Economic Crisis: Here It Is

I've been looking for this chart for weeks, and finally found it. This is the key to why we're in the economic mess we are, and have been.

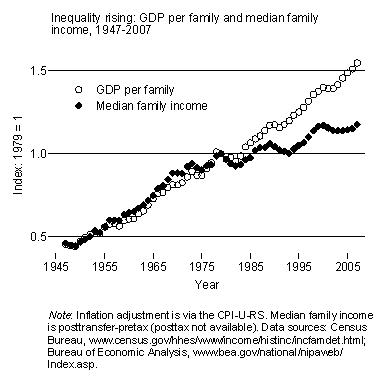

This chart shows the growth of the GDP (basically the "income" earned in the country) with the median household income, with 1979 set as 1 to have a standard for comparison. From the end of World War II to about 1980, the two tracked pretty well, when the GDP went up, median incomes went up by about the same percentage. There's a little bump where incomes went up faster than GDP, but the most notable point is 1980, where the two completely diverge. After 1980, median wages grow more slowly than GDP, and hardly at all from about 2000 to 2007, where the general way the two lines track seems to completely break down.

Now, correlation is not causation and all, so I leave figuring out what events could have caused this to the reader for now, and am just going to get into the implications of what the break means.

What does it mean for median wages to grow more slowly than the national "income" of the GDP? It means average people's wages haven't been keeping up with growth. It means that using the GDP as a predictor of the "health" of the general economy has been useless for at least 20 years, since the general economy, by definition, is driven by average people.

Our economy has lately been driven by "consumption", that is, selling plastic crap made in China to each other. So if GDP's been going up, it means people have been spending more (to vastly simplify). But if GDP's been going up, and the money people make hasn't been going up as fast, that extra money's got to come from somewhere. How can people spend more money than they have? Well, by going into their savings (our savings rate is less than 1%, or at least it WAS) and by taking out loans. Loans like, say, credit cards, or mortgages, or other kinds of debt. The median household had $3000 in credit card debt they carried from month to month in 2007. Just look at the proliferation of "payday loan" places. Or, say, the mortgage bubble.

The other thing it means that the growth going on isn't being shared equally. It's going somewhere other than regular people's wages. And while gaps of a couple percent don't seem like much, over 40 years, that adds up, quickly. Everybody remembers compound interest, right?

So where's that extra money been going? Well, since the chart uses median income, rather than mean, that extra money could be going to a very few people, not enough to affect the position of the median very much, since the median's where 50% of the sample is on either side. Like if Bill Gates walks into a bar, the mean income goes up a lot, but not the median income. So that's one possibility, which seems to be part of it if you look at numbers for income growth among top earners.

It could also be that some of that GDP growth didn't exist. Or at least didn't represent anything productive. Things like say, financial "innovations" like betting on mortgages, that seem to generate a lot of money, but don't actually DO anything.

I think it's some of both. Some of the economic "growth" over the past 20 years has been illusionary, some's been fraud, and some has concentrated into a lot fewer hands. The housing bubble was caused in large part because people were treating houses as investments and ATMs, since their wages weren't covering things. That lack of growth has been hurting many facets of the economy, but that's been covered up for years by the explosive growth of the finance sector, which was a combination of fraud, smoke and mirrors, and a gigantic transfer of wealth from everybody else to a very few. But that couldn't go on forever, there's only so long you can cook the books and make popcorn from your seed corn before you run out. And that's what hit, and the ginormous bets so many companies made almost brought down their whole house of cards, only government guarantees and bailouts are holding it up right now.

So what to do about all this? Well, I have a number of suggestions, but I'll save them for another post some time. People who know me can probably guess at some of them though.

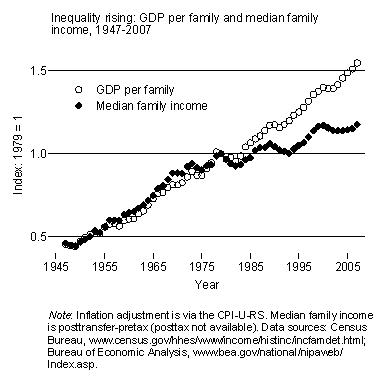

This chart shows the growth of the GDP (basically the "income" earned in the country) with the median household income, with 1979 set as 1 to have a standard for comparison. From the end of World War II to about 1980, the two tracked pretty well, when the GDP went up, median incomes went up by about the same percentage. There's a little bump where incomes went up faster than GDP, but the most notable point is 1980, where the two completely diverge. After 1980, median wages grow more slowly than GDP, and hardly at all from about 2000 to 2007, where the general way the two lines track seems to completely break down.

Now, correlation is not causation and all, so I leave figuring out what events could have caused this to the reader for now, and am just going to get into the implications of what the break means.

What does it mean for median wages to grow more slowly than the national "income" of the GDP? It means average people's wages haven't been keeping up with growth. It means that using the GDP as a predictor of the "health" of the general economy has been useless for at least 20 years, since the general economy, by definition, is driven by average people.

Our economy has lately been driven by "consumption", that is, selling plastic crap made in China to each other. So if GDP's been going up, it means people have been spending more (to vastly simplify). But if GDP's been going up, and the money people make hasn't been going up as fast, that extra money's got to come from somewhere. How can people spend more money than they have? Well, by going into their savings (our savings rate is less than 1%, or at least it WAS) and by taking out loans. Loans like, say, credit cards, or mortgages, or other kinds of debt. The median household had $3000 in credit card debt they carried from month to month in 2007. Just look at the proliferation of "payday loan" places. Or, say, the mortgage bubble.

The other thing it means that the growth going on isn't being shared equally. It's going somewhere other than regular people's wages. And while gaps of a couple percent don't seem like much, over 40 years, that adds up, quickly. Everybody remembers compound interest, right?

So where's that extra money been going? Well, since the chart uses median income, rather than mean, that extra money could be going to a very few people, not enough to affect the position of the median very much, since the median's where 50% of the sample is on either side. Like if Bill Gates walks into a bar, the mean income goes up a lot, but not the median income. So that's one possibility, which seems to be part of it if you look at numbers for income growth among top earners.

It could also be that some of that GDP growth didn't exist. Or at least didn't represent anything productive. Things like say, financial "innovations" like betting on mortgages, that seem to generate a lot of money, but don't actually DO anything.

I think it's some of both. Some of the economic "growth" over the past 20 years has been illusionary, some's been fraud, and some has concentrated into a lot fewer hands. The housing bubble was caused in large part because people were treating houses as investments and ATMs, since their wages weren't covering things. That lack of growth has been hurting many facets of the economy, but that's been covered up for years by the explosive growth of the finance sector, which was a combination of fraud, smoke and mirrors, and a gigantic transfer of wealth from everybody else to a very few. But that couldn't go on forever, there's only so long you can cook the books and make popcorn from your seed corn before you run out. And that's what hit, and the ginormous bets so many companies made almost brought down their whole house of cards, only government guarantees and bailouts are holding it up right now.

So what to do about all this? Well, I have a number of suggestions, but I'll save them for another post some time. People who know me can probably guess at some of them though.