in terms of owning companies, both stock in publicly traded ones (“corporate equities”) and shares of closely held ones (“private businesses”).

The past 30 years ended up being a very good time to own businesses. The S&P 500 is up about tenfold even before you account for dividends, for example. So the value of those specific assets - assets that people in the bottom half of the distribution never had a chance to own in the first place - soared.

President Donald Trump passed a major tax bill in the previous session of Congress that was overwhelmingly targeted at reducing the tax burden on people who own businesses. The theory behind it is that by making it more lucrative to own businesses, you will spur more business investment, which ultimately creates jobs and raises wages. But as you can see in these charts, we’ve already been doing that for the past generation - and overall growth has been generally slow, with wages rising just a tiny bit faster than inflation.